How to Cancel GST Registration Online Easily

Learn how to cancel your GST registration step-by-step, reasons for ineligibility, what happens if you don’t cancel, and how to withdraw your GST application after ARN. Simple guide for Indian businesses to avoid penalties and stay compliant with suo moto cancellation.

Businesses that no longer need a GST registration, or whose turnover has dropped below the threshold, have closed their business or could have shifted to a different business model. In such cases, businesses might be wondering, "How to cancel GST registration?"

GST registration can be cancelled completely online through the GST portal. In this GST registration cancellation guide, we’ll walk you through everything you need to know about GST registration cancellation, including eligibility, required documents, the step-by-step process, and common mistakes to avoid. Because if you haven't cancelled your GST, you'll still be liable to pay

Table of Contents

- Who Can Cancel GST Registration?

- Reasons for Cancelling GST Registration

- Documents Required for GST Registration Cancellation

- Step-by-Step Process: How to Cancel GST Registration Online

- Timeline for Cancellation Approval

- Things to Do After Cancelling GST Registration

- Common Mistakes to Avoid after GST Registration Cancelling

- How GimBooks Can Help with GST Compliance

- FAQs on GST Registration Cancellation

Who Can Cancel GST Registration?

GST registration can be cancelled by:

| Type of Cancellation | When it applies |

|---|---|

| Voluntary cancellation by taxpayer | When the taxpayer applies to cancel their own registration. |

| By GST Officer (suo moto cancellation) | If the department finds that the taxpayer violated GST laws. |

| By legal heirs | In case of death of a sole proprietor. |

So if you’re thinking of winding up your business or moving to a new structure, you’ll need to apply online for cancellation through the GST portal.

Reasons for Cancelling GST Registration

✅ Common Reasons for GST Registration Cancellation

Business Closure

Shutting down operations permanently.

Turnover Below Threshold

Annual turnover falls below ₹40 lakh (or ₹20 lakh for services in some states).

Change in Business Structure

Merger, transfer, amalgamation, or demerger.

Switch to Composition Scheme

Normal GST registration is no longer valid after switching.

Death of Proprietor

Legal heirs can apply for cancellation.

No Longer Liable

Exempt goods/services or voluntary withdrawal of registration.

Tip: If the GST registration isn’t cancelled even when it’s no longer applicable, you’ll still be expected to file NIL returns every month/quarter.

Documents Required for GST Cancellation

Before you begin the GST cancellation process, keep these documents ready:

-

GSTIN (GST Identification Number)

-

Reason for cancellation

-

Closing stock details (inputs, capital goods, semi-finished goods)

-

Proof of business closure (if applicable)

-

Latest GST returns filed

-

Balance sheet and liability/payment details

-

2 Key GST Forms for Cancellation of GST Registration

2 Key GST Forms for Cancellation of GST Registration

In the event of a deceased taxpayer/business owner, their legal heirs can proceed with the following GST forms to cancel GST registration-

- An application for cancellation must be made in the form GST REG 16.

- The following details are required in the form GST REG 16-

Details of inputs, semi-finished, and finished goods held in stock on the date on which cancellation of registration is applied. - Liability thereon

- Details of the payment

- The assigned tax officer issues an order for cancellation in the form GST REG-19 within 30 days from the date of application. The cancellation will be effective from a date determined by the officer, and he will notify the taxable person

Having these documents ready ensures smooth cancellation without delays.

Step-by-Step Guide to GST Registration Cancel Online:

Here’s the detailed 6-step process to cancel GST registration through the official GST portal:

Step 1: Log in to the GST Portal

Go to www.gst.gov.in and log in using your username and password.

