GST Rates and HSN Code 8207 for Interchangeable Tools

What is HSN Code 8207?

HSN Code 8207 covers interchangeable tools designed for use with hand tools or machine tools, whether power-operated or not. This includes a broad range of precision tools used in pressing, stamping, punching, tapping, threading, drilling, boring, broaching, milling, turning, and screw driving. It also includes special dies for drawing or extrusion. Such tools are essential for manufacturing, automotive, metalworking, woodworking, and construction industries where machinery versatility and accuracy are key.

This makes Interchangeable Tools HSN Code 8207 a vital classification for businesses dealing in industrial tooling, workshops, and part production services.

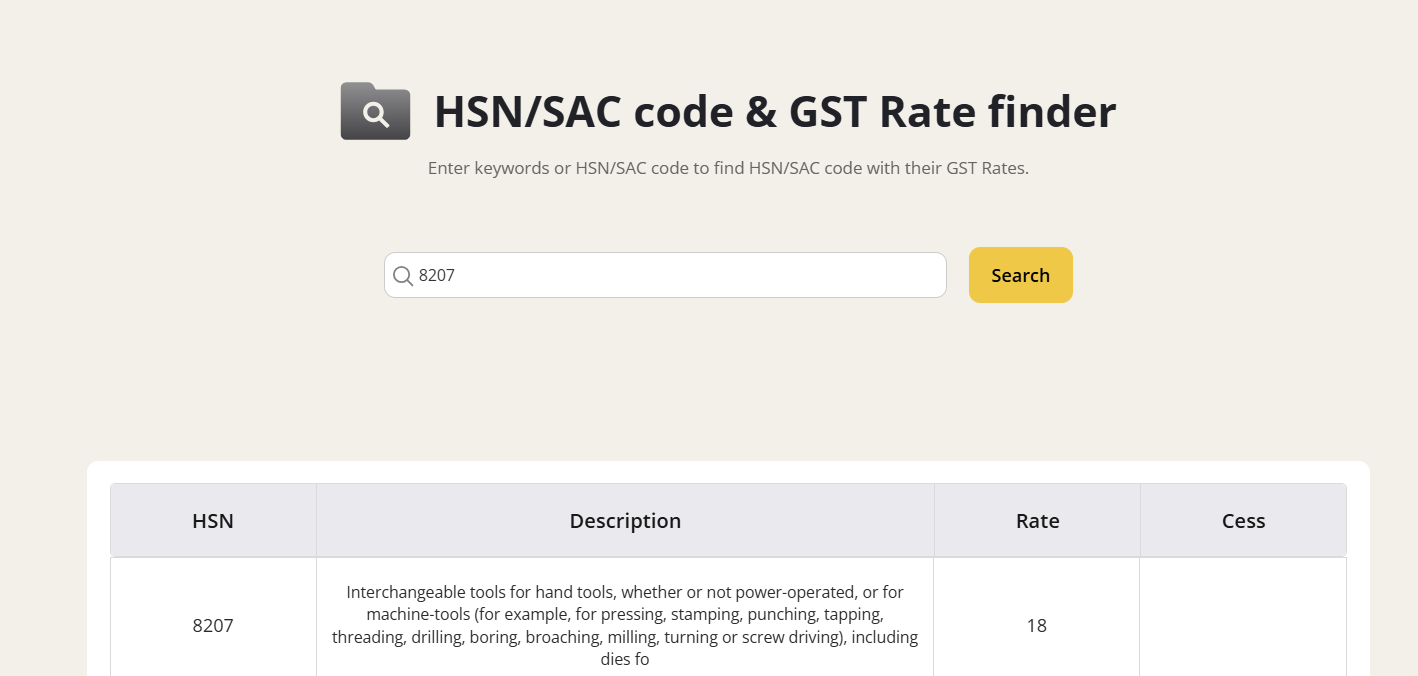

GST Rates & Exemptions for HSN Code 8207

All goods classified under HSN Code 8207 attract a uniform GST rate of 18% from the introduction of GST in July 2017. This rate applies to all subcategories and tool types within this code, including both manual and power-operated tool components. There is no compensation cess levied on items under this HSN code.

