Transportation HSN Code 9965: GST Rate & Service Scope Explained

Understanding the 9965 HSN code is essential for businesses dealing with logistics, freight, and transportation billing. Under GST, the HSN code for transportation charges and freight charges HSN code both fall under 9965, which standardizes tax application across road, rail, air, and water transport services. Knowing how this code works helps companies stay compliant, reduce errors in invoicing, and manage overall logistics costs effectively.

GST has brought transparency and structure to taxation in transport services, using the HSN/SAC code 9965 for most goods transportation services. Knowing how GST applies to transport helps businesses stay compliant and optimize costs.

What is HSN Code 9965?

HSN Code 9965 refers to goods transport services, including by road, rail, waterways, air, and even space, classified under the GST regime for easier compliance and invoicing. This code covers a wide range of logistics solutions for moving goods within and outside India.

GST Rates & Exemptions for HSN Code 9965

Table Notes

- ITC = Input Tax Credit.

- Nil GST applies when transporting eligible agricultural, food, relief, or defense goods, and select services as notified by the GST council.

- 9965 covers road, rail, air, sea, and pipeline services for goods, with subclassifications for detail.

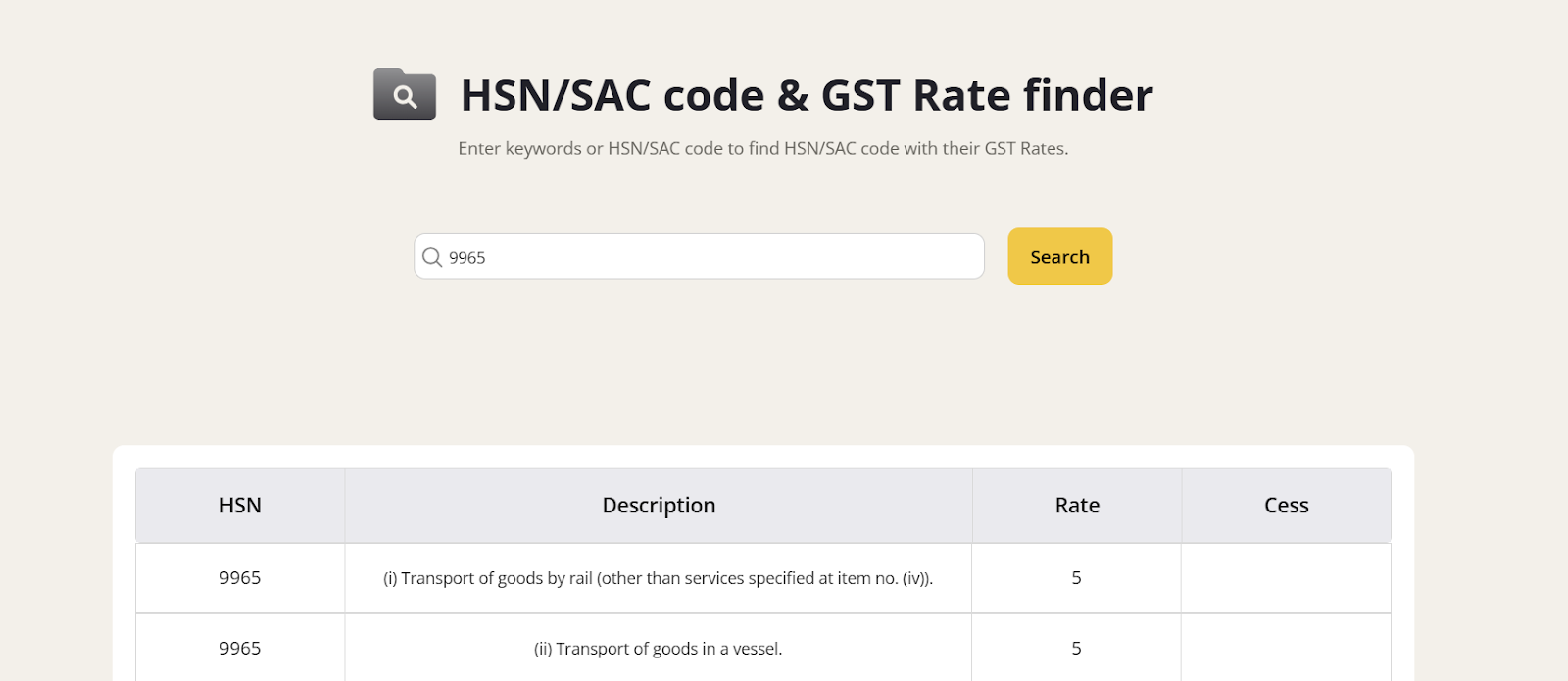

Explore Gimbooks HSN/SAC code & GST Rate finder

GST Rates Applicable Under 9965

The GST rate on transportation services under HSN 9965 varies based on the transport mode and service conditions:

- Goods Transport Agency (GTA) Services: 5% (without input tax credit – ITC), or optionally 12% (with ITC).

- Transport by Railways, Pipelines, or Ropeways: 5% (ITC restrictions apply).

- General goods transport services (other than specified categories): 18%.

- Transport by road (not by GTA/courier/inland waterways): NIL.

- Transport of certain goods (agricultural produce, milk, newspapers, relief materials): Exempt.

What’s Included in 9965 Services?

HSN 9965 covers almost all services related to moving goods:

- Road transport (by trucks, trailers, etc.)

- Rail, air, coastal and inland water transport

- Pipeline transport (natural gas, petroleum, etc.)

- Specialized logistics (live animals, refrigerated cargo, intermodal containers, etc.).

Key Exemptions Under GST for 9965

