How to Add Bank Account in GST Portal Easily in 2026

If you’ve just registered for GST or need to update your bank details, this quick guide shows how to add bank account in GST portal easily, online, for free, and within minutes. Learn the steps to validate your account, fix errors, and link it securely with your GSTIN.

How to Add Bank Account in GST Portal Easily Online

The process of how to add bank account in the GST portal is completely online, free, and available to every registered taxpayer. By linking a bank account to the GST portal, you can ensure eligibility for a refund, smoother return filing, and validation under GST compliance rules.

Let's go over the step-by-step process, the importance of updating bank information on the GST portal, which documents to keep accessible, and more.

What Documents Are Required to Add Bank Account in GST?

Requirements for Updating Bank Information in GST Portal include The following details are required before starting to add your bank account in the GST portal:

- Keep the active GSTIN and login credentials handy for adding a bank account in the GST Portal to log in easily.

- Business bank account number and IFSC code.

- A scanned copy of a cancelled cheque, passbook, or bank statement.

- DSC or EVC (for verification)

- A stable internet connection

This helps you complete the update in one go without errors.

Steps to Add Bank Account in GST Portal Easily Online

Adding or updating bank details on the GST portal is simple. Here’s how you can do it:

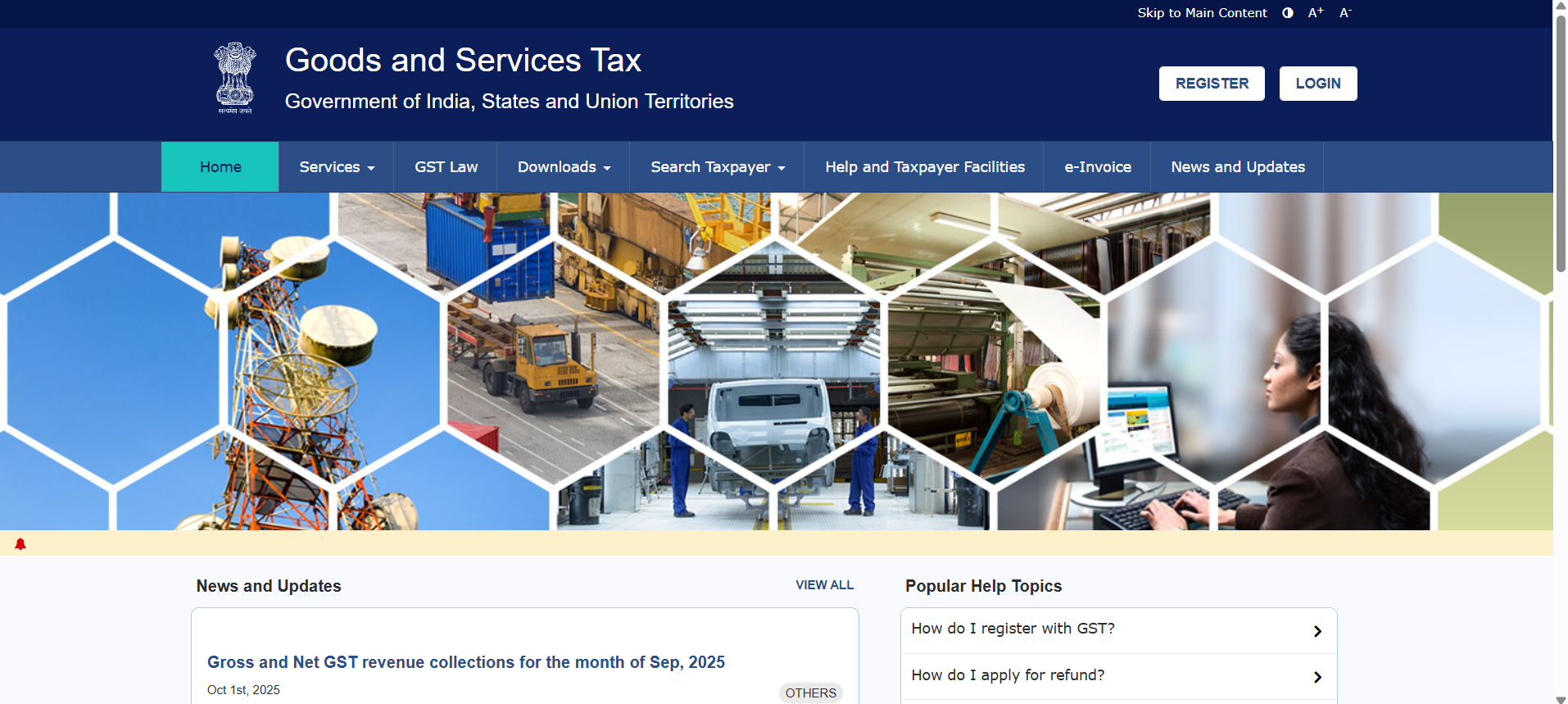

Step 1: Log in to GST Portal

Visit gst.gov.in and log in with your GSTIN and password.

(If you’re wondering how to add bank account in GST Portal easily login, this is where you start.)

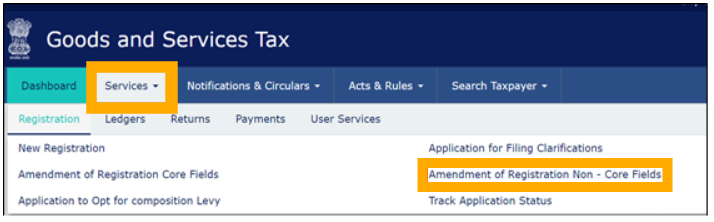

Step 2: Go to Non-Core Field Amendment

From the dashboard, navigate to:

Services → Registration → Amendment of Registration (Non-Core Fields)

This is where you add or change bank account in GST portal without any departmental approval.

