GST Rates and 7214 HSN Code for Bars and Rods of Iron

India's construction boom and infrastructure push make HSN Code 7214 essential for steel traders and builders. Covering bars and rods of iron or non-alloy steel (forged, hot-rolled, twisted), this classification powers ₹2 lakh crore+ steel market. From TMT bars in high-rises to bright bars in auto parts, accurate 7214 hsn code usage ensures GST compliance and ITC flow.

(Note: Keywords like Ginger HSN Code 0910, Saffron HSN Code 0910, Turmeric HSN Code 0910 relate to spices under HSN 0910/0910 hsn code gst rate—not iron products. This guide focuses on steel HSN 7214.)

What is HSN Code 7214?

HSN Code 7214 classifies "Other bars and rods of iron or non-alloy steel, not further worked than forged, hot-rolled, hot-drawn or hot-extruded, but including those twisted after rolling." Under Chapter 72 (Iron and Steel), it covers construction-grade TMT bars, deformed/ribbed rods, spring steel, mild steel bright bars, and free-cutting variants.

Key applications:

- TMT bars (Fe415, Fe500) for RCC structures.

- Deformed/twisted rods with ribs/grooves for concrete bonding.

- Forged bars for heavy engineering.

- Rectangular/square section bars for fabrication.

India consumes 120M+ tons steel annually; 7214 dominates rebar market (~40%). Unlike finished steel (7213), these are semi-processed.

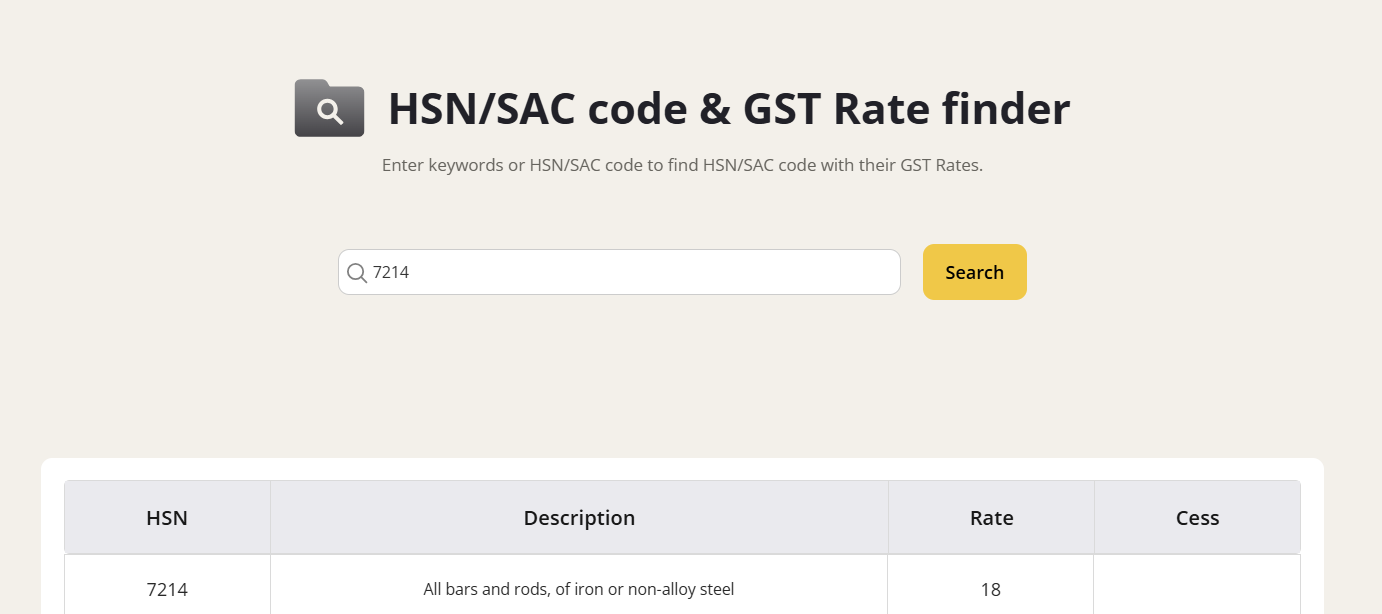

GST Rates & Exemptions for HSN Code 7214

Uniform 18% GST applies across all 7214 hsn code sub-categories since July 2017—no cess. Rates stable post-55th GST Council; supports Make in India steel push.

