HSN Code 8414: Air or Vacuum Pumps, Air Pumps, Compressors Meaning & GST Rate

What is HSN Code 8414?

HSN Code 8414 covers "Air or Vacuum Pumps, Air or Other Gas Compressors and Fans; Ventilating or Recycling Hoods Incorporating a Fan, Whether or Not Fitted with Filters." This classification includes all types of air-moving equipment used in industrial, commercial, and domestic applications such as vacuum pumps, air compressors, fans, blowers, and turbochargers.

The code is essential for manufacturers, dealers, and businesses dealing in air pumps, vacuum pumps, compressors, HVAC equipment, and industrial air-moving machinery for accurate GST billing and compliance.

8414 HSN Code Description

According to the HSN classification, the 8414 HSN code description includes:

- Air or vacuum pumps

- Air or gas compressors

- Fans, blowers, and ventilating or recycling hoods

- Parts and accessories of the above equipment

These machines are widely used in manufacturing, laboratories, chemical industries, and other industrial applications.

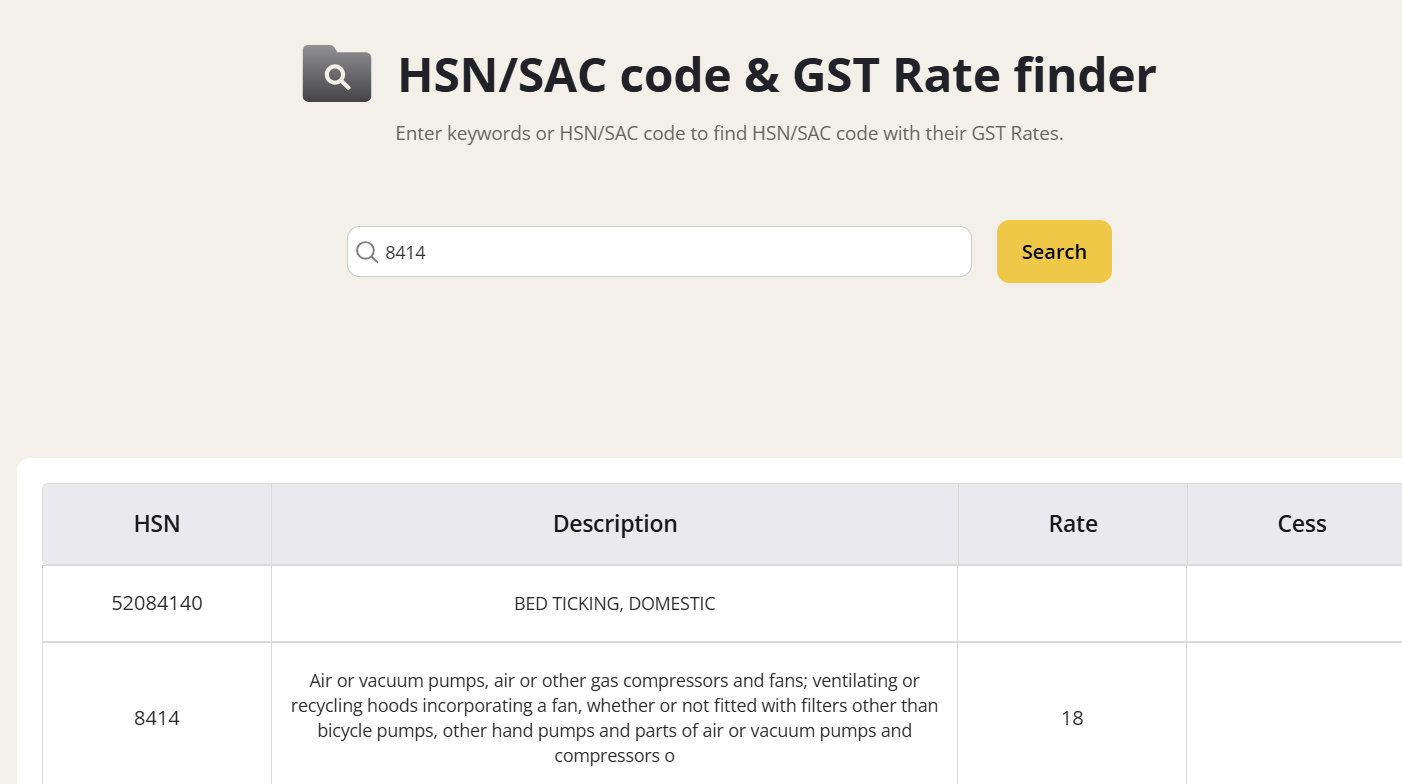

GST Rates & Exemptions for HSN Code 8414

As per the latest GST updates effective from November 15, 2017 (with some items from July 1, 2017), most products under HSN 8414 are subject to 18% GST. However, certain basic hand-operated pumps attract a reduced rate of 12% to make them more affordable for everyday use.

