Bank Charges HSN Code 9971: GST on Financial Services Explained

Understanding the taxation of financial services is crucial for both businesses and individuals managing banking transactions. Under the Goods and Services Tax (GST) regime in India, bank charges such as ATM fees, loan processing charges, account maintenance, and other service fees fall under a specific classification—HSN Code 9971. This blog breaks down what HSN Code 9971 covers, how GST is applied to financial services, and what it means for consumers and service providers. Whether you're a finance professional, a business owner, or simply looking to decode your bank statement, this guide will help clarify the tax implications of common banking charges.

What is HSN Code 9971?

HSN Code 9971 classifies “Financial and Related Services,” which covers banking, central banking, deposit services, credit granting, financial leasing, investment banking, insurance, and auxiliary financial services. Under GST, this code is essential for correctly billing and compliance on all bank-related charges, financial products, service fees, and professional financial advisory services.

GST Rates & Exemptions for HSN Code 9971

Most bank charges and financial services under HSN Code 9971 attract a GST rate of either 12% or 18%, depending on the type of service and conditions specified by government notifications. The lower 12% slab typically applies if no input tax credit (ITC) is claimed on goods used in rendering the financial service and specific exemptions are certified. In normal banking, investment, or insurance transactions, GST at 18% is standard on service charges, processing fees, brokerage, and related financial activities.

Table Notes

- All rates are effective nationwide since January 2019 and revised as per latest GST notifications.

- Exemptions generally require official certification or non-claiming of ITC.

- The table covers core banking and wider financial service activities.

GST Rates Applicable Under 9971

What’s Included in 9971 Financial Services?

HSN 9971 covers a broad range of financial activities: core banking charges, transaction processing, deposit services, credit and loan services, investment banking, insurance, portfolio management, brokerage, and advisory. Every fee or service provided by a financial institution or agency falls under this SAC for GST billing.