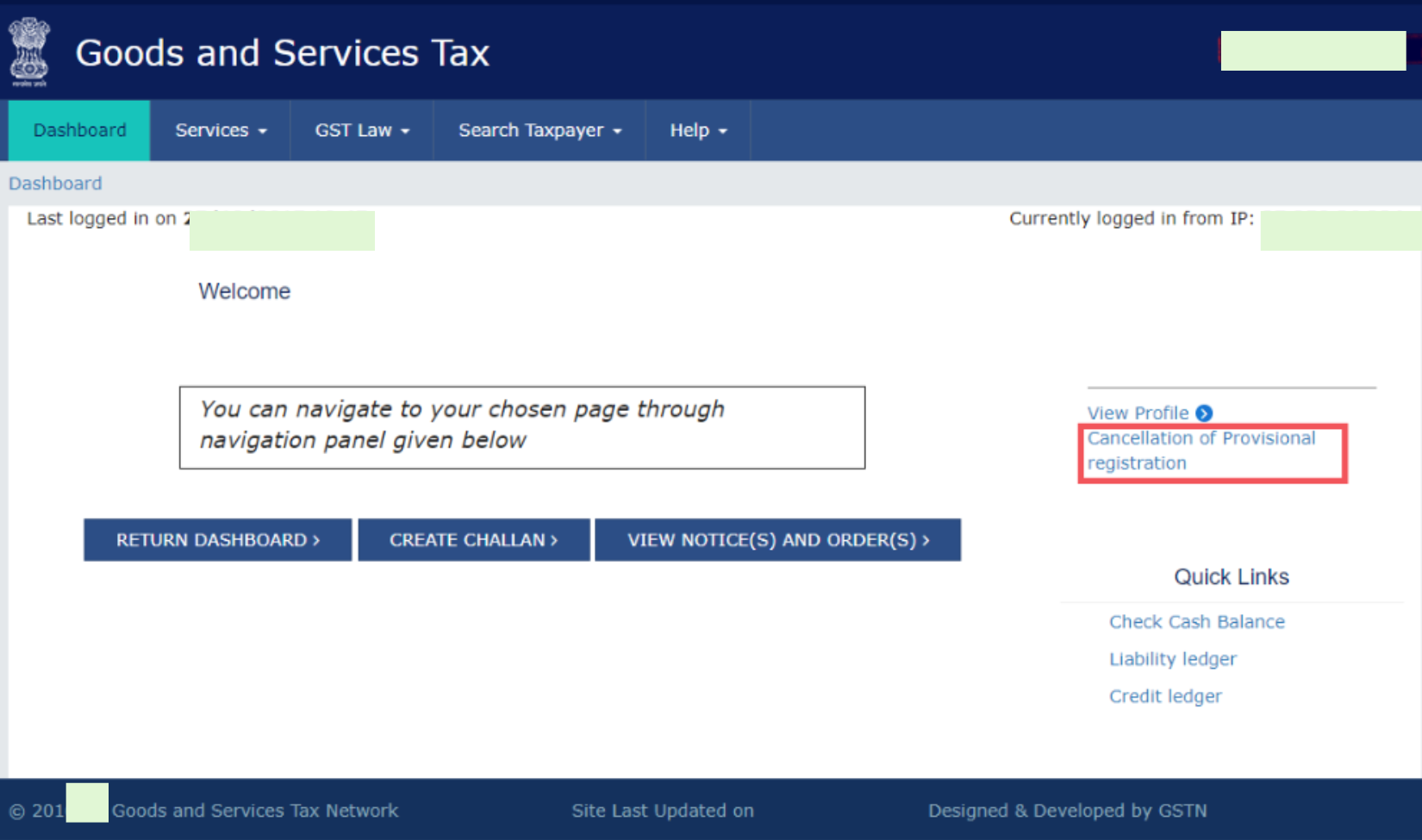

Step 2: Navigate to Cancellation Option

Click on Services → Registration → Application for Cancellation of Registration.

