Plywood HSN Code 4412: GST Rate, Product Use & Classification

What is HSN Code 4412?

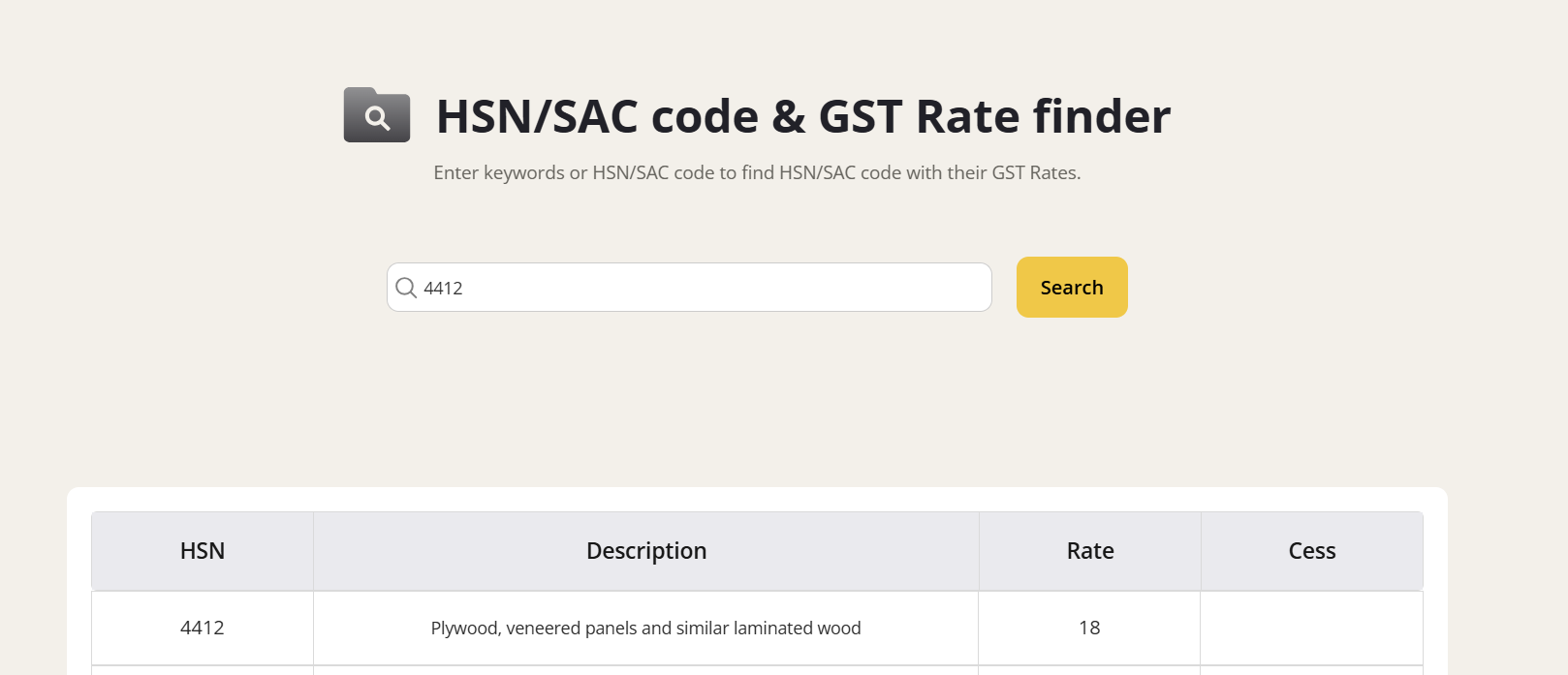

HSN Code 4412 covers plywood, veneered panels, and similar laminated wood products. This includes plywood made from tropical wood, bamboo, and other non-coniferous wood types used in furniture, construction, and decorative applications. The code also includes laminated wood panels used as building materials or in manufacturing furniture.

GST Rates & Exemptions for HSN Code 4412

As per the most recent GST updates effective September 22, 2025, plywood under HSN 4412 attracts an 18% GST rate across all variants. There are no special exemptions for plywood products, whether raw or decorative. This uniform GST rate simplifies tax compliance for manufacturers, traders, and consumers.

Table Notes

- GST rates are inclusive of CGST and SGST (9% each) for intra-state sales or IGST for inter-state.

- No compensation cess applies on plywood.

- Input Tax Credit (ITC) eligibility depends on business use (detailed below).

- Sub-classifications of plywood exist for specific raw materials or panel types under HSN 4412.

GST Rates Applicable Under 4412

What’s Included in 4412 Products?

HSN 4412 includes plywood and laminated wooden panels used primarily in furniture manufacturing, interior design, packaging, and construction. Both structural plywood (used for roof panels, decking) and decorative plywood (used for cabinetry and furniture surfaces) fall under this classification.

Explore Gimbooks HSN/SAC code & GST Rate finder

Key Exemptions Under GST for Plywood

Currently, there are no specific GST exemptions or concessional rates for plywood under 4412. Imported plywood is also taxed at 18% GST plus applicable customs duties, with IGST creditable as ITC if imported by a registered business.

Input Tax Credit (ITC) Rules for Plywood

Businesses registered under GST can claim ITC on plywood purchases if the plywood is used as input for manufacturing or business assets. ITC is generally allowed for plywood used for construction repairs, furniture manufacturing, and other commercial activities. Personal use or unregistered buyers are not eligible to claim ITC.

GST on Plywood Billing: Practical Scenarios

- Dealers must invoice plywood sales with 18% GST, reflecting CGST and SGST for intra-state, or IGST for inter-state transactions.

- Manufacturers buying plywood as raw materials can claim ITC and reduce their output GST liability.

- Interior designers or contractors purchasing plywood for projects can claim ITC if GST registered.

Common Mistakes in Plywood GST

- Misclassifying plywood items under wrong HSN codes, leading to compliance issues.

- Not claiming ITC due to lack of valid GST invoice or improper documentation.

- Charging incorrect GST rates by referring to outdated slabs (the current is uniformly 18%).

- Ignoring IGST eligibility on imports leading to higher effective tax costs.

Conclusion

HSN Code 4412 clearly classifies plywood and laminated wood products under GST with a consistent rate of 18% applicable in 2025. Proper classification, invoicing, and ITC claims are vital for manufacturers, traders, and contractors to remain compliant and optimize tax benefits.

Explore more

Mobile HSN Code 8517

Paint HSN Code 3208

Labour Charges HSN Code 9985

T Shirt HSN Code 6109

FAQs: HSN Code 4412 & Plywood GST

What is HSN 4412?

HSN 4412 covers plywood, veneered panels, and laminated wood products used in construction, furniture, and decorative applications.

What’s the standard GST rate?

The standard GST rate for plywood under HSN 4412 is 18%, effective September 2025.

Can ITC be claimed?

Yes, registered businesses can claim ITC on plywood if used for business purposes, manufacturing, or construction repair.

Are there any GST exemptions for plywood?

No significant exemptions exist for plywood under current GST law, including for imported plywood where IGST is applicable and claimable as ITC.