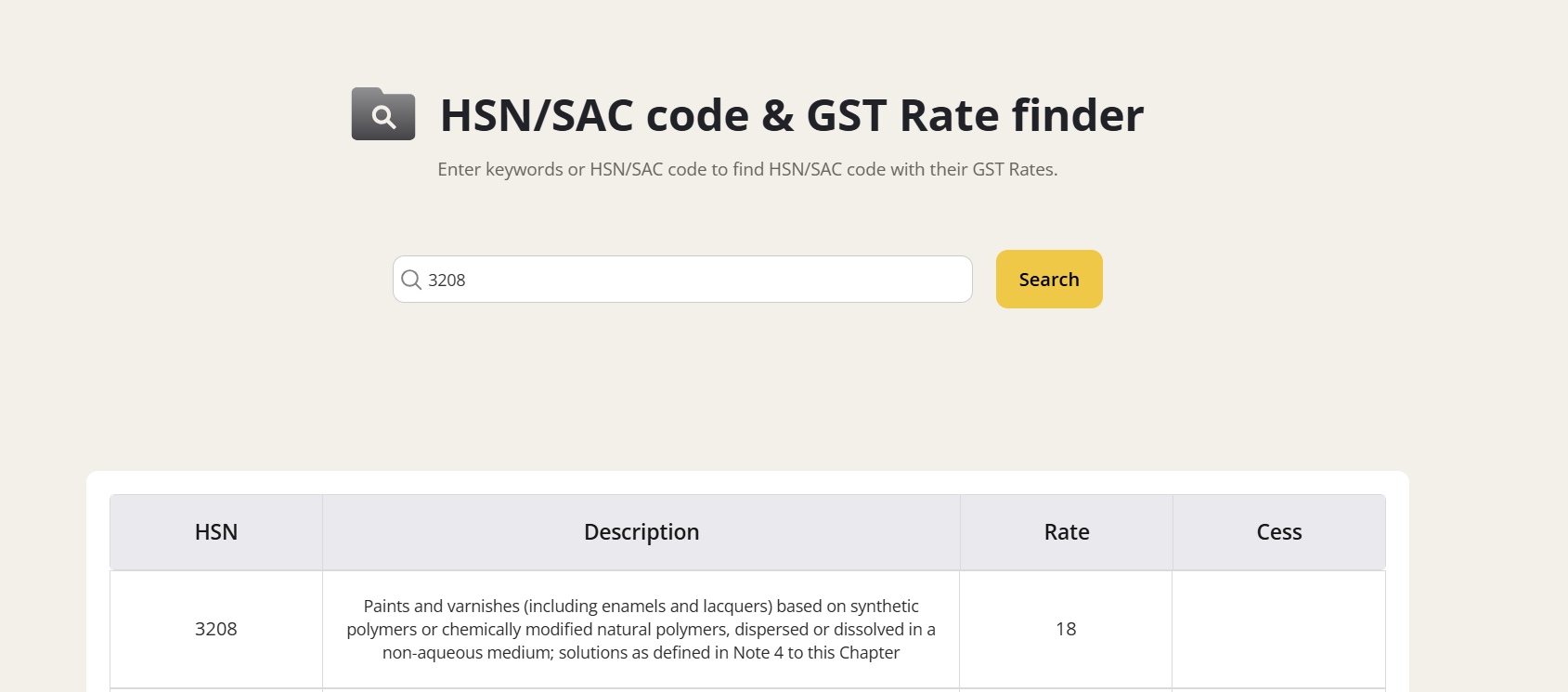

Paint HSN Code 3208: Types, Classification & GST Rate Explained

What is HSN Code 3208?

HSN Code 3208 covers paints and varnishes, including enamels and lacquers, that are based on synthetic polymers or chemically modified natural polymers. This code classifies products dispersed or dissolved in non-aqueous mediums and is widely used for industrial, decorative, and protective paint finishes in India.

GST Rates & Exemptions for HSN Code 3208

The GST Council’s September 2025 update keeps paints under 3208 mostly in the highest slab. Standard paints and varnishes—whether for home use, industrial coating, or retail—are taxed at 18% GST, down from the earlier 28%. Some specialty/emulsion paints (HSN 3209) and artist/student colors (HSN 3213) may also attract 18%, but always check invoice details for exact classification.

Table Notes

- Rates shown are valid from September 22, 2025.

- No compensation cess applies to paints; GST includes both CGST and SGST components.

- IGST is 18% for interstate purchases.

- For ITC, refer to capital/revenue treatment—see the ITC section below.

GST Rates Applicable Under 3208

What’s Included in 3208 Products?

HSN 3208 includes synthetic polymer-based paints, varnishes, enamels, protective coatings, and lacquers in non-aqueous mediums. This encompasses most decorative wall paints, industrial finishes, waterproofing substances, and high-gloss or matte coatings.

Find more - Check Gimbooks HSN/SAC code & GST Rate finder

Key Exemptions Under GST for Paints

Paints under HSN 3208 do not generally carry exemptions for GST except in rare cases of pre-assembled industrial kits meant for export, or certain eco-friendly/cooperative sector products under specific government notification.

Input Tax Credit (ITC) Rules for Paint Products

Businesses can claim ITC on GST paid for paint purchases if the paints are used in regular operations—not if capitalized for the construction of immovable property (like new buildings). For repairs, refurbishment, or resale, ITC is fully available. Always document purchase for invoice-matching and compliance.

GST on Paint Billing: Practical Scenarios

- Retailer billing: Paint sales billed at 18% GST (split CGST/SGST locally or IGST interstate).

- Manufacturers: Can claim ITC on raw materials and packaging if paints are produced for sale.

- Contractors: GST applies on paint purchase and can claim ITC if used for repair—not on new property construction.

Common Mistakes in Paint GST

- Using wrong HSN code (e.g., applying 3209 for 3208 item)—verify product label before invoicing.

- Charging older 28% rate—current GST rate for paints is 18% across most categories.

- Not claiming ITC on eligible purchases due to poor record-keeping.

Simplify Billing and Grow Faster with the GimBooks App.

Conclusion

HSN Code 3208 helps paint manufacturers, dealers, and buyers comply with the unified GST system. With the latest GST rate set at 18% for all major paint types, the regime simplifies tax compliance and enables ITC for eligible expenses in 2025. Correct classification and documentation remain key for paint businesses and home buyers alike.

Also check - Mobile HSN Code 8517

Also check

FAQs: HSN Code 3208 & Paint GST

What is HSN 3208?

HSN 3208 is used for paints, varnishes, enamels, and related synthetic polymer-based products dispersed in non-aqueous mediums.

What’s the standard GST rate?

The standard GST rate for paints under HSN 3208 is 18% in 2025.

Can ITC be claimed?

Yes, eligible businesses and contractors can claim ITC on paint purchases for resale or repairs, but not if paint is capitalized for constructing new buildings.

Which products are tax-exempt?

Paints under HSN 3208 are generally not tax-exempt; only a few government-notified cases or export-specific products may qualify