GST Rates and HSN Code 0910 for Ginger, Saffron, Turmeric, Thyme, Bay Leaves, and Curry

India's spice industry, valued at over $10 billion in exports annually, relies heavily on precise GST classification under HSN Code 0910. From Kerala farms to global kitchens, ginger, saffron, turmeric, thyme, bay leaves, and curry leaves form the backbone of culinary and medicinal trade. This guide breaks down the 0910 hsn code gst rate, exemptions, and compliance essentials for farmers, traders, processors, and exporters in 2025.

Whether you're a small spice vendor or large exporter, understanding Ginger HSN Code 0910, Saffron HSN Code 0910, and Turmeric HSN Code 0910 ensures smooth invoicing, ITC claims, and zero-rated exports.

What is HSN Code 0910?

HSN Code 0910 falls under Chapter 9 (Coffee, Tea, Mate, and Spices), specifically classifying ginger, saffron, turmeric (curcuma), thyme, bay leaves, curry, and select other spices in their unprocessed or minimally processed forms. This includes fresh, dried, crushed, ground, or powdered variants—but excludes further manufactured spice mixes or extracts.

Key items:

- Ginger HSN Code 0910: Fresh roots (Nil GST), dried (white/black), powder.

- Saffron HSN Code 0910: Premium stigma/stamen from Kashmir.

- Turmeric HSN Code 0910: Fresh rhizomes (Nil), dried haldi, powder.

- Others: Thyme, tejpat (bay leaves), curry leaves, seeds like celery/fenugreek.

India produces 70% of global turmeric and leads ginger exports, making accurate HSN Code 0910 usage critical for $4B+ annual spice revenue.

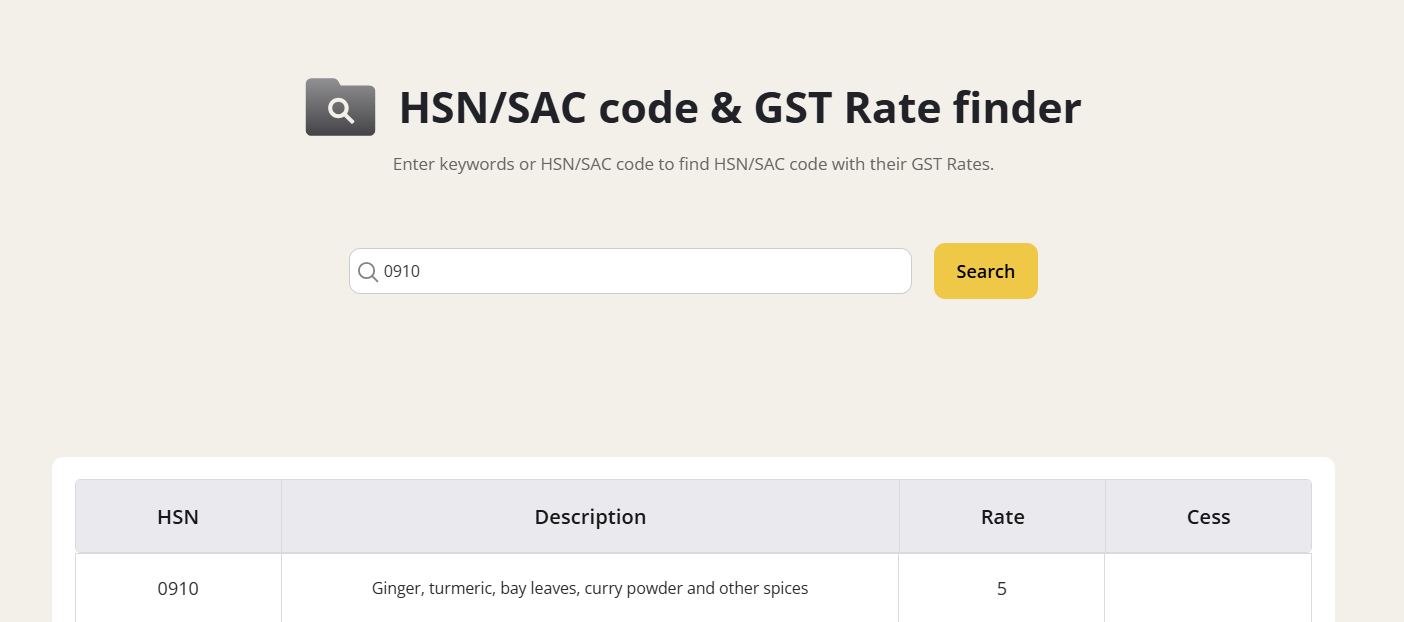

GST Rates & Exemptions for HSN Code 0910

The 0910 hsn code gst rate is predominantly 5% for dried, powdered, or processed forms, with Nil (0%) for fresh ginger (09101110) and fresh turmeric (09103010). No compensation cess applies since 2017. This agri-friendly structure supports farmers while taxing value-added processing.

