How to Deduct TDS on GST Bill (Example Explained)

Understand TDS on GST bills with a clear example, rate chart, filing steps, and compliance tips. Learn how GimBooks helps you with TDS deduction.

Understanding how to deduct TDS on a GST bill is essential for any business or government body making payments to suppliers. It ensures compliance and keeps your books clean, which, in turn, builds credibility with customers, vendors, and tax authorities.

Let’s break this down simply

what TDS on GST is, when it applies, how to calculate it, and how to record it correctly with a real GST bill example.

What is TDS on GST?

TDS stands for Tax Deducted at Source. Under the Goods and Services Tax (GST) law, certain notified entities must deduct 2% tax (1% under CGST and 1% under SGST, or 2% under IGST) from the payment made to a supplier for taxable goods or services.

| Type of Transaction | CGST Rate | SGST Rate | IGST Rate (Inter-State) | Taxable Value | GST Inclusion |

|---|---|---|---|---|---|

| Regular Intra-State Supply | 1% | 1% | - | On taxable value of goods/services | GST excluded from TDS calculation |

| Inter-State Supply | - | - | 2% | On taxable value of goods/services | GST excluded from TDS calculation |

Note: As per the latest provisions, the TDS rate under GST remains 1% under CGST, 1% under SGST, and 2% under IGST (for inter-state transactions). The TDS is deducted only on the taxable value of supply, excluding GST.

This GST rate system helps ensure that a portion of the tax is collected upfront before the payment reaches the supplier, which promotes better tax compliance.

TDS RATE CHART FOR 2025-2026 as per Section 51 of CGST Act-

Who Needs to Deduct TDS Under GST?

Not everyone has to deduct TDS. Only certain notified persons mentioned below are required to do so under Section 51 of the CGST Act:

- Central or State Government departments

- Local authorities and municipalities

- Government agencies

- Public sector undertakings (PSUs)

- Societies established by the government or local authority

- Entities with more than 51% government equity

- Any other organization notified by the government.

If you’re a private business, startup, or MSME — TDS under GST generally does not apply to you.

However, if you supply to these government bodies, you might see TDS deducted from your invoice payments.

When Does TDS on GST Apply?

TDS applies only when all three of the following conditions are met:

- The contract value (excluding GST) exceeds ₹2,50,000 It’s not per invoice — it’s the total value under one contract.

- The supply is taxable under GST No TDS is required for exempted supplies.

- The payment is made by a notified person As listed above.

So, if your contract value is ₹4,00,000 (before GST) and the payer is a government department, TDS must be deducted.

Step-by-Step: How to Deduct TDS on GST Bill

Let’s break the process down into 8 clear steps.

Step 1: Check TDS Applicability

- Confirm that you are a notified deductor under GST.

- Confirm that the total contract value exceeds ₹2,50,000 (excluding GST).

- Confirm that the supply is taxable.

Step 2: Identify the Taxable Value

Take the invoice amount before GST. That’s your base for TDS calculation.

Step 3: Calculate TDS

Apply 2% on that taxable value. If it’s an intra-state supply → 1% CGST + 1% SGST If it’s inter-state → 2% IGST

Step 4: Deduct Before Payment

Subtract that 2% TDS from the payment due to the supplier.

Step 5: Deposit TDS to the Government

Deposit the deducted TDS amount to the government’s GST account by the 10th day of the following month using Form GSTR-7 on the GST portal.

Step 6: File GSTR-7 Return

As the deductor, you must file your GSTR-7 return monthly, declaring:

- TDS deducted

- TDS deposited

- Any interest or late fees, if applicable

Step 7: Issue TDS Certificate

After filing GSTR-7, you must issue a TDS Certificate (Form GSTR-7A) to the supplier within 5 days of deposit.

Step 8: Supplier Claims Credit

The supplier can view this TDS in their GST portal and claim the amount as credit under “TDS & TCS Credit Received.”

