PVC Pipe HSN Code 3917: Uses, Industry Relevance & GST Rates

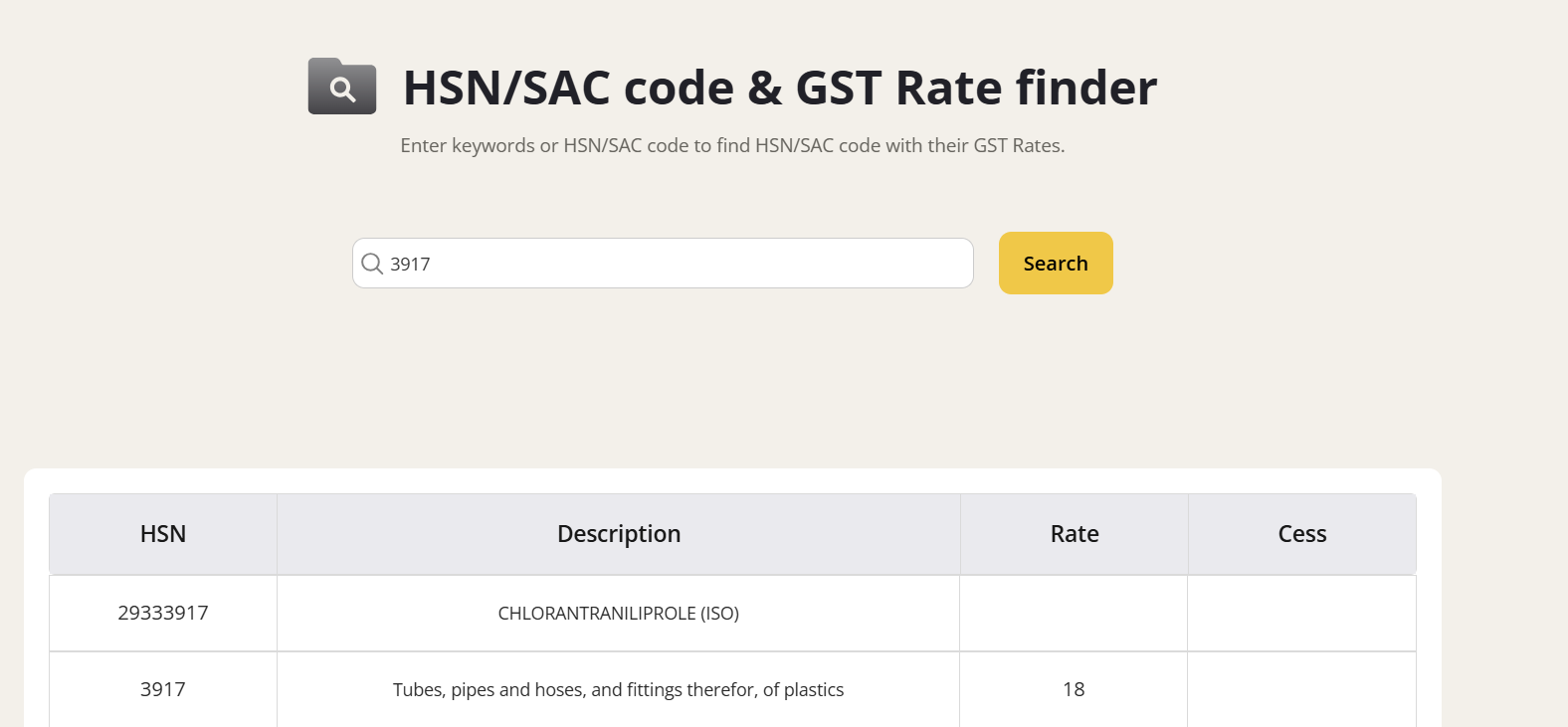

What is HSN Code 3917?

HSN Code 3917 is defined for “Tubes, pipes and hoses, and fittings thereof (for example, joints, elbows, flanges) of plastics,” which includes all types of PVC (Polyvinyl Chloride) pipes, UPVC pipe systems, and their associated connections used for plumbing, irrigation, construction, and industrial fluid transport.

GST Rates & Exemptions for HSN Code 3917

The GST rate for PVC pipes and fittings is standardized at 18% as per the September 2025 GST updates. This applies to all classifications and sizes, whether for household plumbing, agricultural irrigation, or industrial infrastructure. There are currently no specific GST exemptions or concessional rates for PVC pipe products under HSN 3917.

Table Notes

- 18% GST is split equally between CGST and SGST (for intra-state) or charged as IGST (for inter-state trade).

- Fittings, elbows, and joints for PVC pipes are classified under the same HSN and attract the same GST rate.

