LED Light HSN Code 9405: Lamps and Lighting Fittings, Fixtures, GST Rate & Product Examples

Understanding the led hsn code is important for classifying LED products correctly under GST. The 9405 hsn code gst rate helps businesses identify the right tax rate for bulbs, fixtures, and commercial lighting solutions. All major LED products fall under hsn 9405, which includes lamps, fittings, and lighting parts. Using the correct code ensures smooth invoicing, compliance, and easier product categorization.

What is HSN Code 9405?

9405 hsn code details

HSN Code 9405 specifies “Lamps and Lighting Fittings, including Searchlights, Spotlights, and Parts Thereof, not elsewhere specified or included.” This covers all electric and non-electric lighting solutions, from LED bulbs and fixtures to decorative chandeliers, table lamps, illuminated name-plates, and commercial lighting products. The code brings clarity for manufacturers, importers, retailers, and project contractors dealing in lighting supplies and installations.

Why is HSN Classification Important for Lighting Products?

HSN (Harmonized System of Nomenclature) classification is crucial for lighting products because it standardizes product codes for taxation and trade. Proper classification ensures accurate GST compliance, smooth import/export processes, and avoids legal or financial penalties.

GST Rates & Exemptions for HSN Code 9405

The GST rate for LED bulbs, LED lighting fixtures, and most lamps under HSN 9405 is set at 12%, applicable to products like LED bulbs, panel lights, downlights, tube lights, strips, floodlights, and smart LED solutions. Non-LED electric lamps, chandeliers, decorative lighting, and emergency/portable lamps are taxed at 18%. Some special-purpose lighting parts such as certain components or illuminated signs and name-plates also attract 12–18%, depending on their sub-code.

Table Notes

- LED lights and fixtures are taxed at 12% under HSN Code 94051000.

- Decorative lighting, chandeliers, emergency lights, and non-LED products typically have an 18% GST rate.

- Illuminated signs and commercial name-plates may attract either 12% or 18% depending on their classification.

- When assembling or installing lighting products, use the correct sub-code for compliance.

GST Rates Applicable Under Lamps & Lighting HSN Code 9405

What’s Included in HSN 9405 Lighting?

HSN 9405 includes nearly all electric and non-electric lighting fixtures: LED and non-LED bulbs, tube lights, smart lamps, chandeliers, wall panels, bedside table lamps, spotlights, illuminated signage, powered displays, and replacements/parts. This wide coverage ensures clarity in billing, input sourcing, and GST filings for all lighting-related transactions.

