GST Refund and Appeal Rules 2025: Complete Guide for Indian Businesses

A clear guide to GST refund and appeal rules by CBIC. Learn about the GST refund update and GST appeal process, GST refund timelines, common delays, required RFD and APL forms, and the full appeal process explained in detail for business owners who need quick, practical answers.

Major GST Refund and Appeal Rules Announced by CBIC in 2025

The GST Refund and Appeal Rules by CBIC in 2025 make the process slightly tighter but also more predictable if you understand how to navigate them.

The Central Board of Indirect Taxes and Customs (CBIC) has unveiled a crucial set of amendments to the Goods and Services Tax (GST) regime through Notification No. 23/2025–CT dated 10.05.2025

Why did CBIC introduce these specific changes to the GST appeal rules?

CBIC introduced these GST circulars and notifications for exporters, small and medium enterprises (SMEs), and any taxpayer involved in filing appeals or looking for refunds under the CGST Act.

This comprehensive GST update and appeal guide walks you through everything: refund eligibility, new GST updates for SMEs, GST timelines, RFD-01 and RFD-06 forms, appeal procedures, and what to do when your refund is rejected.

All Updates in GST Refund and Appeal Rules by CBIC under CGST Act in 2025

▶ March 2025🔽 27 March 2025 — CGST (Second Amendment) Rules, 2025 | Notification 11/2025 – Central Tax

What changed:

- Amended Rule 164 for refund & appeal scenarios.

- Refund not allowed if tax/interest/penalty for the period already discharged, even if demand spans multiple periods.

- Allowed partial appeal withdrawal (instead of withdrawing the entire appeal) for periods covered under dispute resolution scheme.

Impact:

- Clearer approach to multi-period refund disputes.

- Helps taxpayers withdraw only part of an appeal where issues already resolved.

🔽 March 2025 – Rule 164 Clarification (Appeal Withdrawal & Refund Eligibility)

What changed:

- Clarified how partial withdrawal under Section 128A works.

- Standardised officer procedure for accepting/processing partial withdrawals.

Impact:

- Reduces appeal pendency.

- Gives taxpayers flexibility to close parts of old cases without impacting remaining issues.

▶ April 2025🔽 April 2025 – Guidelines for Refund Scrutiny & Documentation

What changed:

- New internal instructions circulated to standardize refund documentation checks.

- Officers advised to rely strictly on mandatory checklists.

Impact:

- Fewer discretionary document demands.

- Predictable refund processing.

▶ May 2025🔽 14 May 2025 — GSTN Portal Update for Deemed Export Refunds

What changed:

- GSTN updated the refund module for deemed export claims.

- New workflow for recipients of deemed export (e.g., EOU units).

- Updated process for shipping bill/BRC verification.

Impact:

- Faster portal validation.

- Fewer manual clarifications from officers.

🔽 May 2025 — Digital-only Appeal Filing Requirement

What changed:

- Appeal applications must be filed exclusively online via Form GST APL-01.

- No physical submission accepted.

- Stricter enforcement of 3-month appeal filing deadline.

Impact:

- Stronger compliance discipline.

- Simplified tracking for taxpayers.

▶ September 2025🔽 22 September 2025 — CGST (Third Amendment) Rules, 2025 | Notification 13/2025

A major set of refund & appeal changes came into effect.

Key refund-related updates:

- Rule 91(2):

Provisional refund order (GST RFD-04) must be issued within 7 days of acknowledgement for eligible taxpayers. - High-risk cases may skip provisional refund and go straight to full scrutiny.

- Automated mismatch alerts before refund blocking.

Appeal-related updates:

- New Form GST APL-02A introduced.

- Allows single-member bench appeals for cases without a substantial question of law.

- Updated timelines for appellate proceedings.

Impact:

- Faster refund turnaround for compliant taxpayers.

- Better risk classification and fraud-proofing.

- Faster disposal of smaller appeal cases.

▶ October 2025🔽 1 October 2025 — Provisional Refund Restriction for High-risk Taxpayers

What changed:

- Provisional refunds may be withheld if the risk engine flags mismatches, excessive ITC patterns, or abnormal refund behaviour.

Impact:

- Genuine taxpayers unaffected.

- High-risk taxpayers face tighter checks.

Let’s break it down step by step.

Changes in GST Refund and Appeal Rules in 2025

GST Refund & Appeal Rules have affected the businesses in 2025 in the following ways:

The 2025 updates focus on cutting processing time and reducing refund disputes. Here’s what this really means for businesses:

-

Faster refund approvals for zero-rated supplies

Exporters and SEZ units get priority processing with stricter documentary checks. GST refund timelines remain 60 days, but officers are now encouraged to issue provisional refunds quickly. -

Digital-only appeal submissions

- Appeals must be filed online on the GST portal through:

- Form GST APL-01 for the first appeal

- Digital documentation only, no physical filings

-

Mandatory reason behind refund rejections

Officers must give clear grounds for rejecting refunds, making the appeal process cleaner. -

Automated refund tracking dashboard

You can now track refund stages: filed → acknowledged → approved → paid → credited. -

Stricter time limits for appeals

The default limit stays three months from the date of order, but the condonation rules are more rigid.

