How to Change Mobile Number in GST Portal Online

Want to update your mobile number in the GST Portal? This easy online gst number update method helps you through every step, from logging in and verifying OTPs to submitting amendments and getting ARN approval. Ideal for business owners, accountants, and GST users across India.

How to Change Mobile Number in GST Portal

Want to change your mobile number on the GST Portal?

Updating GST-registered contact details is important for smooth compliance and timely notifications. Whether it’s your mobile number, email ID, or authorised signatory’s contact information, the GST portal allows you to make changes easily online, without visiting a GST office

We'll learn how to change your mobile number in the GST portal, update your email ID, and edit contact details for proprietors and companies. You’ll also learn how to find contact details using a GST number and what to do if your old number is inactive.

Importance of Updating your Mobile Number in GST Portal

The GST Portal sends important notifications, OTPs (one-time passwords) for OTP verification in GST and communications to the mobile number registered under your GST registration (GSTIN). If that number is wrong or inaccessible, you risk missing deadline alerts or notices or being locked out of certain operations.

Your registered mobile number in GST portal is used for:

- OTP verification during login and filing

- Receiving system-generated notifications

- Getting alerts about GSTR due dates or status changes

- Approving authorisations and digital signatures

A registered mobile number helps with verification and security , ensuring only authorised persons are making changes.

Even though changing a mobile number in GST is a relatively minor update (non-core field) it still needs to be done correctly so the system recognizes you. The official user guide confirms that updating the mobile number/email falls under non-core field amendment for “Amendment of Registration – Non-Core Fields”.

If you don’t update your mobile number in the GST portal at the right time, you could face delays or complications when filing returns or responding to notices. Better to get it sorted proactively.

Things to know before Changing Mobile Number in GST

Before you log in and start changing the mobile number in GST, ensure you’ve got the following in order:

- You have access to your GST Portal credentials (user ID / password) for the concerned GSTIN.

- The new mobile number you want to register is active and accessible, you’ll receive OTPs on it.

- If the mobile number change is being done because the authorised signatory has changed, make sure you have all details of the new signatory ready (name, mobile, email, designation).

- You’re aware of whether you are updating the mobile number of the same authorised signatory/promoter OR you are replacing the authorised signatory with a new person (because the process differs).

- Understand that this is a non-core field amendment in GST: mobile number and email fall under non-core fields, which means there is no manual processing by tax officials once filed (in normal circumstances).

Ensure the business is active, the GST registration is valid, and there are no pending cancellation or suspension proceedings (if so, amendment links may be disabled).

How to Change Mobile Number in GST Portal Online

Here is the online method for editing contact info in the GST portal, where there are two situations because the GST mobile number update process differs depending on whether the authorised signatory is the same as the promoter/partner or a different person.

Situation A: Authorised signatory mobile number change

When the authorized signatory is the same as the promoter/partner GST

If you (the promoter/partner) are also the authorised signatory whose mobile number you want to change, follow these steps:

- Log in to the GST Portal to Change mobile number with your username and password.

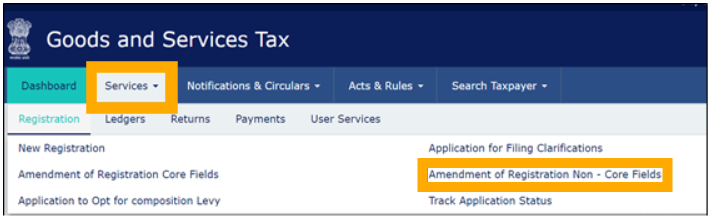

- Navigate to Services → Registration → Amendment of Registration (Non-Core Fields).

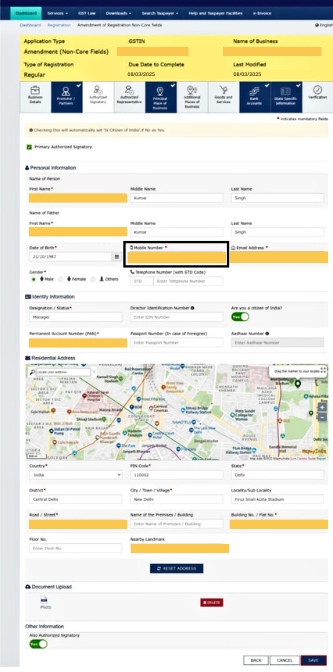

- Select the tab Promoter/Partners (since you are the promoter and authorised signatory). Click the Edit button under “Actions” next to your name.

- In the edit screen, update the Mobile Number field.

Double-check the number.

- Click Save. After this, you’ll get OTPs, one each to the new mobile number. Enter the OTP(s) as prompted.

- Once OTP verification completes, go to the Verification tab. You’ll see a declaration checkbox.

Select the appropriate verification method (EVC, DSC, e-Sign) for your business entity type. Then submit. This is the process of how to change mobile number in gst portal for proprietorship.

- After submission you’ll receive an Application Reference Number (ARN). The system will approve the change (since this is a non-core fields amendment), and the mobile number will be updated. You’ll get a confirmation SMS/email once it’s approved.

