GST Rates and HSN Code 9031 for Measuring Instruments

India's manufacturing and quality control sectors, valued at ₹25 lakh crore, depend on precision measuring instruments classified under HSN code 9031. From automotive assembly lines to pharmaceutical labs, tools like calipers, gauges, and oscilloscopes ensure compliance with BIS/ISO standards. As of the 56th GST Council meeting (Dec 2025), the 9031 hsn code gst rate remains stable at 18%, supporting Make in India precision engineering growth amid ₹1.5 lakh crore metrology market.

This detailed guide covers rates, sub-codes, ITC, and compliance for engineers, lab managers, and traders navigating GST e-invoicing mandates.

What is HSN Code 9031?

HSN Code 9031 (under Chapter 90: Optical, Measuring Instruments) classifies "Measuring or checking instruments, appliances and machines, not specified or included elsewhere; profile projectors." The HSN code for Measuring Instruments includes non-optical precision tools for length, weight, pressure, temperature, electricity, and quality control.

Essential for:

- Vernier calipers/micrometers: Dimensional accuracy.

- Dial gauges/height masters: Tolerances.

- Profilometers: Surface finish.

- Coordinate measuring machines (CMM): 3D inspection.

India's 5,000+ NABL labs and 50,000 factories mandate calibrated tools under Legal Metrology Act 2009.

GST Rates & Exemptions for HSN Code 9031

Uniform 18% GST applies across 9031 hsn code since 2017—no cess or revisions through 2025. Calibration services (9983.57) attract 18%; exports zero-rated.

No exemptions; mandatory for BIS-traceable instruments in regulated sectors.

Table Notes

- 8-digit HSN compulsory for e-invoicing (>₹5Cr turnover).

- Calibration certificates required for ITC.

- Imported instruments: IGST + customs duty.

GST Rates Applicable Under 9031

What's Included in HSN Code 9031?

HSN code 9031 encompasses:

- Linear/angular: Vernier, micrometers, dial indicators.

- Surface: Profilometers, roughness testers.

- Electrical: Multimeters, oscilloscopes (non-display).

- Balancing: Wheel balancers, dynamic/static.

- Profile projectors: Optical comparators.

Excludes optical microscopes (9011), weighing scales (8423). India's metrology imports: $500Cr annually.

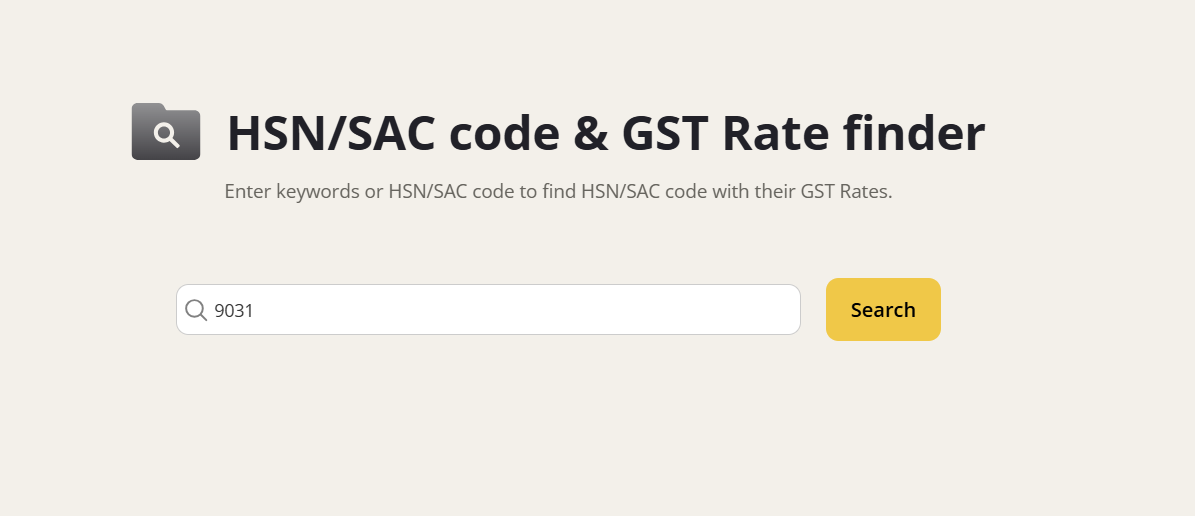

Explore more hsn code and GST rates - with Gimbooks HSN Finder

Key Exemptions Under GST for 9031

- No GST exemptions; 18% standard.

- Govt R&D labs: Potential concessions.

- Exports: Zero-rated LUT/bond.

- Calibration services taxable separately.

Input Tax Credit (ITC) Rules for Measuring Instruments

Full ITC on 18% GST for:

- Manufacturers using in production.

- Labs/service centers.

- E-invoices with HSN/calibration certs.

Blocked: Personal use, exempt supplies. Example: Factory buys CMM (₹20L + ₹3.6L GST)—claims full ITC against taxable output.

GST on Measuring Instruments Billing: Practical Scenarios

- Auto OEM: Micrometers (903180) for engine parts: 18% GST, ITC offset.

- Pharma Lab: Profile projector (903110): Calibration + GST invoice.

- Service Center: Tire balancer (903130): B2C 18% GST.

- Exporter: Zero-rated laser alignment tools.

E-way interstate >₹50K.

Common Mistakes in Instruments GST

- Generic 90xx HSN—ITC denial.

- Ignoring calibration traceability.

- No HSN on service invoices.

- Import GST misclassification.

Conclusion

HSN code 9031 ensures 9031 hsn code gst rate compliance at 18%, powering India's precision manufacturing. Labs/manufacturers: Maintain traceability, e-invoice, reconcile GSTR-2B.

Critical for Quality Council of India certification and global competitiveness in 2025.

Explore more

- GST Rates and HSN Code 8528 for Monitors, Projectors and TVs

- GST Rates and 7214 HSN Code for Bars and Rods of Iron

- GST Rates and HSN Code 8207 for Interchangeable Tools

- Geyser, Water Heater HSN Code 8516 and GST Rate

FAQs: HSN Code 9031 & Measuring Instruments GST

1. What is HSN Code 9031?

HSN Code 9031 classifies measuring or checking instruments, appliances, and machines not specified elsewhere, including calipers, gauges, and profile projectors.

2. What is the standard GST rate for HSN 9031?

The GST rate for HSN Code 9031 measuring instruments is 18%.

3. Can Input Tax Credit (ITC) be claimed on these instruments?

Yes, ITC can be claimed if the instruments are for business use and proper HSN invoices are maintained.

4. What is the GST on calibration of instruments?

Calibration services are charged at 18% GST under SAC 9983.57, separate from the instrument’s GST.

5. Are there any GST exemptions for HSN 9031?

No exemptions exist for HSN 9031 instruments within India, though exports are zero-rated.

6. What import duties apply to HSN 9031 instruments?

Imports attract IGST 18% plus basic customs duty of 7.5–10%, depending on the instrument type.