How to Change Email ID in GST Portal Quickly (2025 Guide)

Need to update your GST contact email? Here’s a simple, verified guide on how to change your email ID in the GST portal quickly. Includes eligibility, step-by-step process, OTP issues, and FAQs for GST login

If you need to change the email ID in the GST portal because you have changed your business email, lost access to your old one, or simply want to update contact details in the GST portal, you can easily do it online.

Let's explore how to change the email ID in the GST portal quickly, step by step, and clear a few common doubts around how to change your email ID in the GST portal for OTP, how to change email ID in the GST portal without login, and other updates.

Eligibility & Requirements for Changing Email ID in the GST Portal?

Before you start the update process, it’s important to know who is eligible and what you need ready. Here’s a quick overview of the eligibility and document requirements to help you change your email ID in the GST portal quickly without errors.

Step-by-Step Guide: How to Change Email ID in GST Portal Quickly

Here’s the simple process to update your registered email ID:

Step 1: Log in to the GST Portal

Visit https://www.gst.gov.in/ and log in with your username and password.

Step 2: Go to “Amendment of Registration”

From the dashboard:

- Click Services > Registration > Amendment of Registration (Core Fields).

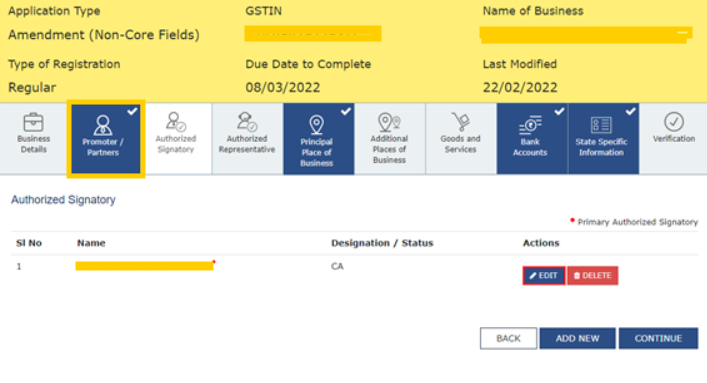

Step 3: Open “Authorized Signatory” Tab

- In the left-hand menu, select Authorized Signatory.

You’ll see the list of existing authorized signatories registered under your GSTIN.

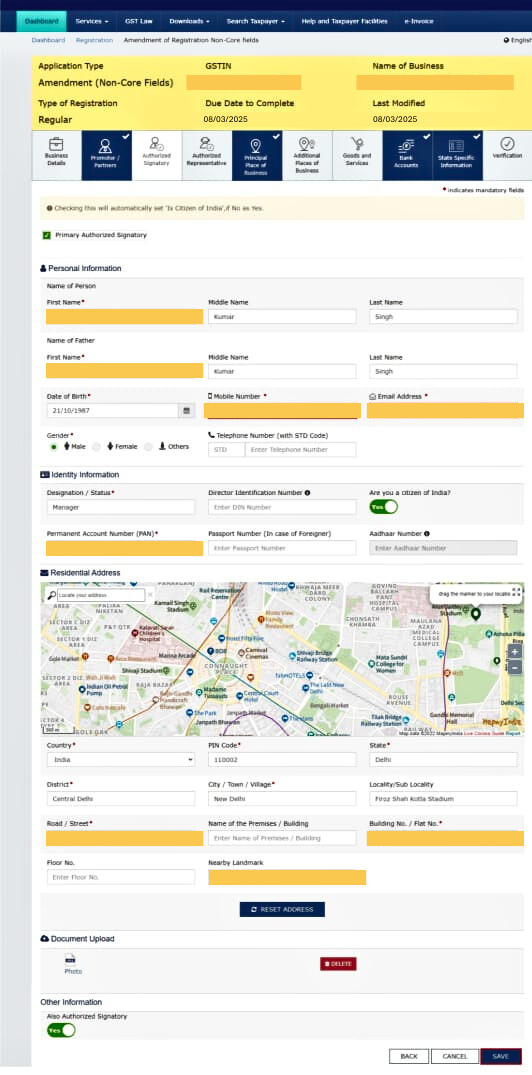

Step 4: Add a New Authorized Signatory

- Click on Add New.

- Enter the new email ID and mobile number you want to use.

- Upload ID proof (PAN, Aadhaar, or authorization letter if applicable).

Step 5: Mark as Primary Authorized Signatory

- Tick the checkbox “Primary Authorized Signatory” for the new signatory.

- Untick the old one.

Step 6: Submit with Digital Signature (DSC) or EVC

- Click Submit with DSC or Submit with EVC.

- The system will send OTPs to the new email and mobile number via gst email verification process.

- Once verified, your email ID will be updated. It usually reflects within 15–30 minutes.

How to Change Email ID in GST Portal for OTP

You would want to change your email ID in the GST portal if you’re not receiving OTPs on your old email ID, and here’s how you change your email ID in the GST portal for OTP:

- Use the Amendment of Registration process mentioned above.