Overall, the rules aim to reduce back-and-forth and push both taxpayers and officers to stick to timelines.

What are the Different GST Refund Categories?

Different GST refund categories include:

Who Can Claim GST Refund in India 2025

Not every taxpayer is eligible for a GST refund in India 2025, so let’s clarify the categories.

1. Exporters (goods or services)

- Zero-rated supplies

- Refund of unutilized ITC

- Refund on IGST paid on exports

2. SEZ developers and SEZ units

For supplies received with payment of IGST.

3. Inverted duty structure cases

When input GST > output GST.

4. Excess balance in cash ledger

Common after mistakes or bulk payments.

5. Refund due to assessment, appeal or order

If the court or appellate authority rules in your favour.

6. Wrong tax paid due to classification error

Example: You paid IGST but should have paid CGST + SGST.

7. TDS/TCS refunds for government bodies or e-commerce operators

8. Excess payment of tax due to a mistake

Happens more often than people admit.

A GST refund claim is possible if you fall under these categories.

Apply for GST refund online

GST Forms for Refund & Appeals (2025)

Before proceeding forward with the GST refund and appeal by CBIC, understand which RFD and APL to fill for smooth claims:

Step-by-Step GST Refund Process 2025-2026

- Start → Identify refund category

- Prepare documents (invoices, LUT/Bond, BRC/FIRC, bank proof, returns)

- Login GST Portal → Services → Refunds → Application for Refund

- Select category → Fill RFD-01 (enter tax period, bank details, calculations)

- Upload supporting docs → Submit → ARN generated

- Portal does automated pre-checks:

- If mismatch or missing docs → RFD-03 (Deficiency) → taxpayer must respond within portal → go to step 4 after correction

- If no issues → forwarded to officer

- Officer review:

- If minor query → RFD-08 (Show Cause) → taxpayer replies via RFD-09 → officer re-evaluates

- If approves provisional refund → RFD-04 issued → provisional amount paid (if applicable)

- If rejects/partially accepts → RFD-06 issued (reasoned order)

- Payment stage:

- Approved → RFD-05/RFD-07A payment order → PFMS verification → amount credited to bank

- If rejected or short-paid → taxpayer may file appeal (go to Appeal Flowchart)

Quick tips: track ARN in portal dashboard, keep bank IFSC/name accurate, and respond to RFD-03/RFD-08 within the timeline.

