Unwrought Aluminium HSN Code 7601: Products, GST Rate & Industry Use

What is HSN Code 7601?

7601 hsn code description - HSN Code 7601 categorizes “Unwrought Aluminium” including aluminium in its simplest forms such as ingots, billets, wire bars, and rods—both pure aluminium and aluminium alloys. This code is critical for taxation and classification of raw and semi-processed aluminium materials used across diverse industries including manufacturing, construction, and automotive.

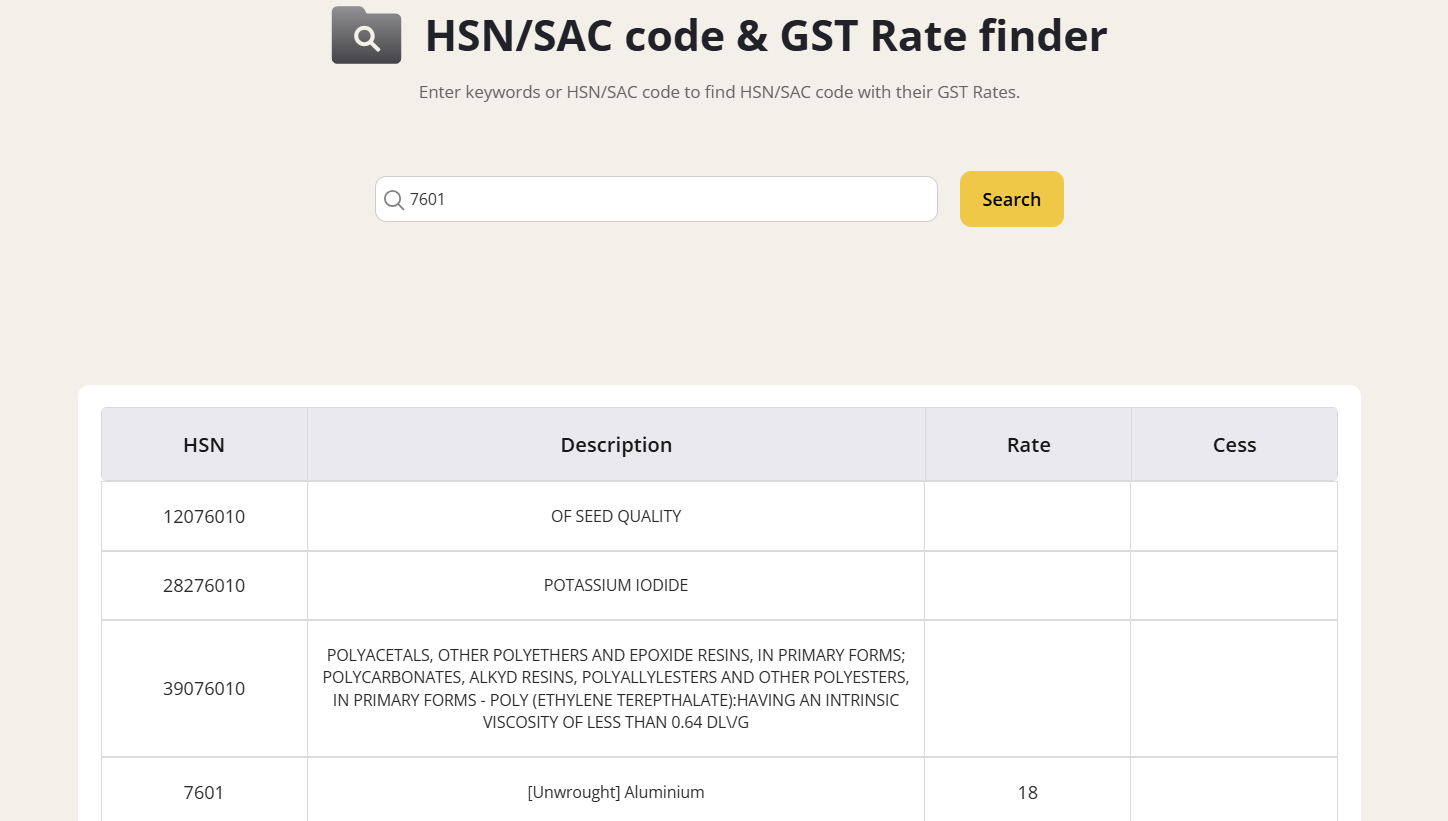

GST Rates & Exemptions for HSN Code 7601

As per GST updates effective since July 1, 2017, all products under HSN Code 7601 attract an 18% GST rate. There is no cess applicable on aluminium either in pure or alloyed forms. This uniform rate ensures adequate tax neutrality and streamlines compliance across the aluminium value chain.

