January 2026 Compliance Calendar: GST, TDS, & ROC Due Dates for Indian Businesses

January 2026 compliance is one of the most compliance-heavy months for Indian businesses. GST returns, TDS payments, and ROC filings all fall together. This guide explains what to file, by when, and how MSMEs and companies can stay compliant without penalties.

GST filing January 2026 for small businesses is one of the most compliance-heavy months. GST filings, TDS payments, and ROC obligations all line up together. Miss one deadline, and penalties kick in early. Let’s understand GST compliance in January for MSMEs and companies in 2026.

Let's understand the January 2026 compliance calendar:

- GST returns and payments

- TDS & TCS filings

- ROC and MCA compliances

Just what you need to do and by when.

Why January 2026 Is a Critical Compliance Month

Statutory compliance in January 2026 reflects December 2025 transactions, which usually include:

- Year-end sales

- High invoice volumes

- Vendor settlements

- Salary payouts and bonuses

That makes errors more likely and scrutiny higher.

What this really means is:

- Delays attract late fees fast

- Mismatches can block ITC

- Non-compliance affects creditworthiness and audits

Planning January compliance properly sets the tone for the entire financial year.

GST Compliance Calendar – January 2026

GSTR-1 – Outward Supplies

- GSTR-1 January Due Date: 11 January 2026

- Who should file: All regular GST-registered taxpayers filing monthly returns.

What to report:

- Sales invoices

- Debit and credit notes

- Export and zero-rated supplies

Why it matters: GSTR-1 feeds into your buyer’s GSTR-2B. Any delay or error can lead to ITC disputes.

2. GSTR-3B – Summary Return & Tax Payment

Due Date:

- 20 January 2026 (standard)

- State-wise staggered dates may apply

What to do:

- Pay GST liability

- Declare ITC claimed

- Reconcile outward and inward supplies

Late filing leads to interest + late fees, even if tax is zero.

3. QRMP Scheme Filers (Quarterly Filers)

If you’re under the QRMP scheme:

IFF (Invoice Furnishing Facility):

13 January 2026- Upload B2B invoices for December if you want your buyers to get ITC early.

PMT-06 (Challan Payment):

25 January 2026- Deposit tax for December using the fixed sum or the self-assessment method.

4. GSTR-2B Reconciliation (Best Practice)

- Between 14–18 January 2026

- Not a return, but critical.

- Match purchase invoices

- Identify blocked or missing ITC

- Follow up with vendors

Skipping this step often causes ITC reversals later.

TDS & TCS Compliance Calendar – January 2026

5. TDS Payment for December 2025

Due Date for January: 7 January 2026.

Applicable for:

- Salaries

- Professional fees

- Contractor payments

- Rent and commissions

Even a one-day delay triggers interest.

6. TCS Payment for December 2025

TCS payment due date in January:

7 January 2026.

Relevant for sellers collecting tax under TCS provisions, including e-commerce operators.

7. TDS Return Filing (Quarterly)

If applicable for Q3 (Oct–Dec 2025):

- Form 24Q / 26Q / 27Q

TDS Return Tiling Due Date: 31 January 2026

This impacts Form 26AS and employee/vendor tax credits.

ROC & MCA Compliance – January 2026

January is quieter for ROC filings, but not empty.

8. Event-Based ROC Filings

Event-based ROC filings are applicable only if:

- Appointment or resignation of director

- Share transfer or allotment

- Change in registered office

Common ROC filing forms include:

- DIR-12

- MGT-14

- PAS-3

Most event-based ROC filings have a 30-day deadline from the date of event. Miss it, and additional fees pile up daily.

Read more- GST compliance 2026 due date

9. OPC & AOC Follow-Ups (If Extended)

Some companies may still be closing extended compliance items from earlier periods. January is usually when MCA scrutiny begins to tighten.

January 2026 Compliance Calendar: MSMEs vs Companies (India)

| Compliance Area | MSMEs (Proprietors, Small Traders, Service Providers) | Companies (Pvt Ltd, LLPs, Corporates) |

|---|---|---|

| GST Registration Type | Mostly Regular or QRMP | Mostly Regular (Monthly) |

| GSTR-1 (Outward Supplies) | Monthly: 11 Jan 2026QRMP: Optional IFF by 13 Jan 2026 | Mandatory Monthly: 11 Jan 2026 |

| GSTR-3B (Tax Payment) | Monthly: 20 Jan 2026QRMP: Quarterly, but tax via PMT-06 by 25 Jan 2026 | Mandatory Monthly: 20 Jan 2026 |

| Invoice Volume Risk | High during year-end sales and credit billing | Very high due to bulk invoicing and B2B transactions |

| ITC Reconciliation (GSTR-2B) | Often skipped but critical to avoid ITC reversal | Mandatory internal control before filing |

| TDS Applicability | Limited (rent, professionals, contractors) | Broad (salary, vendors, directors, consultants) |

| TDS Payment Due Date | 7 Jan 2026 (if applicable) | 7 Jan 2026 (mandatory if TDS deducted) |

| TDS Return (Q3) | Rare for micro businesses | 31 Jan 2026 (Form 24Q, 26Q, 27Q) |

| TCS Compliance | Applicable mainly to e-commerce sellers | Common for e-commerce operators & large sellers |

| ROC / MCA Filings | Not applicable | Event-based filings within 30 days (DIR-12, MGT-14, PAS-3) |

| Penalty Exposure | Late fees impact cash flow immediately | Late fees + audit + compliance score impact |

| Common January Mistake | Assuming nil returns don’t need filing | Filing without internal reconciliation |

| Best Compliance Approach | Simple accounting + GST tracking tool | Structured software + CA + internal checks |

