Difference Between Proforma Invoice and Account Sales: The Right Document for You

The difference between proforma invoice and account sales is the amount a customer will pay. An account sale is the record of a completed consignment sale.

Preparing proforma invoices and account sales is important as they are two important documents that ensure smooth and accurate transactions. The difference between proforma invoices and account sales lies in the payment date of sales and purpose. Proforma invoices allow you to set sales expectations upfront, securing sales and streamlining the sales process. Account sales help in providing a verified record after the sale, ensuring proper accounting, dispute resolution, and tax compliance.

To understand the purpose better, let’s see the difference between account sales and proforma invoices below.

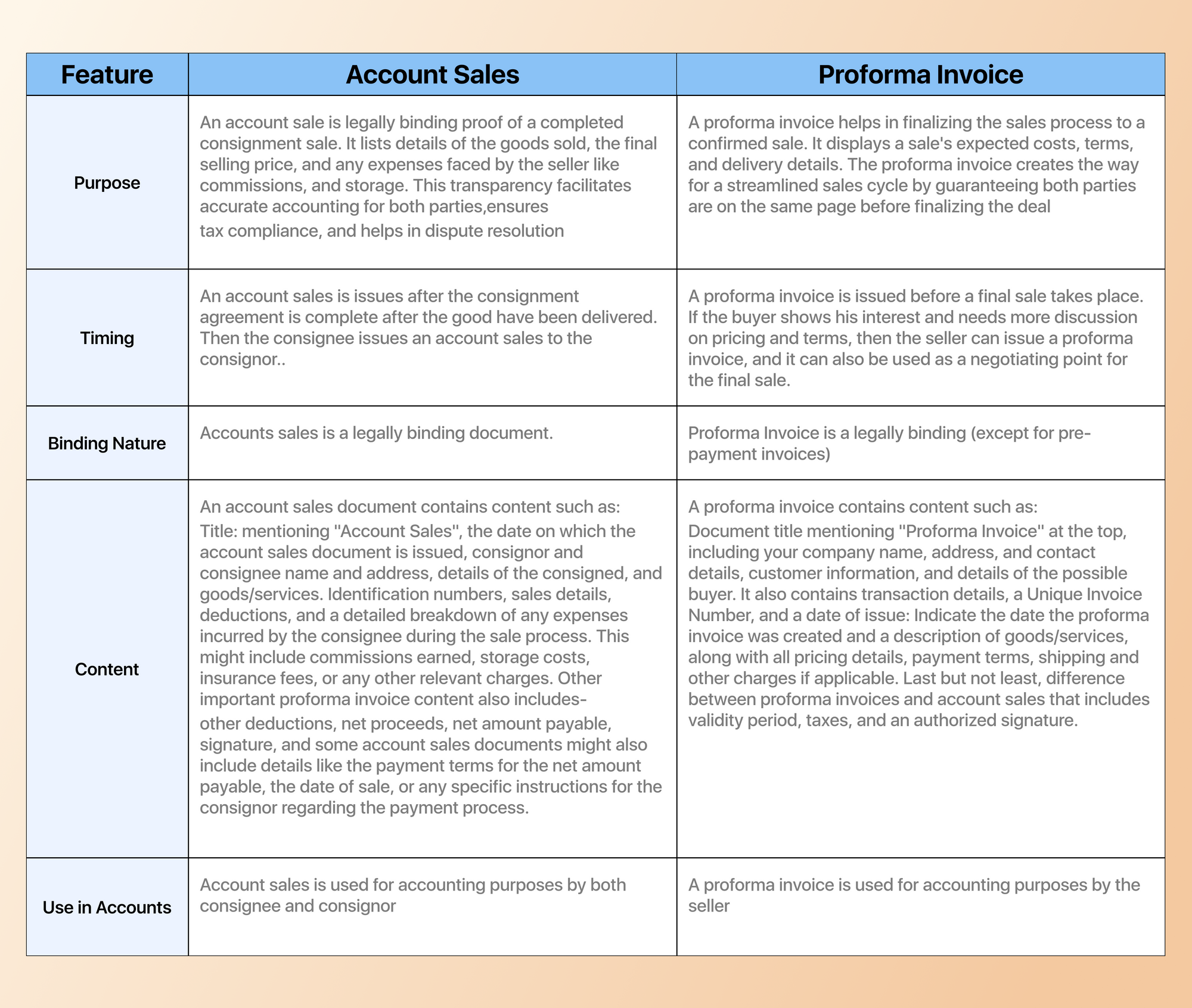

Key Differences Proforma Invoices and Account Sales

Proforma invoice vs sales account have 5 key differences to identify each document individually, which helps you prepare proforma invoice and account sales easily in a tabular format-

Now with this difference between proforma invoice and account sales you chose the right document to prepare proforma invoice and account sales easily.

What is Right for you- Proforma Invoice and Account Sales?

The document you need depends on the stage of the sale you are involved in,

Use a pro forma invoice if you're in the pre-sale phase. This is when you're discussing a possible sale with a customer but haven't finalized the details yet. The proforma invoice outlines the proposed costs, terms, and delivery details, helping you finalise and streamline the sales process.

You can use an account sales document if the sale is already completed. This is when the customer has purchased the goods or services entrusted to you in a consignment agreement. The account sales document details the final outcome of the sale, including the selling price, any deductions for commissions or expenses, and the net amount payable to the consignor (owner of the goods). It serves as a legally binding record for both parties.

Related - Learn How to Create Proforma Invoice in GimBooks App

Conclusion: Proforma vs Account Sales

Understanding the difference between proforma invoices and account sales is important for streamlining business transactions with proforma and account sales.

Proforma invoices make the way for a successful sale by setting clear expectations. It helps you to discuss pricing, terms, and delivery details before finalizing the sale.

Whereas account sales provide a verified record after the sale is complete. Account sales ensure proper accounting for both parties, promote tax compliance and serve as a reference point for dispute resolution.

