How to Download GST Certificate Step-by-Step Online (Updated 2026 Guide)

Quick guide to download GST certificate online step by step from the GST portal for MSMEs, and see how GimBooks simplifies GST compliance.

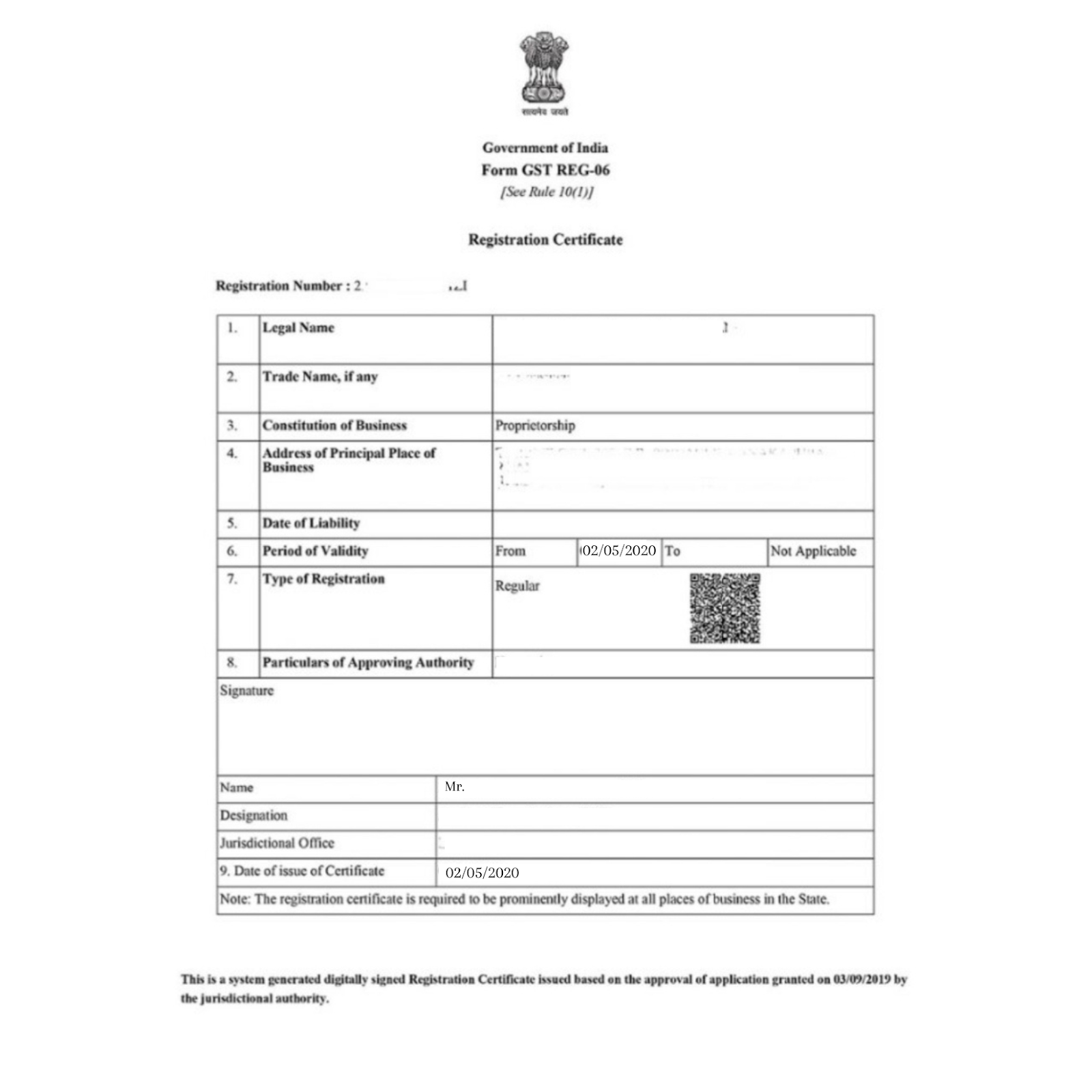

A GST certificate (FORM GST REG-06) is a document provided by the Indian government to Indian businesses that are registered for GST. It proves that a business is registered for GST, which helps businesses to legally collect GST, claim input tax credit, and build trust with vendors and customers.

