Machinery HSN Code 8479: Other Mechanical Appliances, Industrial Use & GST Rate

Understanding the 8479 HSN Code GST rate and 8479 HSN Code description is essential for businesses dealing in specialized machinery or industrial equipment. This category includes machines and mechanical appliances with unique functions not classified elsewhere, making it crucial for accurate billing, tax compliance, and smooth trade operations.

What is HSN Code 8479?

HSN Code 8479 covers “Machines and Mechanical Appliances Having Individual Functions, Not Specified or Included Elsewhere.” This catch-all classification includes special industrial machinery not falling under narrow categories, such as oil-seed crushing machines, particle board presses, industrial robots, air coolers, mixing equipment, mechanical shifting machines, rope/cable-making machinery, and specialized devices for the chemical, soap, or metal industries. It’s crucial for companies procuring or billing niche or custom-designed industrial equipment.

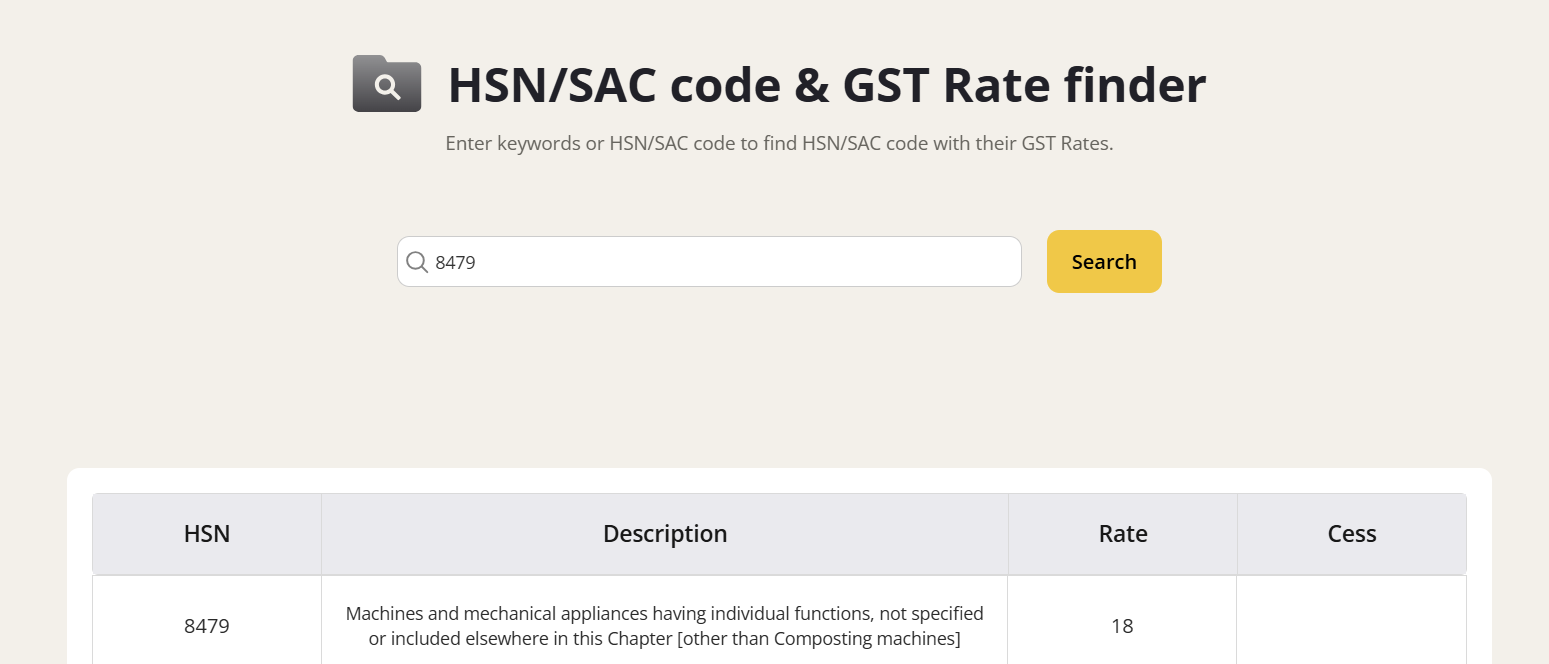

GST Rates & Exemptions for HSN Code 8479

As of 2025, GST on machines and mechanical appliances under HSN 8479 is either 12% or 18%, depending on the product type, project purpose, and relevant government notifications. The standard rate for most sub-categories—including specialized presses, robots, treatment, mixing, cleaning, and extraction machines—is 18%. The 12% GST rate is applicable for select cases and may follow notification or usage-based eligibility.

