Labour Charges HSN Code 9985: GST Applicability & Billing Guide

In India, proper classification of services under GST is essential for accurate billing and compliance. The labour charges HSN code plays a key role in this, helping businesses categorize services like staffing, payroll, cleaning, and packaging. Specifically, the 9985 HSN code GST rate applies to most labour and support services, ensuring the correct tax is applied. Understanding the service charges HSN code not only simplifies invoicing but also helps avoid errors and penalties, making it easier for businesses to manage their accounts efficiently.

What is HSN Code 9985?

HSN Code 9985 refers broadly to “Support Services” within the GST structure and covers a diverse range of labour and business support services—from staffing and payroll to cleaning and packaging services. While goods use HSN codes, services are billed under Service Accounting Codes (SAC), with 9985 being the umbrella for most labour supply and employment-related services.

GST Rates & Exemptions for HSN Code 9985

GST rates for labour charges under SAC 9985 have been recently updated effective September 22, 2025. Most services attract 18% GST; however, a few exempt and concessional categories exist for specific industries and service types.

Table Notes

- Latest rates as per notification (valid from Sep 22, 2025)

- “Exempt” means GST not charged, usually for services relating to agriculture, residential house construction under notified government schemes, and certain warehousing and packing services.

- ITC (Input Tax Credit) is only allowed where specifically mentioned.

GST Rates Applicable Under 9985

What’s Included in 9985 Services?

Services billed under 9985/SAC codes typically cover manpower supply, contract and temp staffing, payroll management, business support (security, cleaning), and packaging, with each described in official GST documentation and the government notification dated September 2025.

Key Exemptions Under GST for 9985

- Pure labour contracts for individual residential house construction under notified housing schemes (e.g., PMAY) are exempt.

- Warehousing of agricultural produce and specific cleaning/fumigation services related to food/agri products are exempt.

- Services provided by tour operators purely outside India or to foreign tourists may be exempt.

Input Tax Credit (ITC) Rules for Labour Services

- ITC is available for labour services billed at 18%—including most business staffing and employment services.

- The 5% rate for selected categories (housekeeping via platforms, long-term staffing, tour operator) carries restricted or no ITC eligibility.

GST on Labour Charge Billing: Practical Scenarios

- Calculate GST on gross billed value (excluding GST) for service contracts.

- Labour supply agencies must charge GST for all taxable labour categories at the point of billing.

- For job work, ensure proper documentation to claim ITC if billed at 18%.

- Pure labour services for government-approved housing or agri sectors—no GST charged.