- Add a new email ID under Authorised Signatory.

- Submit using EVC or DSC.

- OTPs will now be sent to the updated email and mobile number.

If you still face issues, contact the GST Helpdesk or raise a ticket on the GST portal.

How to Change Email ID in GST Portal Without Login

If you can’t log in because your OTP goes to an old or inaccessible email ID:

- Go to gst.gov.in.

- Click on “Forgot Username” or “Forgot Password”.

- Choose “Try OTP on registered mobile number” if it’s still active.

- Reset your credentials.

- Once logged in, follow the Authorized Signatory Amendment process to change your email ID.

If the old email and mobile number are inactive, you should:

- Contact your Jurisdictional Officer with ID proof, and

- Request manual update via application or physical verification.

How to Change Company Email ID in GST Portal

If your business email (like info@company.com) has changed:

- Log in using the authorized signatory’s credentials.

- Add a new authorized signatory with the company’s new email.

- Mark the new signatory as “Primary.”

- Authenticate using DSC/EVC.

The process remains the same for partnerships, proprietorships, LLPs, or private limited companies.

How to Change Email ID & Password in GST Portal

If you also want to update your password along with your email ID:

- First, change your email ID as explained.

- Then, log out and click “Forgot Password” on the GST homepage.

- Use your updated email ID or mobile to generate a new password.

That’s it; both your email and password are now updated.

How to Change Primary Email ID in GST Portal

Your primary email ID is the one linked to your primary authorized signatory. To change it:

- Add a new signatory with the updated email.

- Tick Primary Authorized Signatory.

- Untick the old one.

- Submit for approval with DSC/EVC

How to Change Email ID Name in GST Portal

If your email ID remains the same but you just want to change the name displayed in the portal (like the contact name or signatory name):

- Go to the Promoter/Partners or Authorized Signatory tab.

- Edit the Name field while keeping the same email ID.

- Save and submit with EVC/DSC.

How to Change Email ID in GST Portal Online (Video Reference)

If you prefer visual guidance, search for “how to edit email ID in GST portal YouTube.” The official GSTN channel and multiple verified CA tutorials show the exact steps with screenshots. Always ensure you refer to recent videos (2025-2026), since the GST portal interface may change.

4 Common Issues While Changing Email ID In GST Portal

Here are a few issues users often face while modifying email ID in GST portal:

- OTP not received on the new email → check spam or whitelist “noreply@gst.gov.in”.

- EVC not generated → ensure your PAN is linked with Aadhaar.

- Error “Primary Authorized Signatory Already Exists” → untick the old one first.

- DSC mismatch → update your emSigner utility.

If problems persist, contact the GST Helpdesk or visit your Jurisdictional GST Office.

Conclusion: Change Email ID in GST Portal Quickly

Changing your email address in the GST portal is quick and easy if you know where to look for it. Just remember that all GST communication is sent to your registered email address, so keep it up to date to guarantee you never miss an OTP, notification, or filing alert. If you’re confused or facing login issues, don’t hesitate to contact your CA or jurisdictional officer.

With GimBooks, you stay updated with all GST news and updates on time and make GST compliant business documents on the go!

FAQs on Changing Email ID in GST Portal

How to update email ID in GST portal?

To change your existing email ID in the GST portal, log in at gst.gov.in. Go to Services → Registration → Amendment of Registration, open the Authorized Signatory tab, add your new email ID, mark it as Primary Authorized Signatory, and submit with OTP or DSC.

How to change mobile number and email ID in e-way bill portal?

Visit ewaybillgst.gov.in and log in. Go to My Profile → Update Mobile/Email, enter your new mobile number and email ID, and verify both through OTPs received on your registered contact details.

How to reset GST user ID without email?

Go to gst.gov.in and click Forgot Username. If you don’t have access to your registered email, choose OTP via your registered mobile number. Once verified, reset your GST user ID and password.

How to change mobile number and email ID in e-filing portal?

Log in to incometax.gov.in, go to your Profile → Contact Details, click Edit, and update your mobile number and email ID. Verify both via OTP before saving changes.

How to change email ID in GST portal without login?

If you can’t log in to the GST portal, click Forgot Username or Forgot Password and use OTP on your registered mobile number to regain access. Once logged in, update your email under Authorized Signatory in the Amendment section.

How to change email ID in GST portal for OTP?

To change your email ID for OTP, log in to GST portal and add a new Authorized Signatory with the updated email. Verify it via OTP and mark it as Primary Authorized Signatory so all future OTPs go to your new email.

How to update business email in gst profile?

Open Amendment of Registration on the GST portal, update your company’s new email under Authorized Signatory, tick it as Primary Authorized Signatory, and submit using DSC or EVC for approval.

How to change email ID & password in GST portal?

First update your email ID under Authorized Signatory. Then log out, click Forgot Password, and reset it using your updated email or mobile number.

How to change primary email ID in GST portal?

Add a new authorized signatory with your new email ID, mark it as Primary Authorized Signatory, untick the old one, and submit using DSC or EVC. Your new email will become the primary contact.