By using the right document by understanding the difference between proforma invoice and account sales, at the right stage of the sales process, you can streamline communication, ensure transparency, and build stronger business relationships with your customers.

Create professional Proforma Invoices with Gimbooks

FAQs-

What is the difference between proforma and invoice?

- Proforma invoice: An estimate of the total cost of goods or services. It's a preliminary document used for planning or obtaining financial approval. It is not a legal document and does not imply a sales contract.

- Invoice: A formal document issued by a seller to a buyer detailing the products or services provided, their quantity, and the total amount due. It serves as a demand for payment.

What is the difference between proforma and Sales Order?

The major difference between proforma and Sales Order includes-

- Proforma invoice: A preliminary estimate of costs, used for planning or obtaining approval.

- Sales order: A document created by a buyer to request specific goods or services from a seller. It represents a commitment to purchase.

What is the difference between a proforma invoice and a sales quote?

The key difference between proforma and sales quote includes-

- Proforma invoice: A detailed estimate of costs, often including shipping and taxes.

- Sales quote: A general estimate of costs, often less detailed than a proforma invoice. It's more of a ballpark figure.

What is an account sales invoice?

An Account sales invoice is a document issued by a selling agent to a principal (the owner of the goods) mentioning the sales made on their behalf. It includes information about the quantity sold, price, commission, and other expenses incurred.

What is account sales in consignment?

Account sales in consignment is a report sent by the consignee to the consignor detailing actual sales made, deductions, commissions, and net proceeds.

Is sales order and proforma invoice same?

No, a sales order is a confirmation of a purchase, while a proforma invoice is a preliminary estimate sent before the sale.

What is the difference between a sales order and a proforma invoice?

A sales order confirms the buyer’s intent to purchase, whereas a proforma invoice provides an estimated cost before the sale is finalized.

Difference between proforma invoice and tax invoice?

A proforma invoice is a preliminary document showing estimated costs, while a tax invoice is an official bill issued after sale for tax and accounting purposes.

Explore more-

pro forma invoice

Professional invoices for business in 2024

GST invoice format for you in 2024

Best Invoice Format in India 2024