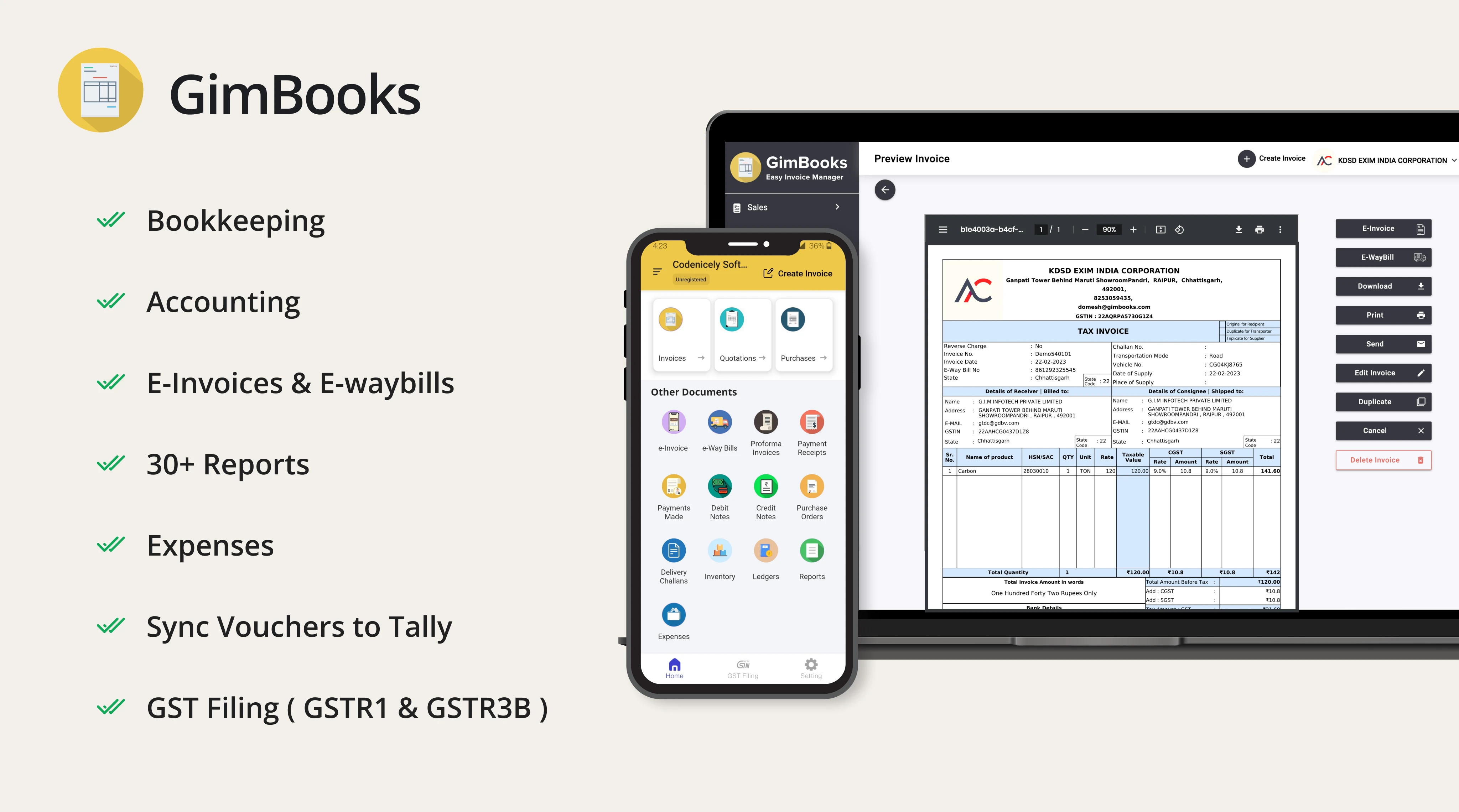

Stay Compliant with GimBooks

Common January Compliance Mistakes to Avoid

Let’s call these out clearly.

- Filing GSTR-3B without reconciling 2B

- Missing PMT-06 payment under QRMP

- Delaying TDS payment due to cash flow assumptions

- Ignoring event-based ROC filings

- Assuming nil returns don’t need filing

Each of these has a cost. Most are avoidable.