Several types of goods and situations are exempt from GST under 9965 when specific criteria are met:

- Agricultural produce, food grains, milk, salt, organic manure

- Relief and disaster supplies

- Newspapers and registered magazines

- Goods carried for the military.

Input Tax Credit (ITC) Rules for Transport Services

- 5% GST rate: ITC on input goods/services not allowed

- 12% GST rate (GTA): ITC is permitted

- 18% GST rates: ITC is permitted as per standard GST rules.

GST on Freight Charges: Practical Scenarios

- Freight for Import/Export: Services transporting goods to or from a customs station in India may have different GST rates (including exemptions), especially via air or sea.

- Domestic Transportation: Rates depend on service provider (GTA or not) and nature of goods.

Learn more - HSN Code List And GST Rate Finder: Important Facts You Should Know

Common Mistakes in Transportation GST

- Using incorrect HSN/SAC codes on invoices

- Not availing eligible exemptions

- Misunderstanding ITC eligibility

Boost Your Business Efficiency with GimBooks Online Billing App.

Conclusion

Understanding HSN 9965 ensures proper GST compliance for any business engaged in goods transportation. Stay updated with GST Council notifications for any rate changes or rule updates.

Trending topic - New GST Rates in India 2025: Complete Updated List Effective from 22 September

T Shirt HSN Code 6109: Fabric Type, Classification & GST Rate

Labour Charges HSN Code 9985

FAQs: HSN Code 9965 & Transport GST

What is HSN 9965?

HSN 9965 is used for most goods transport services under GST.

What’s the standard GST rate?

Usually 5% or 18%, depending on operation; exemptions and specifics apply.

Can ITC be claimed?

Only if opting for 12% rate (GTA) or the 18% slab. Not claimable under 5% for GTA services.

Which services are tax-exempt?

Agricultural produce, essential food items, relief supplies, military goods, and in some cases, low-value consignments.

What is the HSN code for freight services?

The freight HSN code is 9965, which covers goods transportation services under GST. It is used for invoicing, tax calculation, and compliance in logistics.

What is the HSN code for transport charges?

The HSN code for transport charges is 9965, which applies to goods transportation services under GST. It is used to ensure accurate billing and tax compliance.