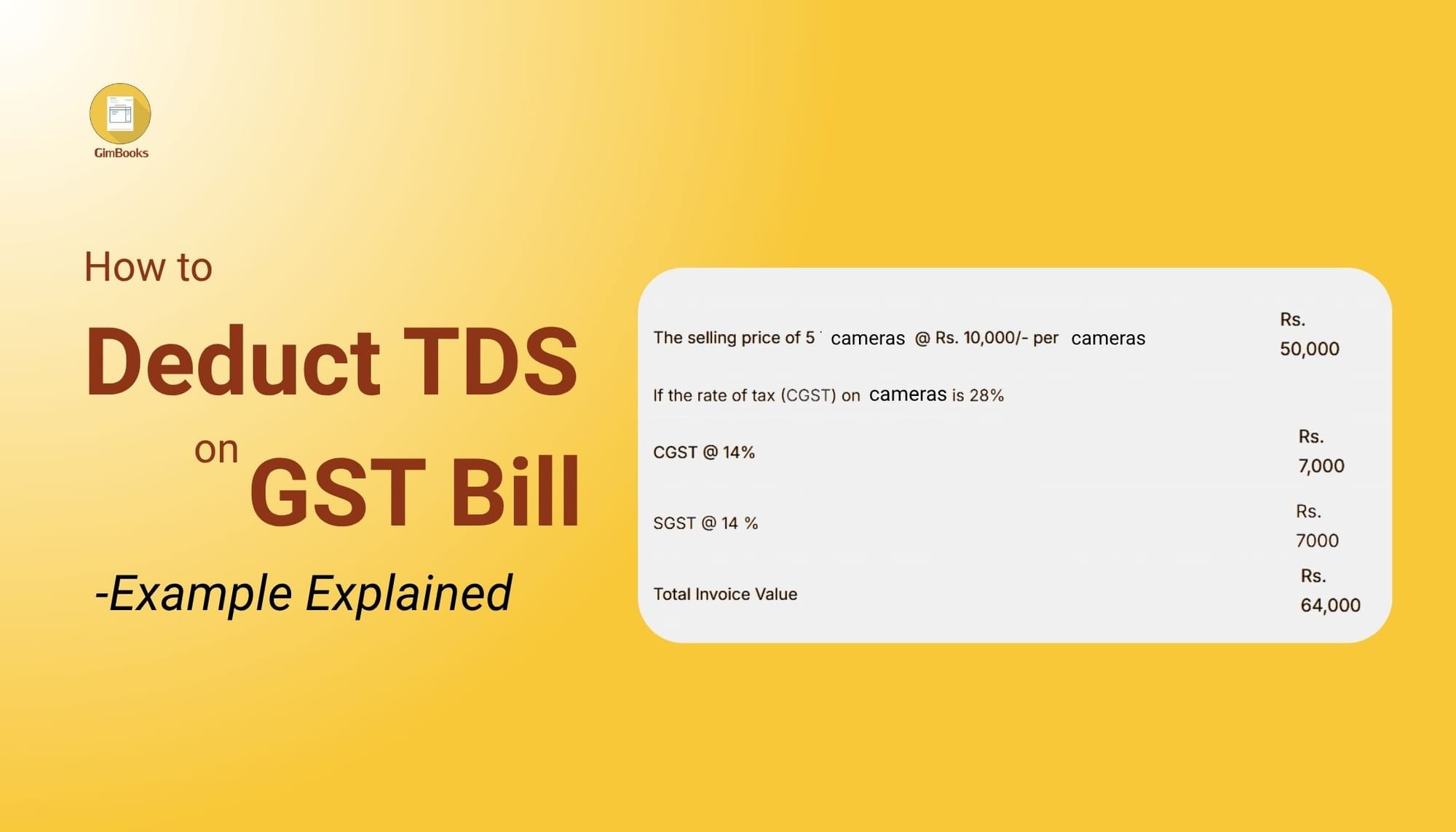

How to Deduct TDS on a GST Bill Example

Let’s go through a complete example to make this real.

Scenario: A government department hires a contractor, M/s ABC Traders, to supply machinery parts worth ₹4,00,000. GST rate = 18% The supply is intra-state.

| Step | Action | Details / Calculation | Outcome |

|---|---|---|---|

| 1. Determine Applicability | Check eligibility | Contract Value = ₹4,00,000 → Above ₹2,50,000 threshold ✅ Supplier = Taxable ✅ Payer = Government Department ✅ |

TDS Applicable |

| 2. Compute Invoice Amount | Add GST | Taxable Value = ₹4,00,000 GST @18% = ₹72,000 |

Total Invoice = ₹4,72,000 |

| 3. Calculate TDS | 2% on taxable value | 2% of ₹4,00,000 = ₹8,000 Split: ₹4,000 CGST + ₹4,000 SGST |

TDS = ₹8,000 |

| 4. Payment to Supplier | Deduct TDS | Total Invoice = ₹4,72,000 Less TDS = ₹8,000 |

Net Payment = ₹4,64,000 |

| 5. Deposit & File GSTR-7 | File return | Department deposits ₹8,000 TDS to government by 10th of next month | TDS Filed via GSTR-7 |

| 6. Issue TDS Certificate (GSTR-7A) | Generate certificate | GSTR-7A auto-generates after filing | Supplier receives ₹8,000 TDS certificate |

| 7. Supplier Claims Credit | Accept TDS credit | Supplier logs into GST portal → TDS/TCS Credit Received → Accepts entry | Credit reflects in Electronic Cash Ledger |

Example for Inter-State Supply

If the same supply was inter-state:

- GST = IGST @18% (₹72,000)

- TDS = 2% IGST on ₹4,00,000 = ₹8,000

Everything else remains the same, except the entire ₹8,000 goes under IGST head.