January 2026 Compliance Calendar – GST, TDS & ROC Due Dates

Find the January 2026 compliance due dates, who needs to comply, and what has to be done for compliance.

| Due Date | Compliance Item | Who Needs to Comply | What to Do |

|---|---|---|---|

| By 7 Jan 2026 | TDS Payment | Businesses deducting TDS | Pay TDS for December 2025 |

| TCS Payment | Sellers collecting TCS | Deposit TCS for December 2025 | |

| By 11 Jan 2026 | GSTR-1 (Monthly) | Monthly GST filers | Upload outward sales invoices |

| By 13 Jan 2026 | IFF (Optional) | QRMP taxpayers | Upload B2B invoices for buyer ITC |

| By 20 Jan 2026 | GSTR-3B | Regular GST taxpayers | File return and pay GST liability |

| GST Tax Payment | Regular GST taxpayers | Clear GST dues for December 2025 | |

| By 25 Jan 2026 | PMT-06 | QRMP taxpayers | Pay GST using fixed or self-assessment method |

| By 31 Jan 2026 | TDS Returns (Q3) | TDS deductors | File Form 24Q / 26Q / 27Q |

| ROC Event Filings | Companies & LLPs | File pending event-based MCA forms |

Quick Note for Businesses for January 2026 Compliance

- Nil GST returns still need filing

- QRMP does not mean no monthly action

- ROC deadlines depend on the event date, not the month

How Businesses Can Stay Compliant Without Stress

Manual tracking works… until it doesn’t. Most compliance issues happen because:

- Data is scattered

- Deadlines aren’t visible

- Invoices aren’t reconciled on time

- Using accounting and GST software that:

- Tracks due dates

- Auto-prepares returns

- Flags mismatches early

can make January manageable instead of chaotic.

Conclusion on January 2026 Compliance

January 2026 compliance is not about doing more work.

It’s about doing the right things on the right dates.

If you plan filings in advance, reconcile regularly, and avoid last-day rushes, penalties become a non-issue.

Trending- Top 6 GST Rules From 1 January 2026

FAQs: January 2026 Compliance Calendar (GST, TDS & ROC)

1. Is it mandatory to file GST returns in January 2026 even if there are no sales?

Yes. If your GST registration is active, you must file returns even if there were no transactions in December 2025. Nil returns are mandatory.

2. I am under the QRMP scheme. Do I need to do anything in January?

Yes. QRMP taxpayers must:

- Upload B2B invoices via IFF by 13 January 2026 (optional).

- Pay taxes using PMT-06 by January 25, 2026.

Skipping these can block buyer ITC and attract interest.

3. What happens if I miss the GSTR-3B due date in January?

Late filing leads to:

- Late fees per day

- Interest on unpaid tax

- Blocked future return filings

Even one day of delay has a cost.

4. Is GSTR-2B reconciliation compulsory?

It’s not a return, but it’s critical. If you claim ITC not appearing in GSTR-2B, it may be reversed later with interest. Best practice is to reconcile before filing GSTR-3B.

5. Do small MSMEs need to deduct TDS?

Only if applicable.

MSMEs usually deduct TDS on:

- Rent

- Professional fees

- Contractor payments

If TDS is deducted, payment by 7 January 2026 is mandatory.

6. What is the due date for TDS payment for December 2025?

The due date is 7 January 2026.

Delay attracts interest even if the amount is small.

7. Are TDS returns required for all businesses in January?

No. TDS returns are required only if:

TDS was deducted during Oct–Dec 2025

You fall under Q3 filing requirements

TDS return Due date: 31 January 2026

8. Do proprietors need to worry about ROC compliance in January?

No. ROC filings apply to:

- Private Limited Companies

- LLPs

Proprietors and partnership firms do not have ROC obligations.

9. What ROC filings may be due in January 2026?

Only event-based filings, such as:

- Director appointment or resignation

- Share allotment

- Change in the registered office

These must be filed within 30 days of the event.

10. Is there any penalty for missing ROC deadlines?

Yes, ROC late fees penalty is-

- Accrue daily

- Have no maximum cap for many forms.

Can become expensive very quickly

11. Why is January compliance considered risky?

Because it covers:

- Year-end transactions

- High invoice volume

- Salary and bonus payouts

- Errors made in January often surface during audits later.

12. Can I file GST returns without paying tax immediately?

No. GSTR-3B filing requires tax payment first. Without payment, the return cannot be submitted.

13. What is the biggest compliance mistake MSMEs make in January?

Assuming:

- Nil returns are optional.

- QRMP means no monthly action

- Reconciliation can be skipped

These assumptions lead to penalties.

14. What is the biggest compliance mistake companies make in January?

Filing returns without:

- Internal reconciliation

- Cross-checking ITC, TDS, and invoices

This leads to corrections, notices, and audit issues later.

15. How can businesses simplify January compliance?

Businesses can simplify January compliance by tracking due dates, auto-preparing GST returns, fixing flagged ITC mismatches, and maintaining TDS and invoice records centrally, and manual tracking increases risk in January.

16. Does January compliance affect future months?

Yes. Mistakes in January compliance often lead to ITC reversals, TDS mismatches, and audit queries.