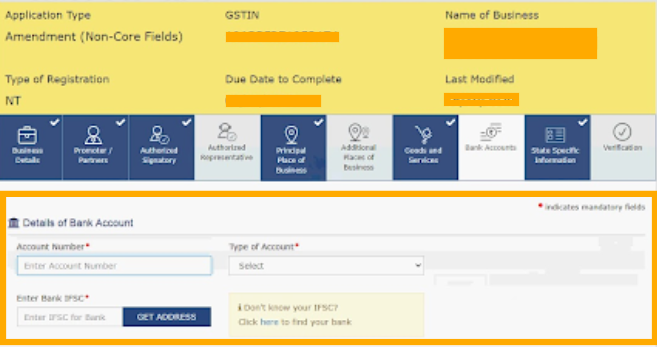

Step 3: Select the “Bank Accounts” Tab

Under this section, click on Bank Accounts.

You’ll see your existing account details (if any) and the option to “Add New”.

Step 4: Add Your Bank Details

Click Add New and fill in the following fields:

- Account Number

- Type (Savings / Current)

- IFSC Code

- Bank Name and Branch (auto-fills after IFSC)

This is the key step in how to add bank details in GST portal correctly.

Step 5: Validate Your Bank Account

Once you enter your details, click Validate Account Details. This triggers GST bank account validation, which checks your name, account number, IFSC, and PAN link. Only after successful validation can you proceed to save.

Step 6: Upload Supporting Documents

Upload a cancelled cheque, bank statement, or the first page of your passbook that clearly shows your name and account number. Make sure the document size and format match portal requirements.

Step 7: Submit Using DSC or EVC

After saving, go to the Verification tab, select the authorized signatory, and submit using either a Digital Signature Certificate (DSC) or Electronic Verification Code (EVC).

Step 8: Confirmation

Once submitted, your request is processed and verified. You can check the status under.

Dashboard → My Profile → Bank Account Status.

That’s how to add bank account in the GST Portal easily after registration in less than 10 minutes.

How to Add Bank Account in GST Portal Easily for Free

Here’s the good news: There’s no fee or charge for this process.

Whether you’re adding, changing, or validating, everything is available for free through the GST portal. All you need is your login access and documents.

You don’t need an agent or intermediary. The GST system is created in a way that taxpayers can do it by themselves, which means the process of updating bank account in GST Portal is easily and freely accessible to everyone.

What If You Need to Change Your Bank Account?

If you’ve closed your old account or switched banks, you can also update or change your account easily.

Here’s how to change bank account in GST portal:

- Log in to your GST account.

- Go to Services → Registration → Amendment of Registration (Non-Core Fields).

- Open the “Bank Accounts” tab.

- Click Edit/Delete next to your old account.

- Click Add New to enter your latest account details.

- Validate, upload documents, and submit with DSC or EVC.

Once updated, GST automatically uses your new account for refunds, filings, and future payments.

Solutions for Issues on Editing GST Info Update

Even though the process of editing GST info is straightforward, users sometimes face errors. Let's understand the reason and fix it with proper solutions.

| Issue | Reason | Solution |

|---|---|---|

| Validation Failed | Bank account PAN not matching GST PAN | Update correct PAN or use business bank account |

| Upload Error | Wrong format or unclear image | Upload a clear JPG/PDF under 1 MB |

| Bank Not Found | IFSC entered incorrectly | Check IFSC on RBI or bank website |

| Amendment Rejected | Non-verified document | Upload a valid cancelled cheque or passbook copy |

If you’re unsure, contact GST Helpdesk via helpdesk@gst.gov.in or 1800-103-4786.

GST Check by Bank: Why It Happens

Bank verifies GST details too. This GST check by bank is part of the compliance framework where banks verify your GST registration and PAN before allowing certain transactions.

This step ensures that only valid GST-registered entities can use business banking features like GST payments, refunds, or vendor credits.

Why Adding Your Bank Account in GST Portal Matters

Before we get into how to add bank account in GST Portal easily online, let’s quickly understand why it is important to add bank account in GST portal-

- Without a linked bank account, GST refunds or Input Tax Credit (ITC) claims can be delayed. The portal immediately processes these through your approved bank account.

- To comply with the CGST Rules, bank details must be provided within 45 days of registration (Rule 10A). Failure to do so can result in registration suspension or cancellation.

- Since 2024, the government has implemented GST bank account validation to ensure that your bank account matches your GSTIN and PAN. This verification step helps to reduce bogus claims.

Read more- Guide on updating GST details

Best Practices to Add Bank a/c in GST for MSMEs

- Use your business account for GST purposes only.

- Validate your bank account immediately after registration.

- Keep track of updates as GST portal often requests for revalidation.

- Monitor refunds and filings so you can always check if refunds are credited to the right account.

- Keep documents scanned and properly name the files, it speeds up verification.

How to Add Bank Account in GST Portal Easily Available 24/7

One major advantage is that the GST portal operates 24/7. This means you can update or validate your bank account from your GST dashboard. So, whether you’re adding after registration or changing details mid-year, the process for how to add a bank account in the GST Portal is easily available, always open, and instant.

Conclusion

Adding your bank account to the GST portal is a one-time step that saves you from multiple future problems, refund delays, filing errors, or even suspension. The GST system is now smarter with GST bank account validation and seamless GST linking with accounts, ensuring transparency for all registered businesses.

If you’re newly registered or have recently changed your bank, don’t delay. Log in, add, validate, and you’re done. The process is free, available anytime, and takes under 10 minutes. That’s how to add bank account in GST Portal easily online.

FAQ for Adding Bank Account in GST after Registration