TDS on Interest: Rules, Thresholds, and Deduction Rates

TDS on interest is an important concept that small and micro-sized businesses need to understand. It ensures that tax is collected at the source when businesses or individuals earn interest from various sources.

If you are running a small business or managing a micro-enterprise, knowing the rules of Section 194A is crucial to staying compliant and avoiding penalties. Let’s dive in!

What is TDS on Interest?

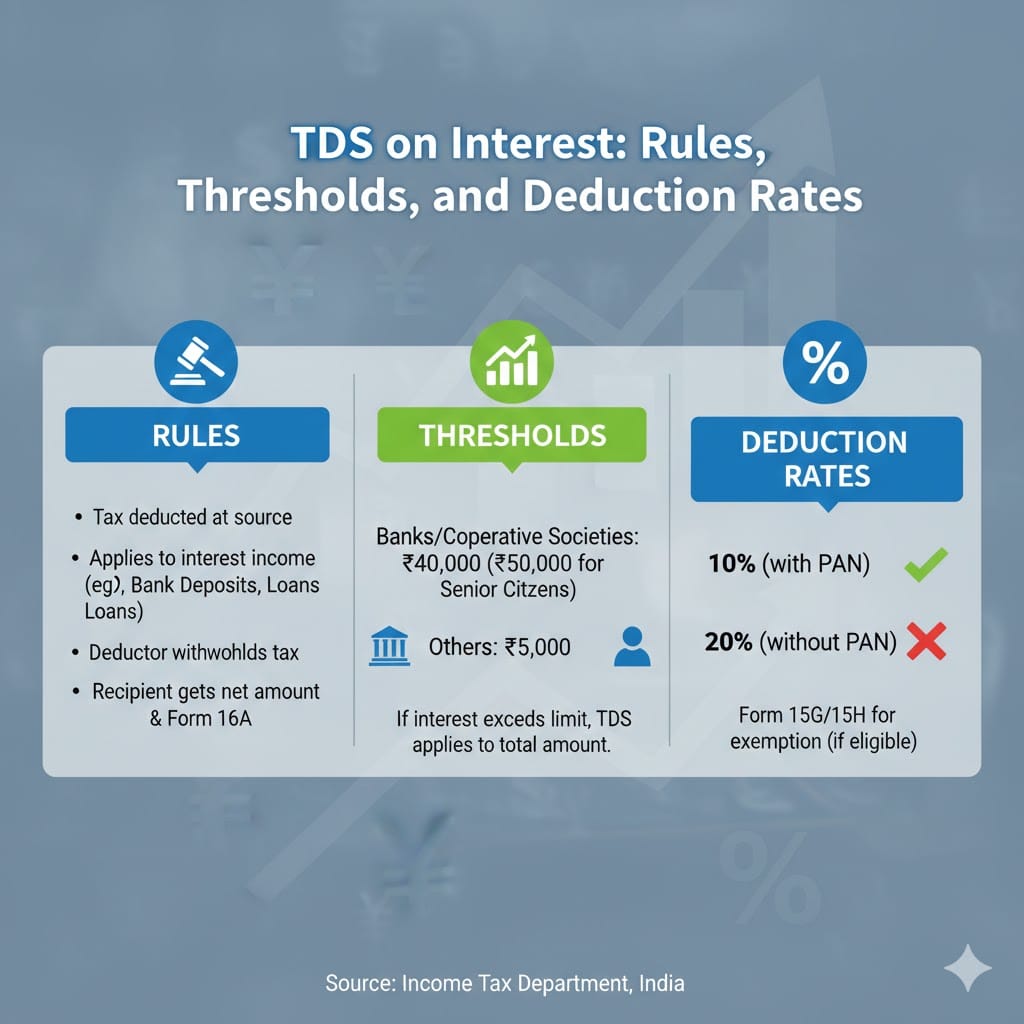

TDS on interest refers to the tax that is deducted when a person or business earns interest income from sources like fixed deposits, loans, or other interest-bearing accounts. According to 194A of the Income Tax Act, this tax must be deducted at the time of payment if the interest amount crosses a certain threshold.

The purpose of Section 194A is to ensure that tax is collected on interest income systematically, rather than relying on individuals to report it later. It helps the government track income and helps businesses maintain proper records.

It applies to a wide range of situations where interest is paid by one party to another. For small businesses, this could be the interest paid on loans taken from other businesses or individuals. For micro-sized businesses, it may include interest paid on deposits with banks or financial institutions.

Who Should Deduct 194A TDS?

Businesses, banks, companies, or individuals who make interest payments need to deduct TDS on interest if the amount is above the specified limit. Here are the key points:

- The payer should deduct TDS before making the payment to the recipient.

- The deducted amount should be deposited with the government within the prescribed time.

- A TDS certificate should be issued to the recipient.

The rule applies regardless of whether the payment is made to an individual, firm, or company. The responsibility to deduct TDS lies entirely with the entity making the payment.

Small and micro-sized businesses need to understand this because failing to comply can lead to penalties, interest charges, and disallowance of expenses during tax assessment.

What is the 194A TDS Limit?

The 194A TDS limit is important because it tells you when you must start deducting tax. Here is the threshold:

- If the total interest payment in a financial year exceeds Rs. 5,000 for an individual or Rs. 10,000 for others (like companies or firms), TDS must be deducted.

For example, if your business pays Rs. 6,000 as interest on a loan to an individual, you must deduct TDS. Similarly, if a company pays Rs. 12,000 as interest to another firm, TDS is mandatory.