No exemptions for standard bars/rods; exports zero-rated with input refunds.

Table Notes

- 8-digit HSN mandatory for e-invoicing/ITC.

- TMT/deformed = 721420xx; bright bars = 72149110.

- Verify BIS certification for construction use.

GST Rates Applicable Under 7214

What's Included in HSN 7214?

HSN Code 7214 covers:

- Hot-rolled TMT bars (ribbed for grip).

- Twisted/deformed rods post-rolling.

- Forged non-alloy iron/steel bars.

- Bright/mild steel rectangular bars.

- Free-cutting variants for machining.

Excludes cold-drawn (7215), wire rods (7213), or alloy steel (7228). TMT dominates 80% construction steel.

Explore more hsn code and gst rate - with Gimbooks HSN Finder

Key Exemptions Under GST for 7214

- No GST exemptions; 18% standard.

- Composition scheme for small traders (6% turnover).

- Zero-rated exports (₹50,000Cr steel exports FY24).

- Govt infrastructure tenders may negotiate.

Input Tax Credit (ITC) Rules for Steel Bars

Full ITC on 18% GST for:

- Builders using in taxable projects.

- Fabricators/manufacturers.

- Traders with e-invoices (HSN/GSTIN mandatory).

Blocked: Personal use, exempt supplies. Example: Contractor buys 10T TMT (721420, ₹60,000/T + ₹10,800 GST)—claims ₹1.08Cr ITC.

GST on Steel Bars Billing: Practical Scenarios

- Builder: 500T TMT bars (72142010) for apartments: ₹3Cr + ₹54L GST, full ITC.

- Trader: Sells bright bars (72149110) interstate: E-way bill + 18% IGST.

- Exporter: Ships deformed rods zero-rated, refunds input GST.

- Fabricator: Rectangular bars (721491) for gates—offsets against fabrication GST.

E-invoicing mandatory >₹5Cr turnover.

Common Mistakes in Steel GST

- Generic HSN (72) vs specific 7214xx—ITC denial.

- 18% vs old rates confusion.

- No HSN/e-way bills for interstate.

- Export without LUT—unnecessary IGST.

Conclusion

HSN Code 7214 standardizes 18% GST for iron bars/rods, fueling India's steel-driven growth. From PMAY housing to highways, accurate classification maximizes ITC and compliance.

Integrate GST software, reconcile GSTR-2B, track BIS. Essential for ₹15L Cr construction sector in 2025.

Explore

GST Rates and HSN Code 8207 for Interchangeable Tools

GST Rates and HSN Code 4402 for Wood Charcoal

Steel HSN Code and GST Rate

Bearing HSN Code and GST Rate

FAQs: HSN Code 7214 & Steel Bars GST

What is HSN Code 7214?

HSN Code 7214 covers bars and rods of iron or non-alloy steel, including TMT bars, deformed bars, forged bars, and bright bars. It is used for classification and taxation purposes under GST.

What is the GST rate for HSN 7214?

The standard GST rate for all sub-codes under HSN 7214 is 18%. This rate applies uniformly to all products categorized under this code.

Can Input Tax Credit (ITC) be claimed on HSN 7214 products?

Yes, businesses can claim full ITC on steel bars under HSN 7214, provided they have valid GST-compliant e-invoices and meet all GST compliance requirements.

Are there any exemptions for HSN 7214?

There are no domestic exemptions for HSN 7214. However, exports of steel bars under this HSN code are zero-rated, meaning GST is not charged on exported goods.

What types of steel bars are included under HSN 7214?

HSN 7214 includes TMT bars, deformed bars, forged bars, and bright bars, all made from iron or non-alloy steel. These are commonly used in construction and manufacturing.

Why is HSN code classification important for steel bars?

Proper HSN code classification ensures correct GST calculation, eligibility for ITC, compliance with invoicing requirements, and smooth export and import processes.