- No compensation cess applies to PVC pipes.

GST Rates Applicable Under 3917

What’s Included in 3917 Products?

This HSN includes PVC pipes for drinking water, sewage systems, borewell lines, agricultural irrigation, cable conduits, and construction. Also covered are matching PVC pipe fittings like elbows, couplers, tees, and flanges required for assembly and installation.

Key Exemptions Under GST for PVC Pipe

Currently, there are no GST exemptions specifically for PVC pipes (HSN 3917). All domestic and imported pipes/fittings attract 18% GST. Exemptions only apply to certain service contracts or small-value materials used in government housing, not to the pipes themselves.

Input Tax Credit (ITC) Rules for PVC Pipe

Registered businesses and contractors can claim ITC on purchases of PVC pipes and fittings used for business operations, infrastructure installation, or resale. ITC is subject to compliance with government invoicing and the new ISD (Input Service Distributor) mechanism, especially for multi-location businesses after April 2025. Personal-use purchases remain ineligible for ITC.

Explore More Check Gimbooks HSN/SAC code & GST Rate finder

GST on PVC Pipe Billing: Practical Scenarios

- Retailers and suppliers should invoice PVC pipes and fittings at 18% GST.

- Contractors and manufacturers can claim ITC for material costs used in building projects or sale.

- Import of PVC pipes also attracts IGST at 18%, claimable as credit if registered for GST.

- GST must be properly classified on all invoices, with HSN 3917 clearly indicated.

Common Mistakes in PVC Pipe GST

- Misclassifying pipe materials under incorrect HSN, leading to compliance errors.

- Failing to account for GST on associated fittings—these are also taxed at 18%.

- Neglecting new ITC distribution rules (ISD), especially in businesses with multiple branches.

- Overlooking ITC documentation, resulting in denied claims under 2025 invoice management reforms.

Conclusion

HSN Code 3917 standardizes GST rates and classification for PVC pipes and fittings in India. With a steady GST rate of 18% and clear ITC mechanisms, the updated tax regime simplifies compliance for manufacturers, traders, and users in 2025. Accurate HSN coding and robust invoice management remain key to claiming GST benefits.

Also check

FAQs: HSN Code 3917 & PVC Pipe GST

What is HSN 3917?

HSN 3917 is the GST classification for “Tubes, pipes, hoses, and fittings therefor, of plastics,” including PVC pipes, UPVC, and all associated pipe joints and elbows.

What’s the standard GST rate?

The GST rate for PVC pipes under HSN 3917 is 18% for 2025, across all use cases and product types.

Can ITC be claimed?

Yes, businesses can claim ITC for PVC pipes and fittings purchased for business use, operations, or resale—subject to compliance with the new ISD rules and proper documentation.

Are any pipes or fittings tax-exempt?

No; all PVC pipes and fittings under HSN 3917 are taxed at 18%. Only select government service contracts or materials used below certain thresholds qualify for exemptions, not the products themselves.

What is the HSN code for PVC pipes in India?

HSN Code 3917 is the official classification for all PVC (Polyvinyl Chloride) pipes, including their joints, elbows, and associated fittings as per the Indian GST regulations.

What is the GST rate on PVC pipes and fittings under HSN 3917?

The GST rate for PVC pipes and all their fittings under HSN Code 3917 is 18% as per the latest GST updates for 2025.

Are there different HSN codes for various types of plastic pipes?

Yes, while HSN 3917 covers most plastic pipes and fittings (including PVC, UPVC, and CPVC), specific sub-codes may apply based on product details—always consult GST rate notifications or your supplier.

Can businesses claim Input Tax Credit (ITC) on GST paid for PVC pipe purchases?

Registered businesses and contractors can claim ITC on GST paid for PVC pipes and fittings under HSN 3917, provided these are used for business purposes, supply, or installation projects.

Are there any GST exemptions available for PVC pipes?

Currently, all PVC pipes and fittings under HSN 3917 are taxed at 18%; there are no specific GST exemptions for these products for either domestic or imported variants as of 2025.

What types of products are included under HSN 3917 for PVC?

HSN 3917 includes PVC pipes for plumbing, agriculture, construction, sewage, cable protection, as well as all standard and specialty pipe fittings, such as joints, elbows, and flanges.

How should GST be billed for PVC pipe sales?

Suppliers and retailers must generate GST-compliant invoices for PVC pipe sales under HSN 3917 at 18% GST—split into CGST and SGST (intra-state) or as IGST (inter-state).

How does correct HSN coding for PVC pipes help with GST compliance?

Accurate use of HSN 3917 ensures correct GST calculation, standardized tax reporting, easier input tax credit claims, and minimizes chances of tax disputes or penalties during audits.