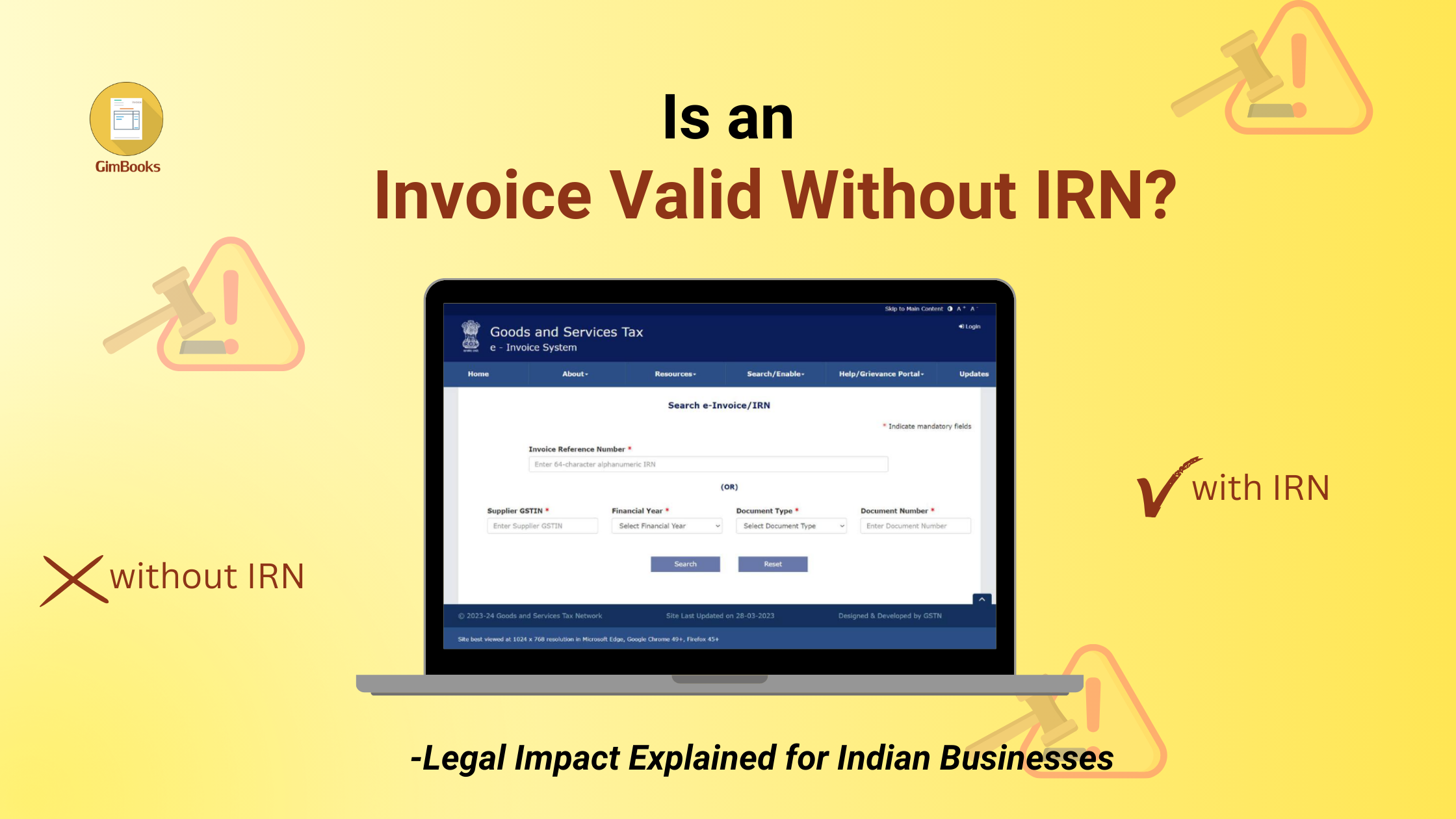

Is an Invoice Valid Without IRN? Legal Impact Explained for Indian Businesses

Is your GST invoice valid without IRN? Understand when IRN is mandatory, the penalties involved with non-generation of invoice, invalid invoice, compliance on non-generation of IRN, and how MSMEs can stay compliant.