It also includes important details like its GST number, business name, and address. You can download the GST Certificate from the GST portal online.

In this guide, you'll find the step-by-step process of how to download GST certificate, explain why it matters, and also show you how an app like GimBooks can simplify your GST and invoicing needs beyond just downloading GST certificates.

Whether you are a new business or an existing one, this tutorial makes GST certificate download quick, easy, and hassle-free.

What is a GST Certificate?

A GST certificate is an official document issued by the Government of India to businesses registered under the Goods and Services Tax (GST) system. It serves as proof that a business is legally authorized to collect GST from customers and claim input tax credits on purchases.

The certificate, officially known as Form GST REG-06, contains essential details such as:

- GSTIN (GST Identification Number) of the business

- Legal name of the business

- Registered address

- Date of registration

Having a GST certificate is important for building trust with vendors and customers, complying with tax regulations, and participating in legal business operations. It is mandatory for all GST-registered businesses to display the certificate at their principal place of business.

The GST certificate contains important details like:

- GSTIN of your business (GST Identification Number)

- Legal name of the business as per GST registration

- Trade name (if applicable)

- Constitution of business (proprietorship, partnership, company, LLP, or private limited company)

- Date of GST registration approval

- Registered principal place of business address

Note: As per GST law, every GST-registered business must display the GST certificate at its principal place of business. Keeping these GST certificate details updated ensures compliance and smooth audits.

Why Do You Need a GST Certificate?

Here’s why the GST certificate document is important:

- Legal requirement: It proves your GST compliance.

- Business credibility: Vendors and clients often ask for it before doing business.

- Tax compliance: It is important for filing GST returns and getting tax credit on purchases.

- Ease of doing business: Banks, lenders, and marketplaces (like Amazon, Flipkart) usually ask for a GST certificate during onboarding.

Step-by-Step Guide to Download GST Certificate Online

The GST portal allows you to download your certificate at any time after the GST registration step-by-step:

Step 1: Visit the GST Portal

Go to the official GST website: https://www.gst.gov.in

Step 2: Log in with Credentials

Click on Login in the top right corner.

Enter your username, password, and captcha code.

Click on Login.