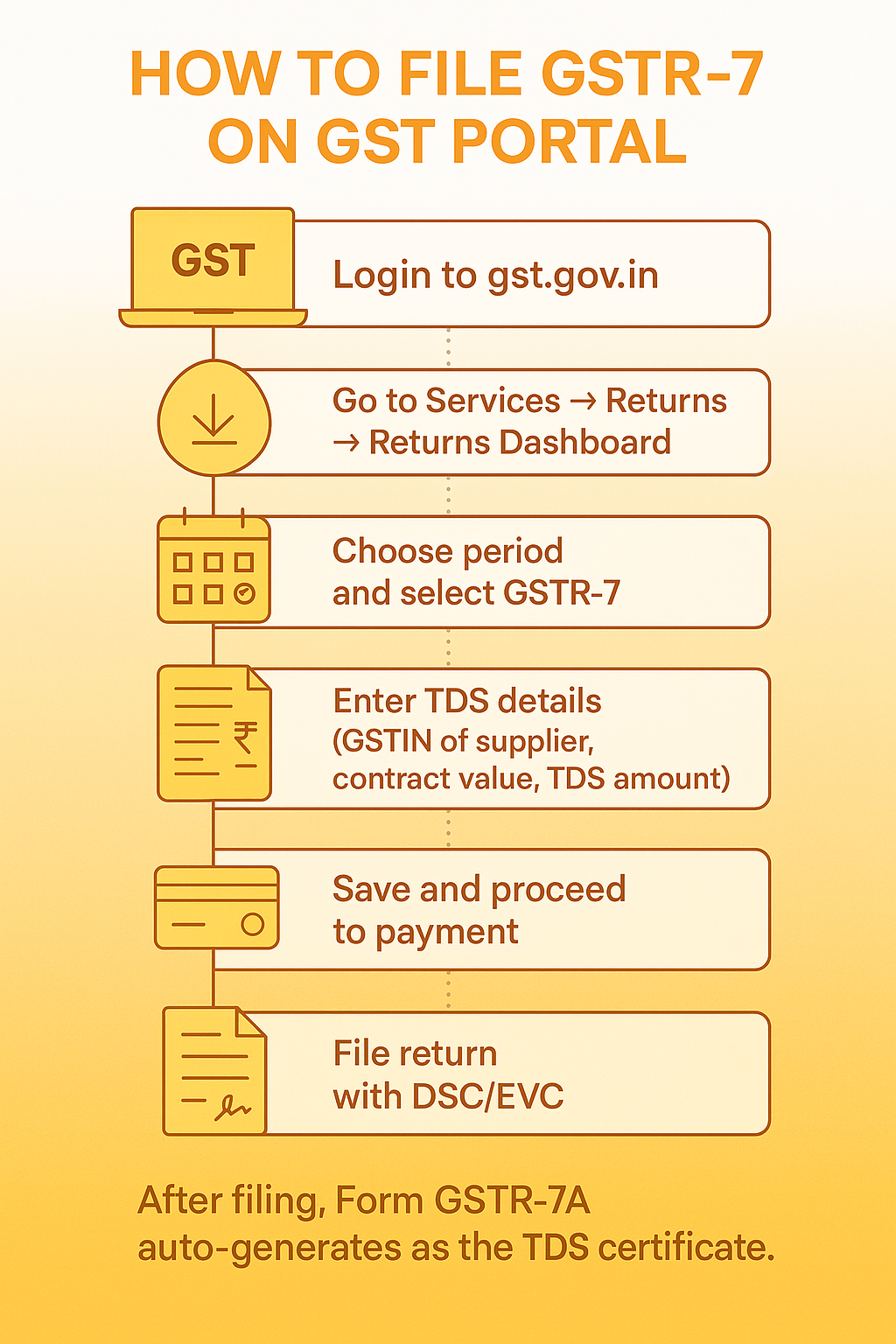

How to File GSTR-7 on GST Portal

- Login to gst.gov.in

- Go to Services → Returns → Returns Dashboard

- Choose period and select GSTR-7

- Enter TDS details (GSTIN of supplier, contract value, TDS amount)

- Save and proceed to payment

- File return with DSC/EVC

After filing, Form GSTR-7A auto-generates as the TDS certificate.

4 Most Common Mistakes to Avoid while deducting TDS on GST Bill

Even experienced accountants make mistakes here. Keep an eye for the following:

- Deducting TDS on total invoice (including GST) → Wrong. Deduct only on taxable value.

- Missing the ₹2,50,000 threshold → TDS applies per contract, not per invoice.

- Not depositing TDS by 10th of next month → Leads to penalties and interest.

- Not issuing TDS certificate (GSTR-7A) → Non-compliance can affect supplier’s credit.