Table Notes

- Rates shown apply to manufacturing, import, and trade of specialized machines.

- GST is charged as CGST+SGST (for intra-state) or IGST (for inter-state) sales.

- Some items previously at 28% GST were rationalized down to 18%/12% for industrial ease.

- Always check product-specific GST notifications and sub-codes for exceptions.

GST Rates Applicable Under 8479

What’s Included in HSN 8479?

HSN 8479 covers a broad range of unmapped mechanical appliances used in public works, manufacturing, food processing, chemicals, pharmaceuticals, paper, cables, automation, and new-tech installations. This code is used for custom machinery, specialized robots, air coolers, heavy industrial mixers, and appliances critical to unique processes and plant operations.

Explore Gimbooks HSN/SAC code & GST Rate finder

Key Exemptions Under GST for HSN 8479

There are no broad GST exemptions for machinery under HSN 8479. However, certain government notifications may apply reduced GST (12%) to select machinery for agricultural processing, public projects, or defense, if specifically mentioned. Always verify the notification and sub-HSN before billing or claiming exemptions.

Input Tax Credit (ITC) Rules for Mechanical Appliances

Businesses buying machinery under HSN 8479 for use in manufacturing, further supply, or eligible projects can claim ITC if purchased from a GST-registered supplier. ITC on capital goods like these offsets output liability, reducing overall tax cost for manufacturers and large-scale users. Maintain GST-compliant invoices and correct HSN codes to ensure valid ITC claims.

GST on Machinery Billing: Practical Scenarios

- A manufacturer buys an industrial robot (84795000) under an 18% GST invoice and claims ITC against factory output tax.

- A soap plant acquires new moulding and cutting equipment under 84798910 and bills at the GST rate applicable by latest notification.

- An equipment trader sells custom coolers (84796000) to factories, billing at 18% (or 12% if notified).

Common Mistakes in Machinery GST

- Listing niche machines under generic codes and missing out on correct GST application.

- Misapplying reduced GST without verifying notification-based eligibility.

- Not including HSN codes or using old codes, risking audit and ITC rejection.

- Mixing up machine parts (847990) with finished machines (8479XX), affecting GST rates.

Conclusion

HSN 8479 streamlines GST compliance for “other mechanical appliances,” used widely in factories, public works, automation, and niche manufacturing sectors. Accurate HSN application, invoice management, and ITC tracking help keep compliance smooth and industrial costs in check for 2025.

Also explore

LED Light HSN Code 9405

Glass HSN Code 7005

Bricks HSN Code 6901

Medicine HSN Code 3004

FAQs: HSN Code 8479 & Machinery GST

What is HSN 8479?

It covers special industrial machinery and mechanical appliances with individual functions, not classed elsewhere in the HSN.

What is the GST rate for machinery under HSN 8479?

Most machinery and parts are billed at 18% GST; some are eligible for 12% under government notifications.

Can ITC be claimed on machinery purchases?

Yes, ITC is allowed for GST-registered businesses buying HSN 8479 equipment for manufacturing, resale, or eligible project work.

Are any machinery types GST-exempt under HSN 8479?

No, except for rare specific notification-based exemptions. Standard GST rates apply otherwise.

What is HSN Code 84799090?

HSN Code 84799090 falls under the broader HSN 8479 category and is used for “Machines and Mechanical Appliances Having Individual Functions, Not Specified Elsewhere.” It typically covers specialized industrial machines not classified under other specific sub-codes.

What does HSN Code 84798999 mean?

HSN Code 84798999 is another sub-category under HSN 8479, representing miscellaneous mechanical appliances or machines with individual functions not mentioned elsewhere. It is used for billing and GST purposes for unique industrial equipment.