Exports remain zero-rated, enabling input refunds. No major revisions through 55th GST Council (Dec 2024); rates stable for 2025.

Table Notes

- Fresh = Nil; any drying/grinding = 5%.

- 8-digit HSN mandatory for B2B ITC.

- E-invoicing required for turnover >₹5Cr.

GST Rates Applicable Under 0910

What’s Included in HSN 0910?

HSN Code 0910 covers primary spices in natural states:

- Ginger: Roots fresh/dried, powder (dry ginger powder staple in Ayurveda).

- Saffron: Costliest spice ($5K/kg), stigma/stamen.

- Turmeric: World's largest producer (1.2M tons/year), fresh/dried/powder.

- Herbs: Thyme, bay leaves (tejpatta), curry leaves.

- Seeds/Powders: Celery, fenugreek, dill, ajwain, cassia.

Excludes blended masalas (09109100, 5%) or extracts (3302). India's spice exports hit $4.5B in FY24, with turmeric/ginger leading.

Explore more hsn code and gst rate - with Gimbooks HSN Finder

Key Exemptions Under GST for 0910

- Nil GST: Fresh ginger/turmeric—farmer sales below threshold exempt from registration.

- Composition scheme for small traders (1% on turnover).

- Zero-rated exports: Full IGST refund + input ITC.

- No cess; supports MSME spice processors.

Input Tax Credit (ITC) Rules for Spices

Registered entities claim full ITC on 5% GST for:

- Processing into powders/oils (e.g., turmeric to haldi).

- Resale/trading with valid e-invoices.

- Turnover reconciliation via GSTR-2B.

Blocked ITC: Nil-rated fresh items, personal use. Example: Processor buys dried ginger (₹100/kg + ₹5 GST), claims ₹5 ITC against spice mix sales.

GST on Spices Billing: Practical Scenarios

- Farmer: Sells fresh turmeric (09103010, Nil) to trader—no GST.

- Trader: Invoices dried ginger powder (09101210, 5% GST) to exporter.

- Exporter: Ships saffron (zero-rated), refunds input GST on packaging/transport.

- Retailer: Buys curry leaves (5% GST), claims ITC against food sales.

E-way bill for interstate >₹50K; mandatory for spices.

Common Mistakes in Spices GST

- Charging 5% on fresh (Nil) items—leads to refunds/disputes.

- Generic HSN (09) vs specific 0910xx—ITC denial.

- Skipping e-invoicing for high-value deals.

- Export without LUT/bond—unnecessary 5% IGST payment.

Conclusion

HSN Code 0910 simplifies GST for India's spice powerhouse, with 0910 hsn code gst rate at 5% (Nil fresh) fueling $10B+ industry growth. From Erode turmeric markets to Kashmiri saffron fields, accurate classification unlocks ITC, refunds, and exports.

Traders: Integrate GST software, reconcile monthly, monitor CBIC. This ensures compliance amid rising global demand through 2025.

Explore more

Ground Nut HSN Code 1202 and GST Rate}

GST Rate & HSN Code 2201 for Beverages, spirits and vinegar

GST Rates and HSN Code 0801 for Coconuts, Brazil Nuts, Cashew Nuts

FAQs: HSN Code 0910 & Spices GST

1. What is HSN Code 0910?

HSN 0910 covers spices such as ginger, saffron, turmeric, thyme, bay leaves, curry leaves, and certain related seeds and powders.

2. What is the standard GST rate for items under HSN 0910?

Most dried or processed spices under HSN 0910 attract 5% GST, while fresh ginger and fresh turmeric are exempt (0% GST).

3. Can Input Tax Credit (ITC) be claimed on spices under HSN 0910?

Yes, ITC can be fully claimed on purchases taxed at 5%, provided the supplier issues a valid GST invoice with the correct HSN code.

4. What export benefits are available for spices under HSN 0910?

Exports are zero-rated under GST, and exporters can claim ITC refunds or opt for duty-free supplies through LUT/Bond.