If you’re issuing GST invoices and still unsure whether an invoice is valid without an IRN, you’re not alone. This is one of the most common compliance doubts among Indian MSMEs, especially after e-invoicing became mandatory for more businesses.

Here’s the thing. Whether an invoice is valid without an IRN legal, depends entirely on who you are, your turnover, and when the invoice was issued.

Let’s understand it.

What Is IRN in GST E-Invoicing?

IRN is Invoice Reference Number; it’s a unique 64-character number generated when an invoice is registered on the Invoice Registration Portal (IRP).

Once an IRN is generated:

- The invoice is registered with the GST system

- The invoice data is authenticated

- The invoice is eligible for GST compliance, ITC, and reporting

In short, IRN is the backbone of the e-invoice system in India.

Is an Invoice Valid Without IRN?

Here’s how to understand why is IRN mandatory in invoice-

Case 1: Businesses Covered Under E-Invoicing

If your business is required to generate e-invoices, then you need to understand e-invoicing applicability in GST:

❌ An invoice without IRN is not legally valid

This applies when:

- Your aggregate turnover exceeds the notified threshold

- The invoice is B2B, export, or deemed export

- The invoice is issued after the date e-invoicing became mandatory for your category

In such cases, a PDF, Excel, or GST-invoicing software without an IRN is treated as not issued at all under GST law.

Case 2: Businesses Not Covered Under E-Invoicing

If e-invoicing does not apply to you, then:

✅ An invoice without an IRN is fully valid if it has:

- Businesses below the turnover threshold,

- B2C invoices (retail customers),

- Exempt categories like banks, insurers, NBFCs, SEZ units, etc.

For these businesses, regular GST invoices without IRN remain legally acceptable.

Current E-Invoicing Threshold in India

As per GST notifications:

- E-invoicing is mandatory for businesses with aggregate turnover above ₹5 crore

- Threshold is calculated PAN-wise

- Includes all supplies across India

If your turnover crossed ₹5 crore in any financial year since 2017–18, e-invoicing applies to you.

Check if your business needs e-invoicing in 2 minutes.

What Happens If You Issue an Invoice Without IRN When Required?

This is where the legal impact becomes serious.

1. Invoice Is Treated as Invalid

Under Rule 48(4) of the CGST Rules:

- An invoice is valid without IRN andis not considered a valid tax invoice, as GST authorities can treat the supply as undocumented.

2. Penalties Under GST Law

You may face:

- ₹10,000 penalty per invoice, or

- Tax amount involved, whichever is higher

This penalty can be applied to both:

- Seller (for non-compliance)

- Buyer (if ITC is wrongly claimed)

3. Input Tax Credit (ITC) Can Be Denied

If your buyer receives an invoice without IRN:

- ITC claim may be rejected

- Buyer may demand a corrected invoice

- Business relationships can suffer

This is one of the biggest practical risks.

4. E-Way Bill Issues

For applicable cases:

- E-way bill generation without IRN can fail or get flagged

- Transporters may refuse goods

- Goods can be detained during transit

Read more: e-way bill generation with IRN

Can You Fix an Invoice Issued Without IRN?

Yes, but timing matters.

If Within 24 Hours

- You can cancel the invoice

- Generate a fresh e-invoice with IRN

- Issue a new valid invoice.

Read more: How to cancel e-invoice within 24 hours

If After 24 Hours

IRN cannot be generated

- You must:

- Cancel the original invoice in books

- Issue a credit note and reissue invoice

- Generate a fresh invoice with IRN

There is no legal way to retroactively add IRN to an old invoice.

Read more for canceling invoice after 24 hours: e-invoice amendment rules

Is IRN Required for B2C Invoices?

No.