It is critical to track the total interest payments over the financial year rather than each payment. It means that even multiple small payments that together exceed the threshold are subject to TDS.

Section 194A TDS Rate

The standard Section 194A TDS rate is:

- 10% on the amount of interest paid.

However, if the recipient does not provide their PAN (Permanent Account Number), the rate increases to 20%. It encourages compliance and ensures correct reporting of income.

Example:

If you pay Rs. 10,000 as interest on a loan:

- TDS to be deducted: 10% of Rs. 10,000 = Rs. 1,000

- The recipient will get Rs. 9,000 after TDS.

If PAN is missing:

- TDS to be deducted: 20% of Rs. 10,000 = Rs. 2,000

- The recipient will get Rs. 8,000 after TDS.

TDS Rate on Interest on Unsecured Loan

For unsecured loans, the TDS rate on interest on unsecured loans is also 10% as per Section 194A. Whether the loan is secured or unsecured does not affect the TDS rate.

It is important to document the loan agreement and the terms of interest clearly. Both parties should maintain records showing the nature of the loan and the interest rate agreed upon.

TDS on Interest on Loan

When your business provides a loan and charges interest, you must deduct TDS if the interest amount crosses the 194A TDS limit.

Key points to remember:

- TDS applies whether the loan is to an individual, a partnership firm, a company, or any other entity.

- Always collect PAN from the recipient to apply the correct TDS rate.

- Maintain detailed records of the transaction, including the loan agreement, PAN details, and interest calculations.

Nature of Payment 194A

The nature of payment 194A is 'Interest other than interest on securities.'

Examples include:

- Interest on fixed deposits.

- Interest on loans.

- Interest on recurring deposits.

Payments excluded under this section:

- Interest on securities (covered under a different TDS provision).

- Dividends.

Understanding the distinction is crucial because interest on securities follows a different set of rules and TDS provisions. For most small businesses, it is unlikely they will deal with interest on securities, but they must be aware of it to avoid confusion.

Deduction Not Admissible Against Interest on Securities

A common confusion is about the deduction not admissible against interest on securities under Section 194A. Here’s the rule:

- The section does not apply to interest income from securities like government bonds or debentures. These have a separate tax treatment and are covered under different TDS provisions.

It ensures clarity in accounting and proper tax compliance.

How to Deposit TDS Under Section 194A

Follow these steps to deposit TDS on interest:

- Calculate the TDS amount based on the 194A TDS rate.

- Deduct TDS before making the payment to the recipient.

- Deposit the TDS to the government using Form 26Q.

- Issue a TDS certificate (Form 16A) to the recipient.

- File the quarterly TDS returns.

Important Points:

- Depositing TDS late can attract interest and penalties.

- Filing the correct TDS return with accurate details ensures smooth compliance.

- The TDS certificate serves as proof of tax deducted for the recipient.

Consequences of Non-Compliance

If you fail to deduct TDS on interest as per Section 194A, you may face:

- Interest penalties.

- Fines.

- Disallowance of the expense claimed in your books of accounts.

It makes compliance critical for small and micro-sized businesses to avoid unexpected costs and legal complications.

How to Simplify TDS Compliance

Managing TDS on interest can seem complicated, especially for small businesses with limited accounting expertise. That’s where tools like GimBooks come in handy.

Benefits of Using GimBooks:

The benefits of using GimBooks are as follows:

- Automates TDS calculation based on the latest rates.

- Tracks all interest payments and related TDS.

- Helps you file TDS returns without hassle.

- Generates TDS certificates automatically.

GimBooks is designed specifically for small and micro-sized businesses in India and the Middle East. It simplifies bookkeeping, invoicing, and compliance, so you don’t have to worry about complex tax rules.

Wrapping Up

Understanding TDS on interest is vital for small and micro-sized businesses to stay tax compliant. Following the rules under Section 194A of the Income Tax Act helps avoid penalties and ensures smooth operations.

Maintaining proper records, collecting PANs, and using reliable tools like GimBooks can make TDS compliance easy. This way, you can focus more on growing your business and less on paperwork.

To know more, explore GimBook’s informative blog section!

Related

TDS on Sale of Goods: Applicability and Compliance

Key Difference Between TDS and TCS You Should Know

TDS on GST Bill

TDS on GST: When and How Tax is Deducted on GST Amount

FAQs

What is TDS on interest, and how does it work?

TDS on interest is the tax deducted at source when you earn interest from loans, fixed deposits, or other interest-bearing accounts. It ensures that the government collects taxes at the time of payment.

What is the TDS on interest limit for individuals and businesses?The

TDS on interest limit is Rs. 5,000 for individuals and Rs. 10,000 for businesses in a financial year. If the interest paid exceeds these limits, TDS must be deducted as per Section 194A.

What is the applicable TDS rate on interest under Section 194A?

The standard TDS rate on interest is 10%. If the recipient does not provide PAN, the rate increases to 20%, as per Section 194A of the Income Tax Act.

Is TDS applicable to interest from unsecured loans?

Yes, TDS is applicable on interest from unsecured loans at a rate of 10%, under Section 194A, if the interest amount exceeds the prescribed limit.

How can small businesses calculate and deposit TDS on interest?

Small businesses can calculate TDS at 10% of the interest paid (or 20% if PAN is missing), deduct it before payment, deposit the amount with the government using Form 26Q, and issue Form 16A as a TDS certificate to the recipient.