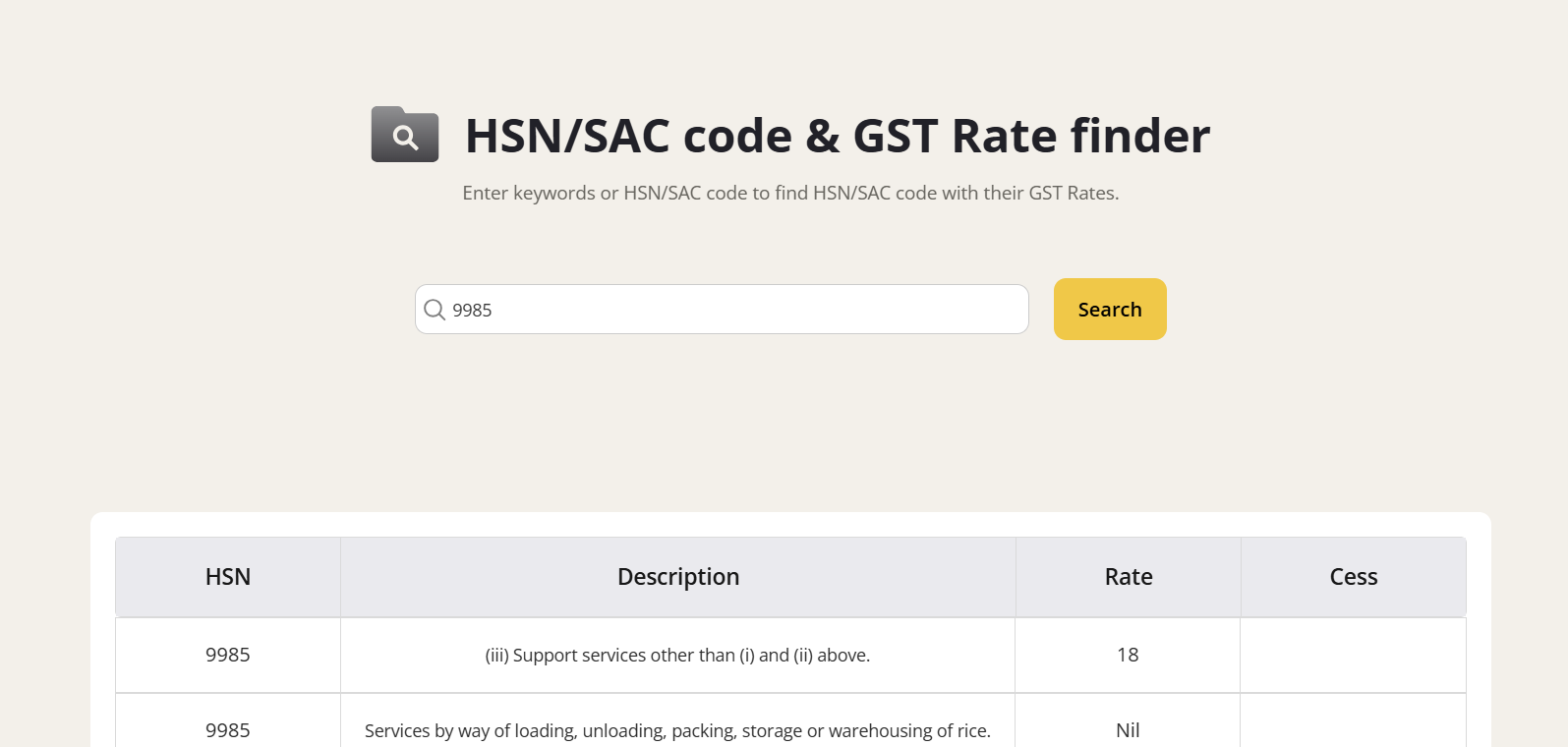

Explore Gimbooks HSN/SAC code & GST Rate finder

Common Mistakes in Labour Charge GST

- Using HSN instead of SAC code for service invoices—always use the correct SAC.

- Ignoring ITC restrictions for services billed at reduced 5% GST.

- Charging GST on exempt categories—review government notifications for latest exemptions.

- Misclassifying composite supplies (labour + material): Works contracts attract 18% GST.

Simplify Billing and Grow Faster with the GimBooks App.

Conclusion

HSN Code 9985 (SAC) remains the backbone for billing labour charges under GST, with the standard rate of 18% applied to most professional and business support services, but new exemptions and concessional rates apply as per 2025 updates. Always check the latest notification when preparing invoices and claim ITC according to the applicable category.

Also check

Transportation HSN Code 9965

T Shirt HSN Code 6109

Service Charge HSN Code 9983

FAQs: HSN Code 9985 & Labour Charges GST

What is HSN 9985?

HSN 9985 covers service support categories including labour supply, staffing, payroll, and associated business support services.

What’s the standard GST rate?

18% is the typical GST rate for most labour support and staffing services under SAC 9985, except for listed exemptions.

Can ITC be claimed?

ITC is allowed at the 18% rate, restricted or not allowed at reduced rates (5%) and for exempted services.

Which services are tax-exempt?

Pure labour contracts for notified housing schemes, certain agriculture-related services, and warehousing of food/agri produce.

What is the HSN code for labor charges?

Labour charges, when billed as a service (excluding those involving the sale of goods/materials), are classified under Service Accounting Code (SAC) 9985. This SAC code covers a broad array of support services, including manpower supply, staffing, job work, and employment-related labour provisions.

What is the HSN code 998519 for labour charges?

HSN code 998519 specifically pertains to "Other employment and labour supply services." It is used for billing labour charges related to services such as contract staffing, temporary labour supply, and other manpower services that do not fall under executive or professional staff leasing. This is a sub-category under the broader 9985 classification, capturing miscellaneous or unspecialized labour supply services.

Is GST on labour charges 12% or 18%?

As of the 2025 GST updates, the GST rate applicable to most labour charges billed under HSN/SAC 9985 (including 998519) is 18%. There are some special cases (such as specific job work for manufacturing or government housing schemes) where concessional rates of 5% or exemptions may apply, but the standard rate for general labour supply and employment services is 18%. The 12% rate is not generally applicable to labour services classified under 9985 or 998519

What is the manpower supply HSN code & GST rate?

The manpower supply HSN code falls under 9985, covering staffing and labour services. The applicable GST rate for these services is as per the standard service GST slab, ensuring proper compliance in billing and invoicing.