IRN is not required for:

- B2C invoices

- Retail sales to unregistered customers

However, large businesses must still:

- Print QR codes on B2C invoices

- Follow dynamic QR code rules

How to Ensure Your Invoices Are Always Valid

Here’s what works best for MSMEs:

- Use GST-compliant accounting software with built-in e-invoicing

- Generate IRN automatically before sharing invoices

- Avoid manual invoice creation for B2B supplies

- Track turnover to know when e-invoicing becomes applicable.

This prevents penalties, ITC disputes, and last-minute compliance stress.

How GimBooks Helps You Avoid Invalid Invoices

This is where most MSMEs slip. Not because they want to, but because manual processes fail.

With GimBooks, you can:

- Automatically generate IRN for eligible invoices

- Issue GST-compliant invoices without portal confusion

- Avoid Excel, JSON uploads, and IRP errors

- Ensure every B2B invoice is ITC-safe for your buyer

- Stay audit-ready without hiring extra staff

No last-minute cancellations. No penalty anxiety. No buyer disputes.

Not sure if your invoices need IRN?

Check your e-invoicing eligibility and generate compliant invoices in minutes with GimBooks.

Invoice Validity Compliance Checklist (MSME-Friendly)

Use this checklist before issuing any GST invoice:

Step 1: Check E-Invoicing Applicability

- Aggregate turnover above ₹5 crore?

- Turnover calculated PAN-wise?

- Threshold crossed in any financial year since 2017–18?

If yes, e-invoicing applies.

Step 2: Identify Invoice Type

- B2B / Export / Deemed export → IRN required

- B2C → IRN not required

Step 3: Generate Invoice Correctly

- Upload invoice details to IRP

- Generate IRN and QR code

- Share invoice only after IRN generation

Step 4: Avoid These Common Mistakes

- Sharing invoice PDF before IRN

- Manual invoice creation in Excel

- Forgetting to cancel and reissue within 24 hours

- Assuming IRN can be added later

Step 5: Keep Records Audit-Ready

- Store IRN and QR code

- Match invoices with GSTR-1

- Ensure e-way bill data aligns with IRN

If all boxes are ticked, your invoice is legally safe.

Conclusion

If e-invoicing applies to you:

An invoice without IRN is legally invalid. Penalties, ITC loss, and compliance notices are real risks of invoicing without IRN. If e-invoicing does not apply, then regular GST invoices without IRN are valid.

The best tip for checking if an invoice is valid without an IRN is to automate e-invoicing with e-invoicing software.

FAQs

What is IRN in GST?

IRN is the unique number that makes an e-invoice valid under GST. It is generated by the GST e-Invoice Portal and confirms that the invoice is officially registered.

Can you generate an e-invoice without GST?

No. E-invoicing is only for GST-registered businesses. Without a GSTIN, you can issue a normal invoice but not a GST e-invoice or IRN.

Is an invoice valid without IRN under GST?

An invoice is valid without IRN only if e-invoicing is not applicable to the business. If e-invoicing is mandatory, an invoice without IRN is legally invalid under GST.

Is IRN mandatory for all GST invoices?

No. IRN is mandatory only for B2B, export, and deemed export invoices issued by businesses that fall under the notified e-invoicing turnover limit.

Can I claim ITC on an invoice without IRN?

If e-invoicing is applicable to the supplier, ITC cannot be claimed on an invoice issued without IRN. Such invoices may be rejected during GST scrutiny.

Is IRN required for B2C invoices?

No. IRN is not required for B2C invoices. However, businesses above the prescribed limit must follow dynamic QR code rules for B2C supplies.

Can IRN be generated later for an invoice?

No. IRN must be generated before or at the time of issuing the invoice. Once the invoice is issued without IRN, it cannot be regularised later.

What is the penalty for issuing an invoice without IRN?

Penalty can be ₹10,000 per invoice or the tax amount involved, whichever is higher, along with denial of ITC and compliance notices.

E-invoice cancellation and Amendment

Avoid consequences of non-generation of IRN for invoice validity.