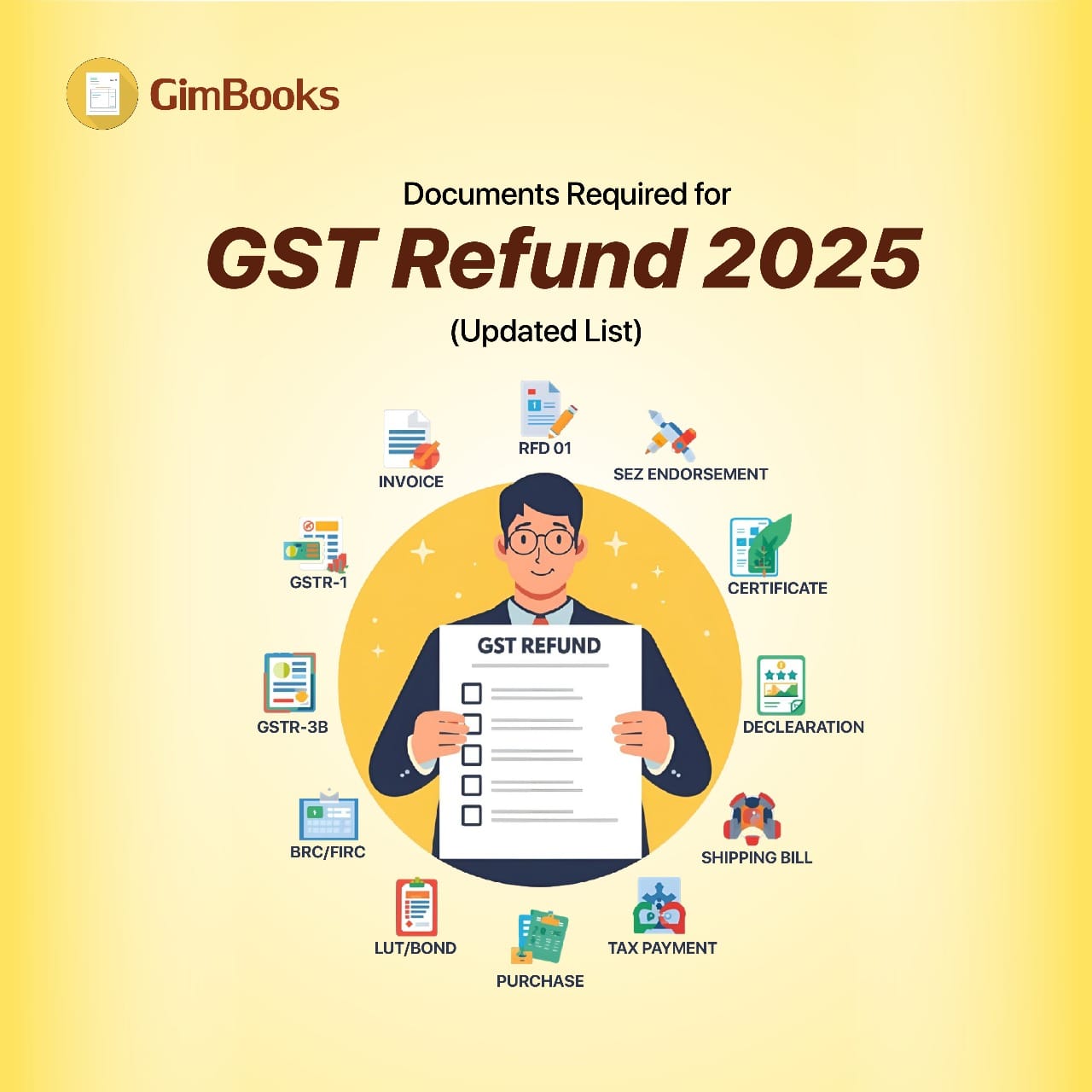

Let's understand the documents required for claiming GST refund by CBIC.

Documents Required for GST Refund in 2025

The safer approach: keep all your tax and invoice records ready for at least 6 years.

Why GST Refund Gets Delayed & How to Avoid Rejection

To avoid GST rejection, identify the reason behind the GST delay and quickly find solutions to GST refund mistakes in 2025:

Read more: How proper invoicing helps avoid GST refund delays.

GST Appeal Process Explained (2025 Edition)

If your refund is rejected or reduced, the next step is the appeal process.

Here’s a simple take on how it works.

When can you file an appeal?

You can appeal if you disagree with:

- Refund rejection

- Refund short-payment

- Assessment order

- Demand order

- Penalty order

- Any adverse order under GST

If your refund is rejected or reduced, the next step is the GST appeal process. Here’s a simple take on how it works.

Where to file a GST appeal?

- First Appeal → Appellate Authority under GST

- Second Appeal → GST Appellate Tribunal (if operational in your state)

Time limit for GST appeal

- 3 months from issue of order

- Additional 1 month if delay is justified Beyond that, appeals are usually not accepted.

Forms used for GST Appeal

- First appeal → GST APL-01

- Grounds for appeal → APL-01A

- Acknowledgment → APL-02

Documents needed for GST Appeal

- Copy of order being appealed

- Statement of facts

- Grounds for appeal

- Certified copies if required

- Supporting proofs (invoices, returns, emails, exports records, etc.)

What happens during the GST appeal?

- You file APL-01 online.

- Pay a mandatory pre-deposit (usually 10% of the disputed amount).

- Appellate authority reviews the case.

- Hearing is scheduled if required.

- Final order is issued (APL-04).

If the ruling is in your favour, refund or relief is processed accordingly.

How to File a GST Appeal Online in 2025

Here’s a process to file GST appeal online easily in 2025-2026.

- Receive adverse order (RFD-06 / assessment / demand / penalty) → Decide to appeal

- Check appeal window → 3 months from order date (condonation possible but stricter)

- Prepare grounds of appeal (facts, legal points, supporting docs)

- Login GST Portal → Services → User Services → Appeals → File APL-01

- Attach APL-01A (detailed grounds) and certified copies where required

- Pay pre-deposit via PMT-06 (usually 10% of disputed tax, confirm exact requirement)

- ARN generated → Acknowledgement (APL-02)

- Appellate authority reviews:

- Admit appeal → issue notice for hearing (APL-03) OR decide on documents

- Dismiss admissibility → order issued (APL-04)

- Hearing (if scheduled): present oral arguments and evidence

- Final order (APL-04):

- If favourable → direction for refund/adjustment/payment reversal

- If unfavourable → consider second appeal to Tribunal (APL-05) or higher remedies

- Execute outcome: department processes the refund/payment as per the order.

Quick tips: preserve a chronological file of orders, challans, and communication; keep pre-deposit ready; use concise, pointwise grounds.

Conclusion

The 2025 GST refund and appeal rules make the process more structured, but they also demand cleaner compliance. If your records are organized and reconciliations are done consistently, refunds can move faster, and appeals become easier to win. For MSMEs, this clarity means better cash flow and fewer disputes, something every growing small business needs.