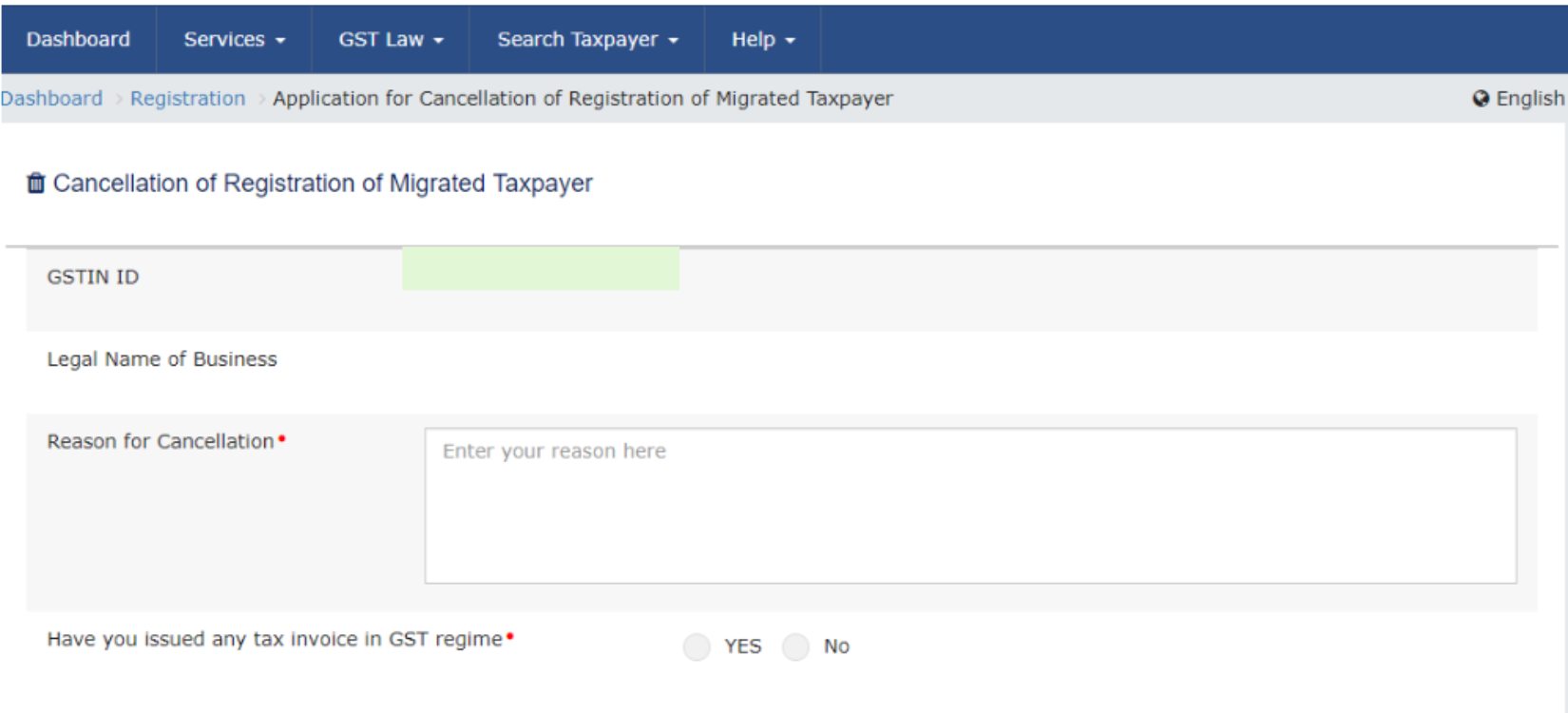

Step 3: Fill in Details

- Select the reason for cancellation (e.g., business closure, turnover below threshold).

- Provide the date from which cancellation is required.

- Enter stock details and tax liability (if applicable).