Table Notes

- The GST rates below apply uniformly across India.

- No compensation cess is levied on aluminium.

- The code includes subcategories differentiating pure and alloyed aluminium forms in various product shapes.

GST Rates Applicable Under 7601 HSN Code

What’s Included under HSN 7601?

This HSN code refers to unwrought aluminium products that serve as raw materials for secondary processing in fabrication, die casting, extrusion, and alloy manufacturing industries. Both pure aluminium and alloyed forms in flat, rod, wire, and ingot shapes are included.

Explore Gimbooks HSN/SAC code & GST Rate finder

Key Exemptions Under GST for 7601

No exemptions or concessional GST rates apply to unwrought aluminium under HSN 7601. The uniform 18% rate aligns with the metal industry tax framework to stabilize market conditions and simplify tax administration.

Input Tax Credit (ITC) Rules for Aluminium

Manufacturers and industrial users can claim ITC on GST paid for aluminium imports or domestic purchases falling under HSN 7601 if used as inputs in manufacturing or further processing. Proper documentation and GST-compliant invoices are required to avail ITC benefits.

GST on Aluminium Billing: Practical Scenarios

- A metal manufacturer purchasing aluminium ingots under HSN 76011010 is billed at 18% GST, claiming eligible ITC on inputs.

- A fabrication unit sourcing alloy wire rods under HSN 76012040 pays 18% GST and includes it in cost of production.

- Bulk wholesalers invoicing raw aluminium billets to industrial buyers maintain GST rate and documentation for audit compliance.

Common Mistakes in Aluminium GST

- Misclassification of pure aluminium vs alloy products leading to incorrect HSN code and tax rate application.

- Charging incorrect GST rates inconsistent with 18% slab.

- Failure to maintain valid GST invoicing affects ITC claims.

- Incorrect input credit utilization resulting in compliance risks.

Aluminium HSN Code and GST rate Overview

Here’s a quick reference for Aluminium HSN codes and their GST rates in India:

Conclusion

HSN Code 7601 provides clear classification and uniform GST taxation for unwrought aluminium products with a standard 18% GST rate in 2025. Accurate classification, invoicing, and ITC compliance ensure smooth operations for metal producers and users alike.

Also check

Electrical Transformers HSN Code 8504

Bearing HSN Code and GST Rate

Other Plastics Materials HSN Code 3926

FAQs: HSN Code 7601 & Aluminium GST

What is HSN 7601?

It refers to unwrought aluminium products including pure and alloyed forms like ingots, billets, wire bars, and rods.

What’s the GST rate for aluminium under HSN 7601?

The GST rate is 18% uniformly across all products under this code.

Can ITC be claimed on aluminium purchases?

Yes, eligible businesses can claim ITC on aluminium used as inputs in manufacturing or processing.

Are there any GST exemptions on aluminium?

No exemptions apply; all aluminium goods under HSN 7601 are taxed at 18%.

What is the GST rate for Aluminium?

The aluminium GST rate is depends on its form and HSN code. Unwrought aluminium under HSN 7601 attracts 18% GST, while other forms like aluminium sheets, foils, and wires (HSN 7606–7608) also generally fall under 18% GST. This rate applies to both pure aluminium and alloys used in manufacturing, construction, and industrial applications.

What is Aluminium Wire HSN Code?

The HSN code for aluminium wire is 7605. This code covers aluminium wires not included under unwrought aluminium (HSN 7601) and is used for GST classification, invoicing, and taxation purposes. The standard GST rate for aluminium wire is 18%, applicable to both pure aluminium and aluminium alloys used in electrical, construction, and industrial applications.