Supplier not accepting TDS credit → If supplier doesn’t accept, credit won’t reflect.

Benefit of TDS to the Deductee (Supplier)

Benefit of TDS to the Deductor (Payer)

Penalties for Not Complying with TDS Provisions under GST

How to Get TDS Refund under GST

If excess TDS is deducted or paid, taxpayers can claim a refund through the GST portal using Form RFD-01. Here’s how the process works:

- Login to GST Portal.

- Go to Services → Refunds → Application for Refund.

- Choose “Refund on account of excess balance in Electronic Cash Ledger.”

- File Form RFD-01, attach necessary documents, and submit.

- Refund is processed directly to your bank account linked with GST registration.

How GimBooks Makes TDS on GST Effortless

Let’s be honest — manual calculation, filing, and tracking credits can be messy. Especially when you’re managing multiple vendors or government clients.

That’s where GimBooks steps in.

Here’s how it helps:

✅ Auto-computes TDS When you create an invoice, GimBooks automatically identifies taxable value and applies the correct TDS rate (1%+1% or 2%).

✅ Tracks payable & deducted TDS You can see which suppliers have TDS deducted and which payments are pending.

✅ Automated reminders for due dates Get alerts for TDS deposit deadlines or GSTR-7 filing.

✅ Generates TDS reports & certificates Easily export or share reports for compliance and reconciliation.

✅ Integrated with GST & invoicing You can generate GST invoices, file GSTR-1/GSTR-3B, and handle TDS — all in one place.

✅ Cloud-based access Your accountant, finance team, or CA can log in anytime, from anywhere, and update records instantly.

If you’re still managing TDS calculations in Excel or manually, try GimBooks — it makes compliance accurate, fast, and stress-free.

Try GimBooks Now — your all-in-one GST accounting and invoicing app trusted by Indian SMEs.

Short Summary

Conclusion

Deducting TDS under GST isn’t complicated — it’s about understanding how to deduct TDS under GST, who needs to deduct, when, and how much. Once you see it with a GST Bill example, it’s straightforward.

But the real challenge is compliance — calculating accurately, depositing on time, and keeping everything in sync with the GST portal.

That’s where GimBooks can take the weight off your shoulders. It handles your GST invoicing, returns, and TDS in one dashboard — helping Indian businesses stay compliant without spending hours on paperwork.

FAQs on TDS Under GST

Q1. Is TDS under GST applicable to all businesses?

No, only government departments, PSUs, and notified entities need to deduct TDS.

Q2. Is TDS deducted on GST amount?

No. Deduct TDS only on the taxable amount before GST.

Q3. What is the TDS rate under GST?

2% of taxable value — split as 1% CGST + 1% SGST or 2% IGST.

Q4. When must TDS be deposited to the government?

By the 10th of the next month following deduction.

Q5. How can small businesses track GST TDS easily?

By using cloud-based accounting software like GimBooks, which automates TDS tracking, calculation, and filing.

Q6. How to deduct TDS on GST bill with example?

Let’s take a simple example:

A government department hires M/s ABC Traders for supplies worth ₹4,00,000 (GST @18%).

Step-by-step deduction:

- Taxable value = ₹4,00,000

- GST @18% = ₹72,000

- Total invoice = ₹4,72,000

- TDS @2% on taxable value = ₹8,000

- ₹4,000 under CGST

- ₹4,000 under SGST

The department pays ₹4,64,000 to the supplier and deposits ₹8,000 as TDS through Form GSTR-7. The supplier then receives a TDS certificate (Form GSTR-7A) and can claim this ₹8,000 as credit in their Electronic Cash Ledger.

Q7. How much TDS is deducted on GST bill?

Under Section 51 of the CGST Act, TDS is deducted at:

- 1% under CGST

- 1% under SGST

- Or 2% under IGST for inter-state supplies.

TDS is always calculated only on the taxable value, not on the GST component of the invoice.

Q8. How to claim TDS deducted under GST?

Suppliers can claim TDS credit easily through the GST portal:

- Log in to gst.gov.in

- Go to Services → Returns → TDS/TCS Credit Received

- Accept the TDS entries reflected in Form GSTR-7A

- Once accepted, the amount automatically appears in your Electronic Cash Ledger and can be used to pay future tax liabilities.

If you’re using GimBooks, this process is even simpler—TDS deductions and credit tracking get auto-updated in your GST dashboard with accurate ledger mapping.

Q9. What is the rule for 2% GST TDS?

As per the GST Act, 2% TDS applies when:

- The total contract value exceeds ₹2.5 lakh, and

- The deductor is a government department, PSU, or notified authority, and

- The supplier is GST-registered.

TDS must be deducted at the time of payment or credit, whichever is earlier, and deposited by the 10th of the next month. Non-compliance can attract interest @18% per annum and penalties.