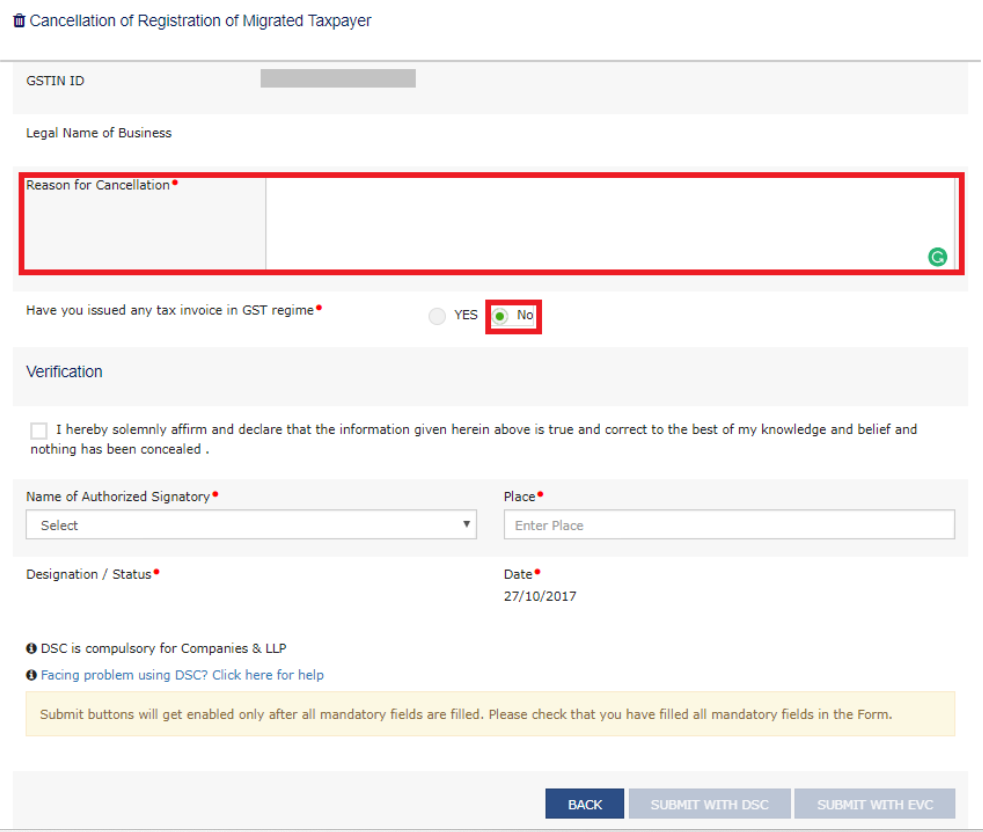

Step 4: Submit Supporting Documents

Upload relevant documents (like closure proof, transfer papers, etc.).

Step 5: File Application

Use DSC (Digital Signature Certificate) or EVC (Electronic Verification Code) to file your application.

Step 6: ARN Generation

- Once submitted, you’ll get an Application Reference Number (ARN), which you can track under “My Applications.”

Timeline for GST Registration Cancellation Approval

If all details are correct, the GST officer approves the GST registration cancellation within 30 working days.

- You’ll receive a formal order of cancellation on the GST portal.

- In case of queries, you may need to submit additional documents.

- Until approval, you’re still required to comply with GST rules, including filing returns.

Things to Do After Cancelling GST Registration

Cancelling GST Registration doesn’t mean you’re done. You still need to:

-

File a final GST return (Form GSTR-10) within 3 months of cancellation.

-

Pay off any outstanding tax liabilities, interest, or penalties.

-

Maintain records of accounts and invoices for at least 6 years (as per GST law).

-

Failure to do so can attract penalties, even if your GST registration is cancelled.

Common Mistakes to Avoid while Cancelling GST Registration

Avoid these frequent GST cancellation mistakes to stay compliant and prevent penalties.

- Not filing the final return (GSTR-10) — Many businesses skip GSTR-10, leading to notices and fines.

- Incorrect date of cancellation — A wrong effective date can cause compliance mismatches in books and returns.

- Ignoring stock liability — Input tax credit on unsold stock must be reversed; skipping this invites demand notices.

- Not using a GST tool — Manual processes increase errors and missed deadlines without automated reminders.

How GimBooks Can Help with GST Compliance

Here’s the thing — cancelling GST registration may sound simple, but compliance in India is rarely straightforward. Small business owners often miss deadlines, file incorrect returns, or struggle with stock liability calculations.