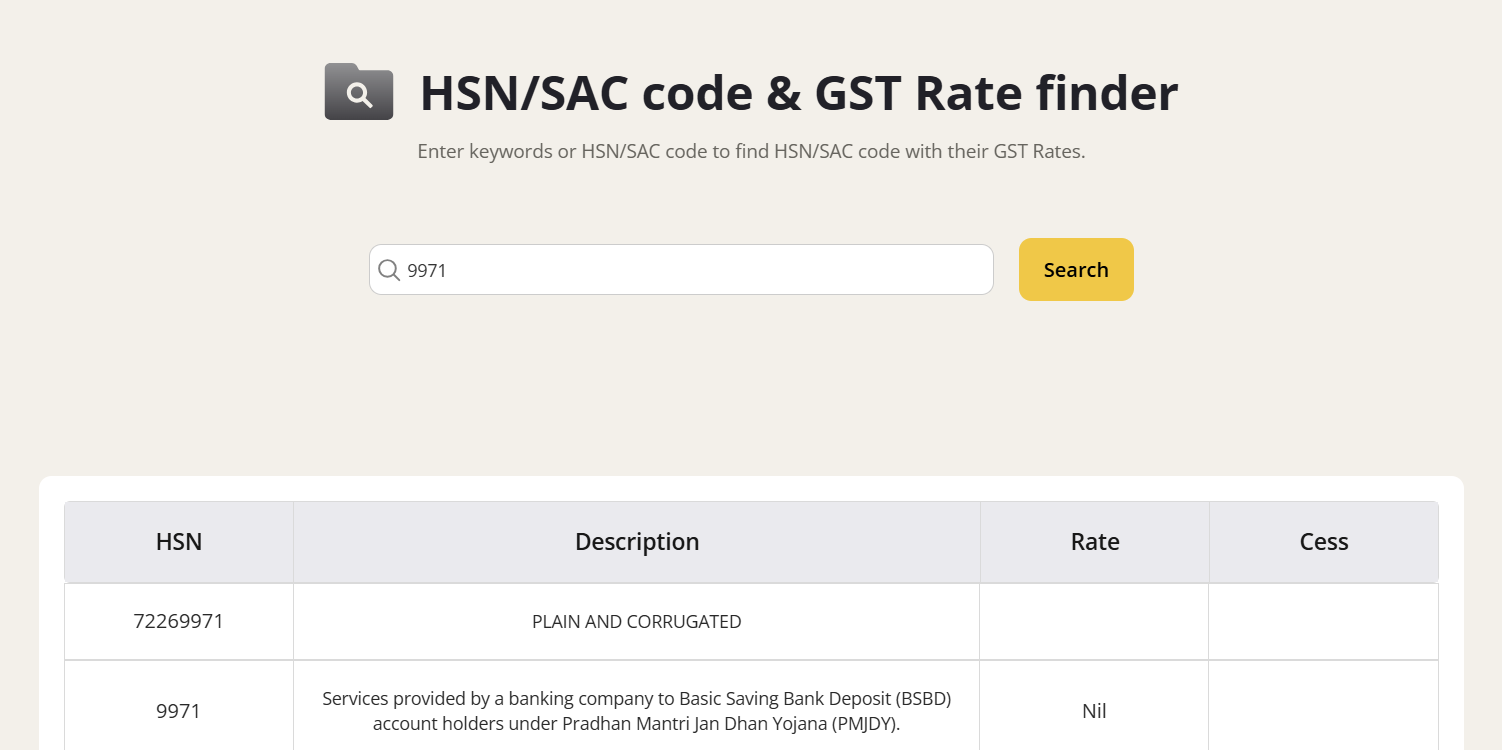

Explore Gimbooks HSN/SAC code & GST Rate finder

Key Exemptions Under GST for 9971

Certain bank or financial service charges may be exempt under government notification if linked to certified sports events, specific government activities, or when ITC is not available/claimed on input goods. These exemptions are rare and require strict compliance with documentation and certification requirements. However, standard charges like ATM fees, processing fees, advisory, and brokerage are generally taxed at 18%.

Input Tax Credit (ITC) Rules for Financial Services

Businesses and GST-registered entities can claim ITC on GST paid for financial services if such services are used as part of their business operations (e.g., loan processing, investment advisory for company activities). If operating under concessional 12% GST, ITC cannot be claimed for goods used to render the service. For most commercial bank charges and financial services at 18%, ITC is available if conditions are met and proper GST invoices are maintained.

GST on Bank Charges: Practical Scenarios

- A business pays bank processing fees for a loan; GST is charged at 18% and the business can claim ITC for eligible expenses.

- An investment firm bills portfolio management services under HSN 997153; GST at 18% applies, except where an exemption or 12% concessional slab is certified.

- An insurance broker invoices claim handling charges at 18%, which end clients pay as part of their insurance processing.

Common Mistakes in Banking GST

- Misclassifying bank and financial service charges under incorrect SAC codes resulting in wrong GST rates.

- Charging 12% GST without meeting exemption or non-ITC conditions.

- Failing to maintain GST-compliant invoices, restricting ITC claims for business customers.

- Neglecting to update billing systems for GST rate revisions by CBIC notifications.

Conclusion

Bank charges and financial services under HSN Code 9971 are subject to GST at 12% or 18%, with most commercial activities taxed at the standard 18%. Accurate coding, proper billing, and diligent ITC management help businesses and individuals optimize costs and remain compliant with 2025 GST law.

Also check

FAQs: HSN Code 9971 & Financial Services GST

What is HSN 9971?

HSN 9971 refers to all financial services including bank charges, deposit services, investment banking, insurance, and related financial advisory.

What GST rates apply to bank charges under HSN 9971?

Bank charges and financial services are taxed at 18% GST unless eligibility for 12% slab is certified and no ITC is claimed.

Can ITC be claimed on financial service GST?

ITC is available for financial service GST charged at 18%, provided the business meets the conditions and maintains correct documentation.

Which financial services are GST-exempt?

Exemptions are very limited, mostly for specific certified events or government activities. Standard banking charges are not exempt.