The rate structure reflects the government's approach to balance industrial equipment taxation while keeping basic manual pumps accessible for common use.

Table Notes

- Most air pumps, vacuum pumps, and compressors are taxed at 18% GST.

- Hand-operated bicycle pumps and basic manual pumps attract 12% GST.

- No compensation cess applies to any products under HSN 8414.

- Rates have been reduced from the initial 28% to current levels to support manufacturing and industrial sectors.

GST Rates Applicable Under 8414

What's Included in HSN 8414 Equipment?

HSN 8414 encompasses a comprehensive range of air-moving and pressure-creating equipment:

- Vacuum Pumps: Laboratory, industrial, and medical vacuum systems

- Air Compressors: Reciprocating, centrifugal, and screw-type compressors

- Fans: Table, floor, wall, ceiling, and industrial fans

- Blowers: Portable and industrial air movement equipment

- Specialized Equipment: Turbochargers, refrigeration compressors, ventilation hoods

- Parts and Components: Spare parts for all the above equipment

This classification serves industries including manufacturing, automotive, HVAC, medical equipment, and general engineering.

Explore Gimbooks HSN/SAC code & GST Rate finder

Key Exemptions Under GST for HSN 8414

There are no outright GST exemptions for equipment under HSN 8414. However, the government provides reduced rates for basic hand-operated equipment:

- Bicycle pumps and basic hand pumps: 12% GST instead of 18%

- Parts for bicycle pumps: 12% GST to maintain affordability

All other air pumps, vacuum pumps, compressors, and fans are subject to the standard 18% GST rate without exemptions.

Input Tax Credit (ITC) Rules for Air Pump Equipment

Businesses registered under GST can claim Input Tax Credit (ITC) on purchases of air pumps, vacuum pumps, compressors, and related equipment under the following conditions:

ITC Eligibility:

- Equipment must be used for business purposes in manufacturing, services, or further supply

- Capital goods like industrial compressors and vacuum systems qualify for ITC

- Parts and components purchased for equipment maintenance are ITC-eligible

- Proper GST invoices with HSN codes must be maintained

ITC Restrictions:

- Personal use equipment (like home fans or car accessories) cannot claim ITC

- Equipment installed in residential premises for personal use is not eligible

- Mixed-use equipment requires proportional ITC calculation

GST on Air Pump Equipment Billing: Practical Scenarios

- An industrial manufacturer buying a screw air compressor (84144030) pays 18% GST and claims full ITC for business use

- A bicycle shop purchasing hand pumps (84142010) pays 12% GST and claims ITC against sales

- A laboratory acquiring vacuum pumps (84141000) pays 18% GST with ITC benefits for research equipment

- A service center buying fan spare parts (84149030) applies 18% GST with ITC eligibility for repair services

Common Mistakes in Air Pump Equipment GST

- Wrong HSN classification between manual pumps (12%) and electric pumps (18%)

- Missing sub-code specificity leading to incorrect GST rate application

- ITC claims on personal-use fans or home appliances (not eligible)

- Incorrect parts classification affecting the 12% vs 18% rate structure

- Mixing up air conditioning equipment (HSN 8415) with air pumps (HSN 8414)

Conclusion

HSN Code 8414 provides comprehensive coverage for air or vacuum pumps, compressors, and fans with a clear GST structure of 18% for most equipment and 12% for basic hand-operated pumps. The classification supports industrial growth while maintaining affordability for basic manual equipment. Proper HSN usage, documentation, and ITC management ensure compliance and cost optimization for businesses dealing in air-moving equipment in 2025.

Also explore

- HSN Code 3926: Other Plastics Materials

- LED Light HSN Code 9405

- Glass HSN Code 7005

- Bricks HSN Code 6901

FAQs: HSN Code 8414 & Air Pump Equipment GST

What is HSN 8414?

It covers air or vacuum pumps, gas compressors, fans, and ventilating equipment including both manual and electric variants.

What's the standard GST rate for air pumps and compressors?

Most equipment under HSN 8414 attracts 18% GST, while basic bicycle pumps and hand pumps are taxed at 12%.

Can ITC be claimed on air compressor purchases?

Yes, businesses can claim ITC on air pumps, compressors, and fans used for commercial or industrial purposes with proper GST documentation.

Are there any GST exemptions for fans or pumps?

No complete exemptions exist, but basic hand-operated pumps enjoy a reduced 12% GST rate compared to the standard 18%.

How are spare parts for air pumps taxed?

Parts follow the same rate as the main equipment – bicycle pump parts at 12% and other equipment parts at 18% GST.

What is 84145120 HSN code?

The 84145120 HSN code is used for vacuum pumps. It helps in proper GST classification and compliance.

What is compressor machine HSN code?

The compressor machine HSN code is 841480. It is used for all types of air and gas compressors.

What is exhaust fan HSN code and GST rate?

The exhaust fan HSN code is 841451 or 841459, depending on the type. The applicable GST rate is generally 18%.