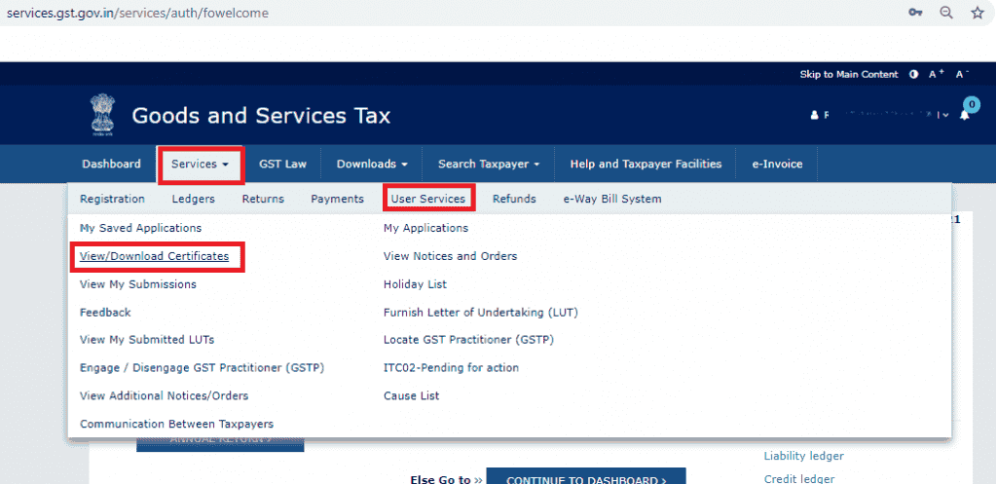

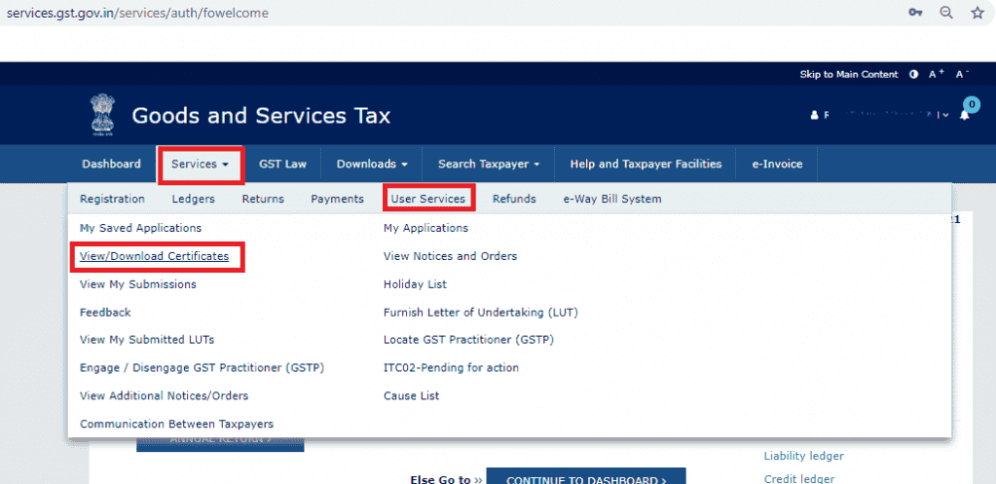

Step 3: Go to ‘View/Download Certificates’.

Then click on the Services tab on the dashboard

Under User Services, select View/Download Certificates.

Step 4: Download the GST Registration Certificate

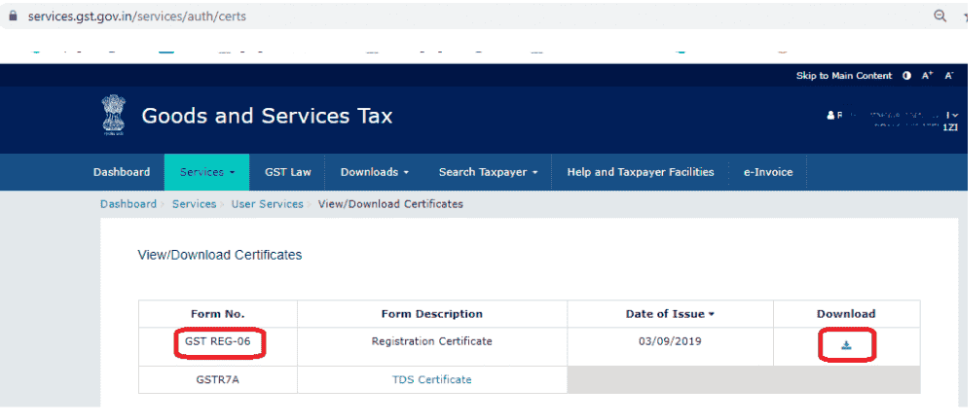

A list of certificates appears.

Click on Download next to the Registration Certificate.

The certificate (Form GST REG-06) will be downloaded in PDF format.

That’s it! Now you have your GST certificate ready for compliance or business use!

Key Sections in GST Certificate (Form GST REG-06)

When you open the downloaded GST Certificate PDF, you’ll find:

- Basic details – GSTIN, legal name, trade name, and constitution of business.

- Address of principal (main) place of business.

- Details of additional places of business (if any)( APOB in GST registration).

- Date of GST registration.

- Type of registration (regular, composition, etc.).

- Details of the approving authority.

These GST Certificate (REG-06) details help you maintain accuracy and update if any information is incorrect.

Latest Update

GST Registration Updates Timeline [2025]

-

1

17th April 2025 – CBIC Instructions

The CBIC issued Central Tax Instruction No. 03/2025-GST for processing GST registration applications. Key highlights include:

- Ensure compliance with document list.

- Avoid unnecessary queries.

- Timely approvals of applications.

- Verification of place of business, including physical checks.

-

2

12th February 2025 – GSTN Advisory

The GSTN released an advisory on new Aadhaar and biometric authentication requirements. Applicants fall into three categories:

- Applicants not opting for Aadhaar authentication.

- Applicants opting for Aadhaar authentication with biometric verification.

