Rice HSN Code 1006 and GST Rate

What is HSN Code 1006?

HSN Code 1006 classifies rice in various forms including rice in the husk (paddy), husked (brown) rice, semi-milled or wholly milled (parboiled, polished), and broken rice. This classification is crucial for processors, traders, wholesalers, and retailers in the rice supply chain to ensure correct GST application.

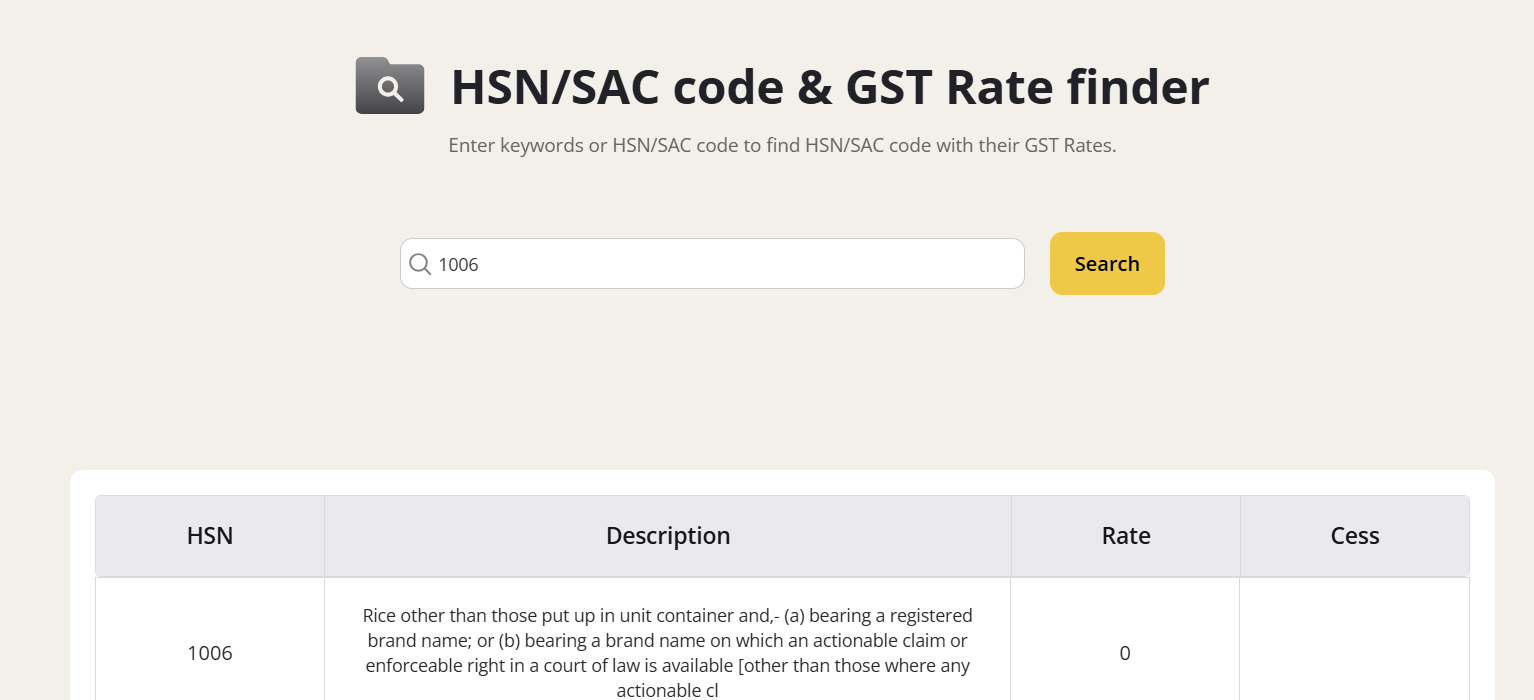

GST Rates & Exemptions for HSN Code 1006

Most rice varieties under HSN 1006 are subject to a GST rate of 5%, effective since July 1, 2017. However, unprocessed husked rice (paddy) may be treated differently under some state taxes but is generally taxed at 5% in GST. No additional cess applies to rice, making it affordable while maintaining compliance.

Table Notes

- The GST rates below are applicable for all-India transactions.

- The 5% rate includes CGST and SGST or IGST for inter-state purchases.

- Tax slabs cover detailed rice categories including seed quality, milled, and broken rice.

GST Rates Applicable Under 1006

What’s Included in HSN 1006?

HSN 1006 covers every stage of rice processing from raw paddy, husked brown rice, polished milled rice, parboiled variants, to broken rice used in processed products. It applies to both domestic consumption and exports.

Explore Gimbooks HSN/SAC code & GST Rate finder

Key Exemptions Under GST for 1006

Rice supplies under HSN 1006 do not enjoy GST exemptions but benefit from a uniform low rate of 5% and zero cess. This ensures essential food affordability while enabling tax compliance.

Input Tax Credit (ITC) Rules for Rice

ITC on rice purchase GST is typically available to registered businesses involved in food processing, retail, or export. End consumers cannot claim ITC on rice purchases. Proper invoice and GST compliance is essential to avail credit during business transactions.

GST on Rice Billing: Practical Scenarios

- A rice miller sells semi-milled parboiled rice to wholesalers GST-charged at 5%, allowing them to claim ITC on their GST returns.

- Retailers selling broken rice to bulk buyers apply the 5% GST rate and maintain compliant invoicing.

- Exporters of Basmati rice follow applicable GST rates and input credit mechanisms for efficient refund claims.

Common Mistakes in Rice GST

- Incorrect classification between husked and milled rice leading to incorrect GST rate application.

- Confusion in invoicing without proper HSN code mentioning.

- Failure to maintain proper records for ITC claims.

- Misunderstanding GST vs. local state taxes on raw paddy.

Stuggling to calculate GST - Try Gimbooks Online GST Calculator

Conclusion

HSN Code 1006 carefully categorizes rice types ensuring a uniform 5% GST rate across raw, parboiled, milled, and broken rice forms. Understanding the classification and billing nuances is vital for compliance and efficient tax management in 2025.

Also check

FAQs: HSN Code 1006 & Rice GST

What is HSN code 1006?

HSN 1006 classifies rice including paddy, husked, semi-milled, parboiled, and broken rice varieties.

What is the GST rate on raw and parboiled rice?

The GST rate is 5% across all rice categories under HSN 1006.

Can ITC be claimed on rice purchases?

ITC is claimable by GST-registered businesses involved in processing, retail, or export of rice with valid invoices.

Are there any GST exemptions on rice?

No standard exemptions apply, but the uniform 5% GST keeps rice affordable nationwide.