Glass HSN Code 7005: Float Glass, Polished Glass Types & GST Rate Classification

What is HSN Code 7005?

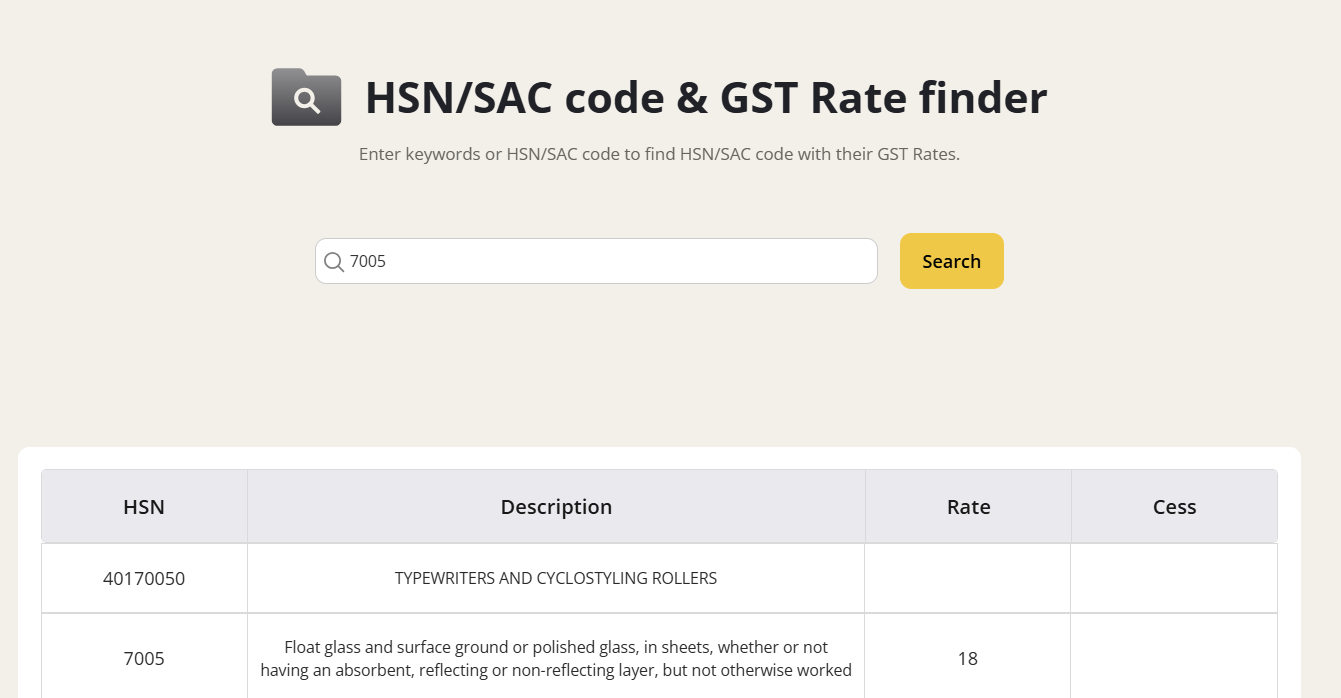

HSN Code for Glass - HSN Code 7005 covers “Float Glass and Surface Ground or Polished Glass, in Sheets.” This category includes float glass, surface ground glass, polished glass, and glass with absorbent, reflecting, or non-reflecting layers—whether or not tinted, wired, or further processed. It’s widely used in windows, architectural projects, automotive windshields, shopfronts, and interior design.

GST Rates & Exemptions for HSN Code 7005

As per the GST regime (and since November 15, 2017), all categories of glass covered under HSN Code 7005—float glass, surface ground glass, polished sheets, wired glass, tinted or colored glass—are taxable at a uniform GST rate of 18%. There is no cess applicable, and no differential rates for tinted, wired, or colored glass in sheets. The rate was reduced from 28% to 18% to rationalize costs and support the construction and auto sectors.

Table Notes

- All rates are standardized at 18% GST across varieties and sub-codes under HSN 7005.

- Glass products may be subject to different classifications if further processed or assembled; such items should be checked separately.

- The table includes common commercial glass types for quick reference.

GST Rates Applicable Under 7005

What’s Included in HSN 7005?

HSN 7005 includes all types of float glass and processed flat glass (including surface ground or polished in sheets), whether or not they have coatings, are body-tinted, opacified, flashed, surface ground, or reinforced with wire. These products are essential in construction, auto, retail display, designer home projects, and industrial glazing.

Explore Gimbooks HSN/SAC code & GST Rate finder

Key Exemptions Under GST for Glass

There are no GST exemptions or concessional rates for float glass, polished glass, or their variants under HSN 7005. All products falling under these sub-headings are taxable at the standard rate of 18%, regardless of color, finish, reinforcement, or sheet thickness.

Input Tax Credit (ITC) Rules for Glass

Businesses registered under GST (e.g., builders, glazing contractors, auto body shops) can claim ITC on GST paid for float glass purchases under HSN 7005 if used in taxable supplies or manufacturing/installation projects. Ensure GST-compliant supplier invoices and correct HSN usage for smooth ITC claims.

GST on Glass Billing: Practical Scenarios

- A glass dealer selling tinted float glass sheets issues invoices at 18% GST, with eligibility for the builder to claim ITC.

- Automotive glass repair shops buy float/polished glass under HSN 7005, pay 18% GST, and avail input credit.

- Interior fit-out contractors purchasing colored or opacified glass for commercial projects apply uniform GST and manage credits accordingly.

Common Mistakes in Glass GST

- Using incorrect HSN codes for fabricated vs. raw flat glass (check assembly or extra processing).

- Applying outdated 28% rates or ignoring new GST rate cuts.

- Failing to mention HSN 7005 on invoices, risking confusion for ITC claims.

- Not distinguishing between glass as a raw material (7005) and as a finished good (other codes).

Conclusion

HSN Code 7005 provides a uniform GST framework for float glass, polished glass, and their industrial/commercial variants at 18%. Proper classification, clear invoicing, and ITC management support cost efficiency and regulatory compliance across construction, automotive, and design industries in 2025.

Explore more

- GST Rate and HSN Code 6203

- Construction Services, Work Contract HSN Code 9954

- 9987 HSN Code and GST rate

FAQs: HSN Code 7005 & Glass GST

What is HSN 7005?

It designates float, surface ground, and polished glass in sheets, with or without specialty coatings or wiring.

What’s the standard GST rate for glass under 7005?

All sheet glass types under HSN 7005 attract a uniform 18% GST after the 2017 rate revision.

Can ITC be claimed on float glass purchases?

Yes, registered businesses can claim ITC on 18% GST paid for glass under HSN 7005 when used in taxable output or installation.

Are there GST exemptions for glass under HSN 7005?

No, all float and polished glass must be billed at 18% GST regardless of finish, color, or usage.

What is the HSN code 70051090?

HSN code 70051090 refers to non-wired float glass that is not otherwise specified, typically used in windows, facades, and interior applications.

What is the HSN code 70053090?

HSN code 70053090 covers polished glass sheets other than wired glass, used for furniture, mirrors, and decorative purposes.

What is the HSN code 70072900?

HSN code 70072900 applies to laminated safety glass used in buildings and automotive applications for added strength and protection.

What is the Window Glass HSN Code and GST Rate?

The HSN code for window glass is 7005, and the GST rate is 18% for all types of float, polished, tinted, or wired glass.