Future of e-invoicing in India. How GimBooks is leading the future of online invoicing?

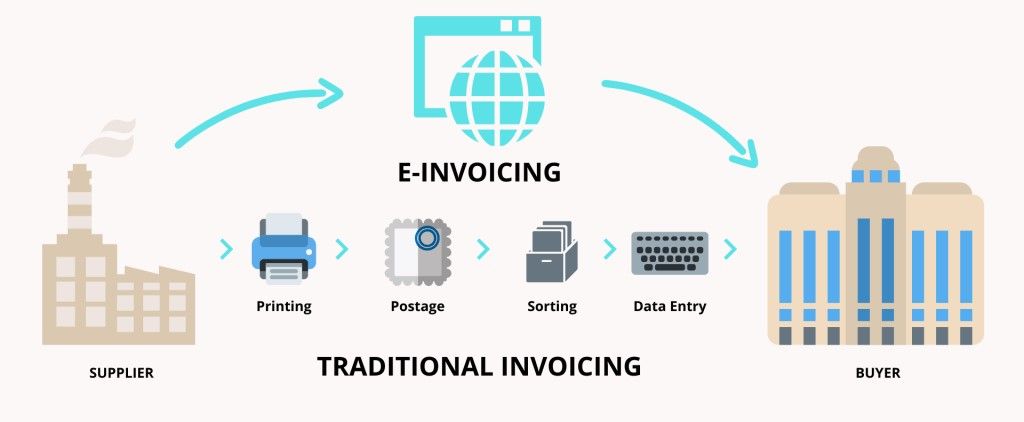

The world has adapted to e-invoicing and is in the transition of moving from conventional ways of Invoicing. Gimbooks is leading the future of E-invoicing by incorporating best practices

The world has seen a rapid revolution in technology. In this era of advancements, business processes are under para-time shift too. India's government had foreseen(back in July 2017) that the GST network would implore about 3.5 billion invoices every month, making it 42 billion e-invoices annually.

To examine and approve 42 billion invoices would be burdensome for the Indian Tax Authorities. The legal claim of the tax credit from conventional invoices would be cumbersome. Therefore, after looking at

1.The current Indian scenario,

2. Global e-invoicing solutions,

3.Best International practices that were mostly evolved out of Denmark's mandate,

India's GST council constituted a committee of officers to govern E-invoicing in India through the GST portal. This was done to examine the global electronic invoice tax system, suggest an e-invoicing schema, and integrating e-invoice numbers to different accounting systems.

E-invoicing in India

The Indian market is divided as - B2B, B2C, and B2G based on the transactions. The future of E-invoicing in India largely depends on the threshold limit on invoicing and the nature of supplies (goods or service or sectoral implementation). India has kept B2B E-invoices on top of their mandate.

The government will roll out the electronic invoicing (e-invoicing) system for all business-to-business (B2B) transactions under the Goods and Services Tax (GST) regime from April 1 next year that will replace physical invoices, finance secretary Ajay Bhushan Pandey said.

Thereby all invoices for B2B transactions shall be generated from the GSTN portal mandatorily by every registered person, which would tame the problem of fake invoices. India lost over INR 48,000 crore to indirect tax evasion during April-December, 2018. Hopefully, with such anti-evasion methods, we might bring lower the high levels of tax evasion.

E-invoicing in India: Benefits for the Government

- Controlled tax evasion.

- Real-time sharing of data to the nearest point of sale.

- Enhanced invoice reliability.

- Enabling a better exchange of information.

Since every B2B business is incorporating the GST E-invoicing, the GST portal is vulnerable to site crashes. The government will have to drastically upgrade and improve the GSTN portal before this process is even conceptualized. Like a tax credit matching scheme, this scheme would also remain a mere pen and paper scheme.

E-invoicing in India: Benefits for the business

- Reduced government intervention

- Annulment of e-way bills.

- Withdrawal of tax credit mechanism requirement

- Lowering of commercial disputes.

Businesses will have a hard time incorporating the E-invoicing standards initially, but they would also be on the receiving end of paybacks from this futuristic change.

E-invoicing in India: How GimBooks is Leading the future?

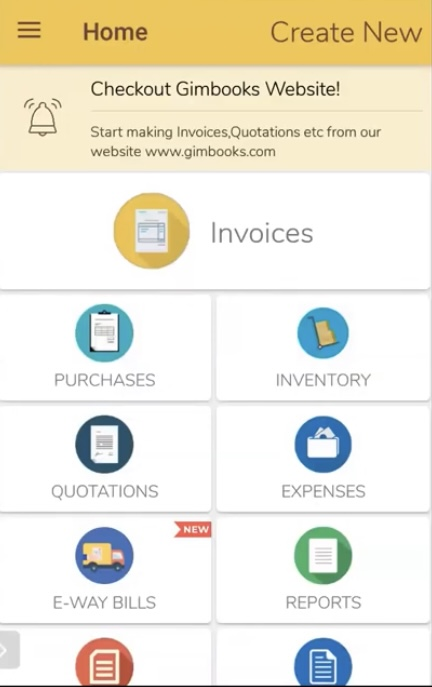

GimBooks is the best-rated e-invoicing mobile app on the play store. Equipped with the best GST e-invoice generation system and GST e-invoice verification system, Gimbooks is leading the future of E-invoicing in India. How? Besides being an award-winning e-invoicing software, GimBooks provides features to generate quotations, payment challans, payment receipts, manage your expenses and ledgers. Gimbooks entail benefits for society and business.

Easy Invoice Manager by Gimbooks leads the future in reducing paper consumption, encouraging e-commerce, use of newer technologies, standardization of business processes, reduced commercial litigation due to availability of reliable evidence, lower tax evasion, higher collections, and bonafide business relations.

Easy Invoice manager by Gimbooks is a user-friendly e-invoice mobile app that gets your e-invoices and IRN verified through the GSTN portal on the go. You need not go anywhere for any financial documents. Be it GST-ITR filling or Managing your inventory, Gimbooks has got your back.

Download Easy invoice manager By Gimbooks, your GST E-invoicing solution and be part of the future.