Currently, there are no specific GST exemptions or special rates applicable to these tools; the standard 18% GST rate remains in effect for all domestic sales and supplies.

Table Notes

- The GST rate applies equally to all types of interchangeable tools listed under 8207, whether used manually or mounted on machines.

- For accurate GST compliance and to claim Input Tax Credit (ITC), invoices must specify the precise 8-digit HSN code corresponding to the specific tool or tool set.

- No concessional rates or exemptions exist currently under GST rules for this category.

GST Rates Applicable Under 8207

Explore Gimbooks HSN/SAC code & GST Rate finder

What’s Included in HSN Code 8207?

This HSN code encompasses:

- Cutting, forming, and machining tools adaptable to various hand and machine tools.

- Dies for drawing, pressing, stamping, tapping, threading, punching, broaching, milling, boring, turning, and screw-driving operations.

- Replaceable heads, inserts, and components designed to extend the functionality of tools and machines.

These tools cater to metalworking, woodworking, automotive repair, and many other precision manufacturing sectors.

Explore more hsn code and gst rate - with Gimbooks HSN Finder

Key Exemptions Under GST for 8207

As of 2025, no exemptions or concessional GST rates are available under HSN 8207. The 18% GST is applied uniformly across all interchangeable tool categories.

Businesses should stay updated with notifications from CBIC in case of any future changes or specific sectoral exemptions.

Input Tax Credit (ITC) Rules for Interchangeable Tools

Registered businesses can claim ITC on the 18% GST paid for supplies under HSN Code 8207 if:

- The tools are used in furtherance of business or manufacturing operations.

- Tax invoices mentioning the correct HSN code and GSTIN details are available.

- Tools are not used for personal or exempted activities.

Proper HSN classification and GST invoicing ensure smooth input credit flows, vital for manufacturers and workshops with high tooling expenses.

GST on Interchangeable Tools Billing: Practical Scenarios

- A manufacturer purchases interchangeable milling cutters (HSN 820770) at ₹1,00,000 plus 18% GST and claims ITC for the GST amount.

- An automotive workshop buys tapping and threading dies invoiced under HSN 820740 with 18% GST charged and properly documented for tax credit.

- A supplier sells mixed tool sets under HSN 8207, charging 18% GST, ensuring compliance for B2B transactions.

Common Mistakes in GST Filing for Interchangeable Tools

- Using generic or incorrect HSN codes instead of specific 8207 classifications, resulting in denial of input credit or audit issues.

- Charging outdated GST rates (before the rate was standardized at 18%) leading to GST liability disputes.

- Omitting HSN codes or GSTIN details on invoices; this leads to ITC denial for buyers.

- Confusing these tools with exempted items or different GST categories.

Conclusion

HSN Code 8207 standardizes the GST treatment of interchangeable tools, with a steady 18% GST rate across all subtypes ensuring clarity and consistency. Businesses dealing in these tools—from manufacturing units to repair workshops—benefit from straightforward compliance and full tax credit options when invoicing properly.

Employers must maintain accurate HSN and GST documentation to avoid penalties and optimize ITC claims.

Also explore more

Geyser, Water Heater HSN Code 8516 and GST Rate

GST Rates and HSN Code 4402 for Wood Charcoal

Steel HSN Code and GST Rate Details 2025

Electrical Transformers HSN Code 8504

GST Rates and HSN Code 8528 for Monitors, Projectors and TVs

FAQs: HSN Code 8207 & Interchangeable Tools GST

What is HSN 8207?

Interchangeable tools for hand and machine tools, covering pressing, tapping, threading, drilling, milling, and more.

What’s the GST rate on HSN 8207?

Uniform 18% GST applies across all categories under HSN 8207.

Can businesses claim ITC?

Yes, full input tax credit is available with proper invoices and business use.

Are there exemptions for interchangeable tools?

No current exemptions; all supplies taxed at 18%.