That’s where GimBooks, a GST and invoicing app made for Indian MSMEs, comes in:

-

Create and manage GST-compliant invoices in seconds.

-

File GST returns directly through the app.

-

Get reminders for due dates like GSTR-10 (final return).

-

Track stock, input credits, and liabilities easily.

-

Access professional support for GST cancellation and compliance.

So, whether you’re starting, scaling up, or shutting down — GimBooks keeps your GST journey hassle-free.

Conclusion

Knowing how to cancel GST registration is important if your business doesn’t need GST anymore. It saves you from unnecessary compliance burdens, penalties, and paperwork.

But compliance doesn’t end at cancellation — you still need to file final returns, manage liabilities, and maintain records. Instead of stressing over these steps, let GimBooks handle it for you.

Whether you’re cancelling GST, filing returns, or simply invoicing clients, GimBooks is built for Indian MSMEs to simplify compliance and focus on business growth.

Download GimBooks today and make GST compliance effortless.

FAQs on How to Cancel GST Registration Online Easily

Can I cancel GST registration if my turnover is below ₹20–40 lakh?

Yes. If your annual turnover falls below the GST exemption threshold (₹40 lakh for goods and ₹20 lakh for services), you can apply for cancellation on the GST portal. This is one of the most common reasons for voluntary GST cancellation.

How does one cancel their GST registration?

To cancel GST registration:

- Log in to the GST portal.

- Go to Services → Registration → Application for Cancellation of Registration.

- Fill in the reason, stock details, and upload documents.

- Submit using DSC/EVC.

- File final return (GSTR-10) within 3 months.

Approval usually takes up to 30 working days.

What happens if I stop filing GST returns but don’t cancel my registration?

You will continue to receive late fee and penalty notices from the GST department. It is always better to apply for cancellation instead of ignoring compliance.

Do I need to file a final return after GST cancellation?

Yes. GSTR-10 (Final Return) must be filed within 3 months of cancellation to settle liabilities and reverse Input Tax Credit (ITC) on remaining stock.

Why am I unable to cancel GST registration?

You may be unable to cancel GST registration if:

- All pending GST returns are not filed.

- There are outstanding tax dues, interest, or penalties.

- Final return (GSTR-10) hasn’t been filed within the 3-month window.

- Supporting documents for cancellation are missing or incorrect.

Tip: Ensure compliance is complete before applying. Using a tool like GimBooks helps track returns and liabilities, making cancellation smooth.

How long does GST cancellation take?

Usually 30 working days, subject to officer approval.

Can I cancel an application for GST registration after receiving an ARN?

If you’ve applied for new GST registration but want to cancel it after getting an ARN (Application Reference Number):

- Log in to the GST portal → Services → Track Application Status.

- Use your ARN to check progress.

- If still under processing, you can file a withdrawal request.

- If approved already, you’ll need to file for cancellation of registration instead.

Can I cancel GST registration voluntarily?

Yes, if your turnover is below the threshold or your business is closed, you can apply for voluntary cancellation.

Can I reapply for GST after cancellation?

Yes. If your business grows again or you cross the threshold turnover, you can apply for fresh GST registration anytime in the future.

What happens if I don’t cancel GST registration?

You’ll still be liable to file returns and pay penalties, even if your business turnover falls below the threshold.

Can GST officer cancel my registration?

Yes, in cases of non-compliance, fraud, or ineligible registration, the GST officer has the power to cancel your GST registration.

How does GST cancellation affect business credibility?

Businesses without GST cannot issue tax invoices or pass ITC to B2B clients. This may limit opportunities with corporates and government contracts.

Why are most GST cancellations reported in states like Uttar Pradesh and Maharashtra?

These states have the highest number of MSMEs and traders. Many small businesses cancel GST due to low turnover, high compliance burden, or seasonal business models.

Do small traders in rural and Tier-2 cities prefer GST cancellation?

Yes. Many micro and seasonal businesses prefer to cancel GST instead of filing NIL returns every month. This reduces cost and compliance stress, especially in rural areas.