Maintenance, Repair & Installation Services – 9987 HSN Code and GST rate

What is HSN Code 9987?

HSN Code 9987 covers “Maintenance, Repair and Installation (Except Construction) Services” across various goods and equipment. This includes installation, setup, and commissioning of fabricated metal products, machinery, electrical appliances, communication equipment, and other relevant goods. It is essential for businesses and service providers to correctly classify installation charges under this SAC for accurate GST compliance.

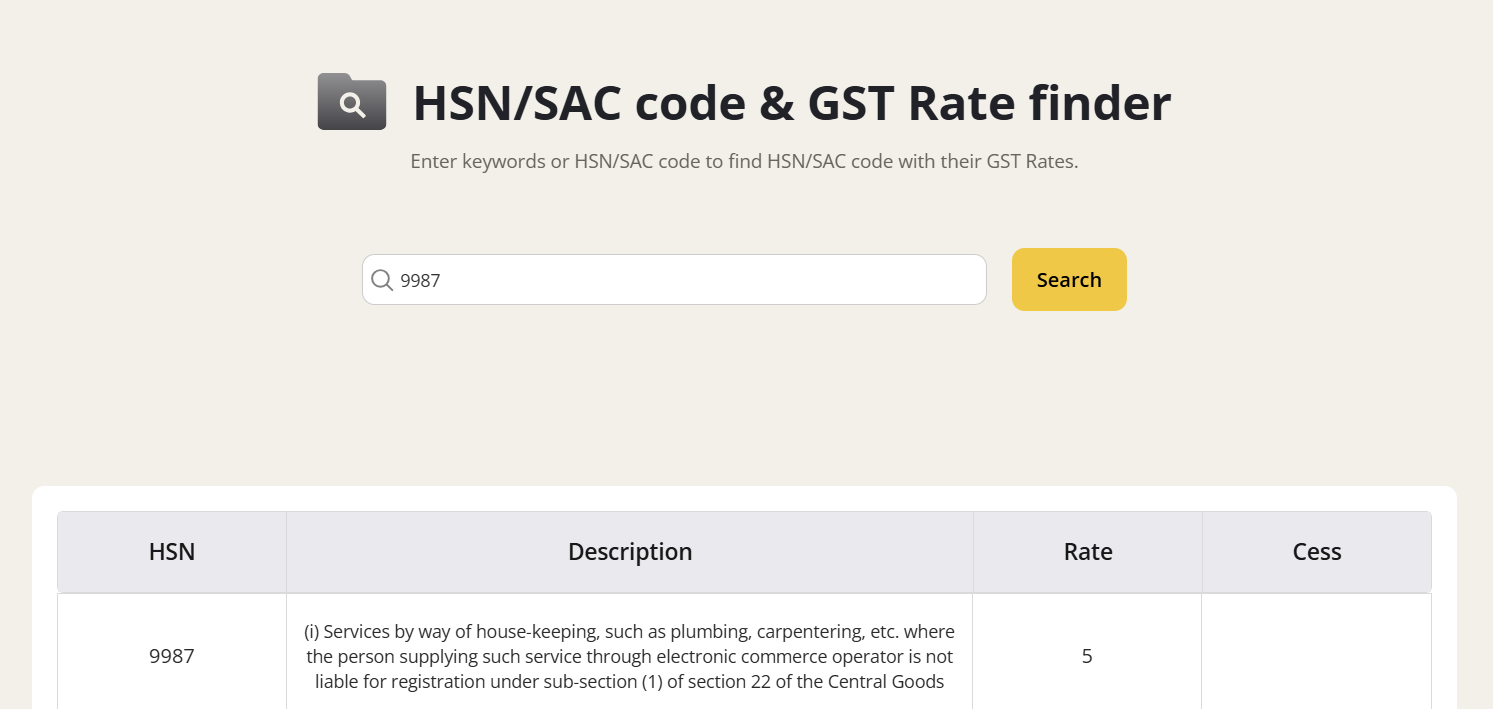

GST Rates & Exemptions for HSN Code 9987

Installation services under HSN 9987 attract either 5% or 18% GST depending on the nature of services and specific government notifications. Generally, basic installation and maintenance services are taxed at 18% GST. However, a concessional GST rate of 5% applies in some cases, such as maintenance related to certain government-approved events or when input tax credit has not been taken on related goods and services.

Table Notes

- Rates are applicable from 1st April 2020 and per latest GST notifications.

- The standard GST is 18%, but 5% may apply under specified conditions.

- Tax rates are consistent across intra-state (CGST+SGST) and inter-state (IGST) transactions.

- Input tax credit (ITC) eligibility depends on usage and compliance with GST rules.

GST Rates Applicable Under 9987

What’s Included in Installation Charges (9987)?

HSN/SAC 9987 includes installation services for a wide variety of goods such as fabricated metal products, machinery, office equipment, telecommunications apparatus, household electrical appliances, and specialized professional equipment. It covers on-site installation, testing, configuration, assembly, and necessary repairs outside of construction works.

Explore Gimbooks HSN/SAC code & GST Rate finder

Key Exemptions Under GST for 9987

Exemptions under 9987 are limited and conditional. The concessional 5% GST may apply only if the Director (Sports), Ministry of Youth Affairs and Sports certifies the service relates to specified sports events (e.g., FIFA U-17 Women’s World Cup 2020) or if input tax credit on goods and services involved is not claimed. Otherwise, the usual rate is 18%.

Input Tax Credit (ITC) Rules for Installation Charges

Businesses can claim ITC on GST paid for installation charges under HSN 9987 if the services are used for further business activity, such as manufacturing, resale, or commercial operations. ITC cannot be claimed for services rendered for personal use. Correct invoices with SAC codes and GST regulation compliance are essential to claim ITC.

GST on Installation Charges: Practical Scenarios

- An HVAC contractor bills installation of air conditioning units under SAC 998715, charging 18% GST, which the corporate client claims as ITC.

- A telecom company uses installation services for network equipment and pays 18% GST under SAC 998716, later claiming input credit.

- Installation related to sporting events certified by the Ministry of Youth Affairs may bill at concessional 5% GST if input credit is not claimed.

Common Mistakes in Installation Charges GST

- Wrong SAC code usage for installation services leads to GST disputes.

- Charging 5% GST without meeting the exemption conditions causes compliance issues.

- Failure to issue proper GST-compliant invoices restricting ITC claims.

- Mixing installation services with construction services, which have different GST treatments.

Conclusion

Correct classification of installation charges under HSN Code 9987 ensures accurate GST billing, compliance, and tax benefit optimization. Both 5% and 18% GST rates are applicable based on usage scenarios and government notifications. Businesses must maintain correct documentation and SAC usage to reap full GST advantages in 2025.

Also checkT Shirt HSN Code 6109Service Charge HSN Code 9983Cloth HSN Code 5208Furniture HSN Code 9403

FAQs: HSN Code 9987 & Installation GST

What is HSN Code 9987?

It signifies Maintenance, Repair, and Installation services on various goods excluding construction activities.

What GST rates apply under HSN 9987?

Standard GST rate is 18%, with a concessional 5% applied in specific certified scenarios or when ITC is not claimed.

Can ITC be claimed on installation charges?

Yes, businesses can claim ITC for installation services used in commercial operations with proper GST compliance.

Are there GST exemptions for installation charges under 9987?

Exemptions are limited to special certified events or where ITC is not taken on related goods/services, otherwise not applicable.