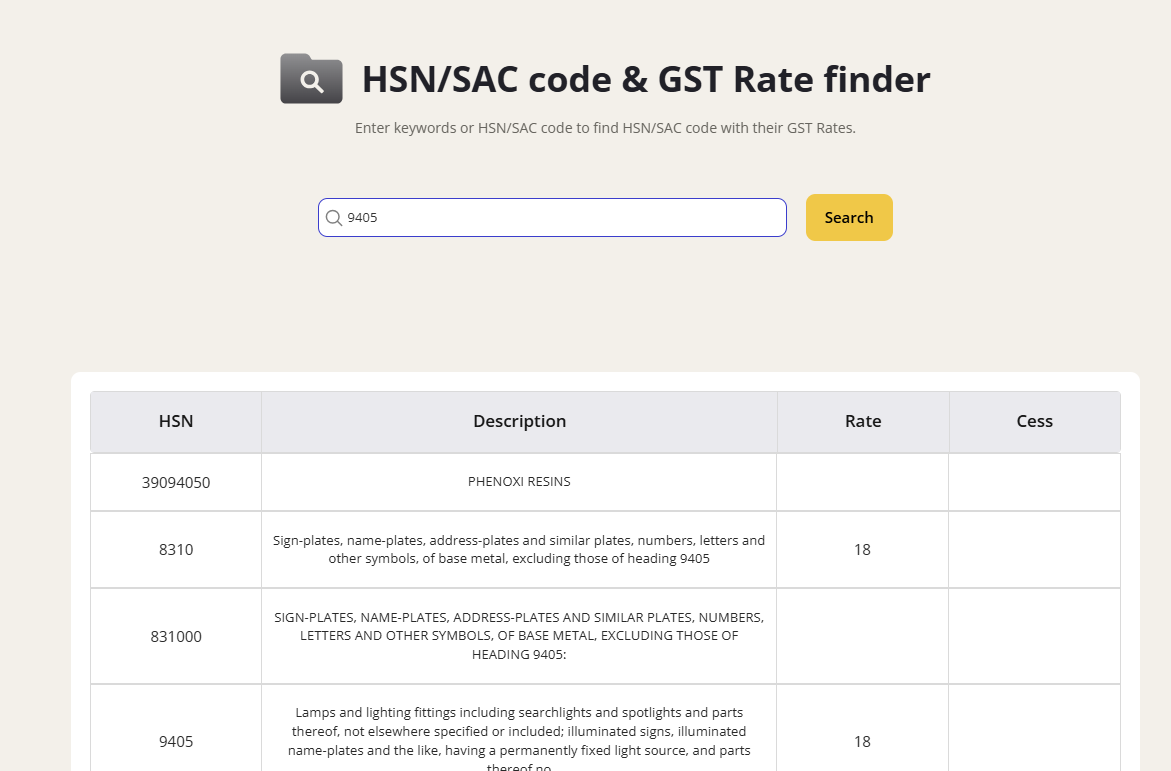

Explore Gimbooks HSN/SAC code & GST Rate finder

Key Exemptions Under GST for HSN 9405

Energy-efficient and solar-based lamps may be eligible for a lower GST rate (5% for solar LED systems under select sub-codes). Essential and low-value lighting parts have a concessional 5% GST. Mainstream LED lights and most decorative fixtures do not have GST exemptions under HSN 9405; check sub-code classification or government notifications for specific exemption eligibility.

Input Tax Credit (ITC) Rules for LED and Lighting

GST-registered dealers, manufacturers, and installers can claim ITC on all input purchases (LED chips, drivers, electrical components) and sourcing of finished lamps and fixtures billed at standard GST rates. Correct supplier invoices, HSN mention, and adherence to GST return requirements are needed for seamless ITC claims.

GST on Lighting Billing: Practical Scenarios

- An LED lighting manufacturer invoices LED panel lights under 94051000 at 12% GST; builders and retailers avail ITC.

- Retailers selling decorative chandeliers bill under 94053000 at 18% GST for end-consumers.

- Commercial signage vendors specify the correct type (illuminated/fixed) and GST rate (12% or 18%) for signage and branded plates during large project installations.

Common Mistakes in GST for Lighting Fittings

- Misclassifying LED fixtures under non-LED codes, leading to incorrect 18% billing instead of 12%.

- Using the wrong HSN for replacement parts, drivers, or MCPCB, risking audit issues.

- Failing to mention HSN and product sub-type on invoices, complicating ITC for buyers.

- Not updating classifications post-GST notification changes in rates or energy-efficient product incentives.

LED Light Businesses Must Ensure GST Compliance

LED light businesses must follow GST regulations to avoid penalties and legal issues. Proper invoicing, HSN code usage, and timely tax filing help ensure transparent transactions and smooth operations in both domestic and international trade.

Conclusion

HSN Code 9405 enables efficient classification and uniform GST treatment for LED lights, lamps, lighting fittings, and illuminated signs—making compliance straightforward at 12% for most LED fixtures and 18% for traditional or decorative lamps in 2025. Use the exact sub-code for optimal GST rate application, proper documentation, and smooth ITC management.

Explore more

- GST Rate and HSN Code 6203

- Construction Services, Work Contract HSN Code 9954

- 9987 HSN Code and GST rate

- Glass HSN Code 7005

FAQs: HSN Code 9405 & Lighting GST

What is HSN 9405?

It includes all types of lamps, electric and non-electric lighting fittings, LED and non-LED fixtures, chandeliers, and illuminated signs.

What’s the standard GST rate for LED lights under 9405?

LED bulb, fixture, and panel lights attract 12% GST, while non-LED, decorative, and emergency lighting attracts 18% GST.

Can ITC be claimed for lighting products?

Yes, GST-registered entities can claim ITC on eligible lighting purchases used in taxable supplies or installations.

Are there GST exemptions for lighting under HSN 9405?

Only select low-value essential lamps and solar lighting products may have exemptions. Most mainstream LED and decorative lamps must be billed at 12–18% GST.

What is the led tube light hsn code?

The led tube light hsn code comes under HSN 9405, which includes LED lamps, fittings, and lighting fixtures for taxation and classification.

What is the 9405 hsn code 8 digit?

The 9405 hsn code 8 digit is used to classify specific types of lamps, LED lights, lighting fittings, and their parts under detailed sub-categories of HSN 9405 for accurate GST classification.

What is the tubelight hsn code?

The tubelight hsn code generally falls under HSN 9405, which covers various electric lamps, LED tube lights, and lighting fittings for GST classification.

What is the emergency light hsn code and GST rate?

The emergency light hsn code falls under HSN 9405, which covers various electric lamps and lighting fittings. Emergency lights are typically taxed at 18% GST, depending on their specific classification under 9405.

Why is GST higher for traditional lighting?

Traditional lighting products, such as incandescent bulbs, attract a higher GST because they are less energy-efficient and fall under a different HSN classification. The higher rate also encourages the shift toward energy-saving alternatives like LED lights.

Why is GST lower for LED lights?

LED lights are more energy-efficient and eco-friendly, which is why the government has assigned them a lower GST rate. This promotes adoption of sustainable lighting and reduces electricity consumption nationwide.

Has the GST rate for LED lights changed recently?

Yes, the GST rate for LED lights has been reduced in recent years to encourage energy-efficient lighting. Businesses should stay updated with latest notifications from the GST Council to ensure compliance.