- Cases where ARN (Application Reference Number) is not generated.

GST Certificate Applicants must follow the advisory’s instructions. Check below for more details.

Read GST Registration Updates-

Common Issues While Downloading the GST Certificate

Sometimes, business owners face issues when they try to download their GST certificate. Here are the most common GST certificate issues and their solutions:

Common Issues & its Solutions While Downloading GST Certificate

| Issue with GST Certificate | Solution |

|---|---|

| Forgot username or password? | You can easily retrieve your login details. Click on the “Forgot Username/Password” option on the GST portal login page and follow the instructions. |

| Certificate not visible? | If your GST registration is still under process, the certificate will not be available. Wait until your GST application is approved to download the certificate. |

| PDF not opening? | Update your PDF reader software to the latest version or try downloading and opening the GST certificate on another device. |

How GimBooks Makes GST Compliance Easier

While downloading the GST certificate is a one-time task, managing GST compliance is an ongoing process for small businesses. Filing returns, sending GST invoices, calculating tax, and staying audit-ready can be overwhelming if you’re doing it manually. This is where GimBooks helps.

With GimBooks, you can:

- Create GST-compliant invoices in less than a minute.

- Calculate GST on bills automatically.

- File GST returns directly from the app.

- Keep digital records of all your accounting and invoicing documents.

- Set payment reminders for customers so you don’t miss out on cash flow.

Simplify your accounting and invoicing with professional invoicing software.

Benefits of Using GimBooks After Downloading The GST Certificate

Benefits of having GimBooks with your GST certificate make your business stay compliant, and:

Time-saving: You can stay compliant and directly file GST from the GimBooks App.

Error-free GST returns: Auto-prepared GST reports reduce errors, which helps to avoid penalties.

Professional business identity: Invoices generated via GimBooks look professional and build trust with clients.

Conclusion

The GST registration certificate provides businesses with a unique GSTIN, enabling them to collect GST, submit GST returns, claim Input Tax Credit (ITC), and comply with tax regulations. For small businesses, online retailers, and large corporations alike, a GST registration certificate ensures legitimacy, transparency, and expansion prospects. By following the proper registration procedure, providing the required documentation, and monitoring the application status, businesses can easily obtain their GST certificate and maintain compliance.

To stay compliant and stress-free, you need a system that manages GST invoices, payments, and returns seamlessly. That’s what GimBooks does for over 4 million businesses in India.

Download your GST certificate today, and then take the smarter step—switch to GimBooks to handle all your GST and accounting needs in one app.

Frequently Asked Questions on GST Certificate Download

1. Can I download my GST certificate without logging in?

You must log in with your GST credentials to download the certificate.

2. Is the GST certificate free to download?

Yes, you can download the GST certificate for free from the GST portal.

3. How many times can I download the GST certificate?

There is no restriction—you can download it as many times as needed from the GST portal.

4. Do I need to display the GST certificate at my shop or office?

Yes. As per the GST law, every business must display the certificate prominently at its principal place of business where key operations are carried out.

5. How can I download GST certificate online?

You can download your GST certificate online by logging into the GST portal (www.gst.gov.in), navigating to Services → User Services → View/Download Certificates, and clicking Download next to the Registration Certificate (Form GST REG-06).

6. How can I download the GST certificate by GST number?

You can download the GST certificate by GST number by logging into the GST portal at gst.gov.in → Go to Services → User Services → View/Download Certificates → Select GST Registration Certificate. Enter your GST number if required, and then download the certificate in PDF format.

7. Can I do a gst certificate download pdf without login?

No. gst certificate download pdf without login is not possible because the GST portal requires a registered user to sign in to access certificate documents.

8. Why is gst certificate download pdf without login not allowed?

gst certificate download pdf without login is restricted for security and privacy reasons. GST certificates contain sensitive business information that can only be accessed after authentication.

9. Is there any alternative method for gst certificate download pdf without login?

There is no official method for gst certificate download pdf without login. You must log in using your GSTIN username and password to download the certificate safely.

10.What are the charges for GST registration?

GST registration in India is free of cost and does not require any government fee; however, businesses may incur optional professional fees if they choose to hire a consultant or tax expert to assist with the process.