- Log out and perhaps log in again to verify the new mobile number appears in your GST registration details.

Situation B: Changing the Authorised Signatory Altogether

If the authorised signatory is not the same person as the promoter/partner, or you’re changing to a new authorised signatory whose mobile number you wish to register, the steps are slightly more involved:

- Log in to the GST Portal.

- Go to Services → Registration → Amendment of Registration (Non-Core Fields).

- Click on the Authorised Signatory tab. Click Add New. Input details of the new authorised signatory (name, mobile number, e-mail etc.). Click Save.

- Move to the Verification tab. Complete the declaration and submit using DSC/EVC/e-Sign. This step initiates the adding of the new signatory.

- Wait for about 15 minutes (recommended) then log in again.

- Go to Services → Registration → Amendment of Registration (Non-Core Fields) → Authorised Signatory tab. Now you’ll see the old and new signatories listed.

- Deselect the old signatory as “Primary Authorised Signatory” and select the new one as “Primary”. Confirm that the mobile number (and email) entered is correct for the new signatory. An OTP will be triggered to the new mobile number (and/or email) for OTP verification in GST.

- After OTP verification, again go to the Verification tab and submit (using DSC/EVC/e-Sign). This completes the process. You’ll receive a confirmation for ARN approval. This is how to change mobile number in GST portal for company.

- Once the system shows “Changes approved”, log out and back in to verify the correct authorised signatory and look for GST contact details change.

How to Change GST Mobile Number without OTP

If you cannot receive OTPs on the old number, and it’s showing as registered in the portal but you cannot change it, then you may need to approach your jurisdictional tax officer. There is a GST mobile number update process by which the officer can reset the mobile number/email under certain situations.

The taxpayer will need to submit an application with identity documents, proof of business, etc., to establish their claim. The tax officer will update the system, and you’ll receive a new username/temporary password.

Note: This route is more manual and should be used only when the self-service route fails (for example, you don’t have login access or the mobile number is completely lost).

If you haven't lost the login but have only lost mobile access, still try the self-service steps first; the “no access to old mobile” situation is a special case.

Solution to Problems While Updating Contact in GST

Here are a few problems users commonly face and how to address them:

| Issue | What to check / fix |

|---|---|

| OTP not received on new mobile | Ensure the mobile number is entered correctly and is active (can receive SMS). Also check if the number has DND settings blocking SMS. |

| Unable to find “Amendment of Registration (Non-Core Fields)” option | Ensure your GSTIN is active, not under cancellation/suspension, and that you are logged in as an authorised signatory. |

| Changes not reflecting even after submission | Since mobile number update is a non-core field, it typically gets auto-approved, but sometimes it may appear with a slight delay (15 minutes or more). Log out and check again. ([GST Tutorials][1]) |

| Old mobile number still shows up | Double-check that you changed the mobile number in the correct tab (Promoter/Partners vs Authorised Signatory). Also verify you submitted the verification step correctly. |

| Cannot log in because the registered mobile/email is inaccessible | Use the jurisdictional officer pathway (see above). |

| Frequent changes flagged by system | Avoid making frequent changes unless necessary. Every change generates an ARN and audit trail; excessive changes could complicate compliance. |

8 Best Tips After Updating Contact Info in GST Portal

Here are some things I recommend to make the process smoother and avoid future problems:

- After updating the mobile number in the GST portal, update your contact records (internal business records, GST records, email, etc.) so that you always use the correct mobile when filing returns or accessing the portal.

- Keep the old mobile number/account active (if possible) or at least record when you changed it, just in case you need to verify earlier communications.

- When adding a new authorised signatory (scenario B), ensure that person is reliable, aware of their responsibilities, and comfortable with receiving OTPs and handling GST portal tasks.

- Don’t leave the number change too late. If you are anticipating a change (for example, you are getting a new smartphone or switching numbers), plan ahead so you don’t miss any GST communications.

- Periodically check your GST profile (Services → My Profile in portal) to ensure your mobile and email are correct and you can access them.

- Save the ARN for ARN approval and acknowledgement screenshot/email after submitting the amendment, for your records.

- Make sure the mobile number belongs to the authorised signatory or person responsible for compliance, since GST authorities will send critical notices and OTPs to that number.

- If you are a business with multiple GSTINs (multiple registrations), ensure the correct mobile number is mapped to the correct GSTIN and authorized person; mismatches could cause confusion.

Conclusion: Update Mobile Number in GST Registration

Updating your GST contact information isn’t complicated; it just needs a few careful steps. Whether you want to update your GST mobile number online or change the authorised signatory’s mobile in GST, everything can be done digitally through the GST portal in minutes.

The key is to keep your contact details current so you never miss important alerts, OTPs, or filing updates from the GST department. Always verify changes using OTPs and confirm submission with DSC or EVC for security.

Think of it as routine maintenance for your GST profile: small updates that prevent big compliance issues later. If you change the authorized signatory mobile in GST or your business contact number is replaced, log in and update it right away, and you can also change the email ID in gst portal quickly.

Learn more on how to edit contact information in GST registration