Construction Services, Work Contract HSN Code 9954: GST Rate & ITC Rules

What is HSN Code 9954?

HSN Code 9954 applies to “Construction Services of Buildings,” including all types of residential, commercial, industrial, and non-residential buildings. It categorizes construction contracts for apartments, offices, hotels, educational institutions, factories, and various building renovation, repair, and additions. Work contracts under this SAC play a central role for builders, contractors, developers, and promoters in GST compliance.

GST Rates & Exemptions for HSN Code 9954

Multiple GST slabs apply to construction services and work contracts under HSN 9954, depending on project type, client, and credit eligibility. Rates currently range from 1.5%, 5%, 7.5%, 12%, to 18%, determined by factors such as affordable housing status, type of client (government, promoter, or commercial entity), availability of input tax credit (ITC), and contractual scheme chosen. Affordable residential projects may qualify for 1.5% or 5%, while standard commercial buildings can attract 12–18% GST.

Table Notes

- GST rates since April 2019 reflect the government’s rationalization for affordability and credit management.

- 1.5% and 5% rates are generally valid for affordable housing; 12–18% for commercial or non-affordable sectors.

- ITC eligibility and invoice management rules differ per slab and scheme.

GST Rates Applicable Under 9954

What’s Included in HSN 9954 Services?

This HSN covers new building construction, apartment development, office setup, industrial factory assembly, commercial hub build, and renovation, maintenance, alteration, and additions for all building types. It provides a uniform framework for GST compliance, billing, and credit eligibility in construction work contracts across India.

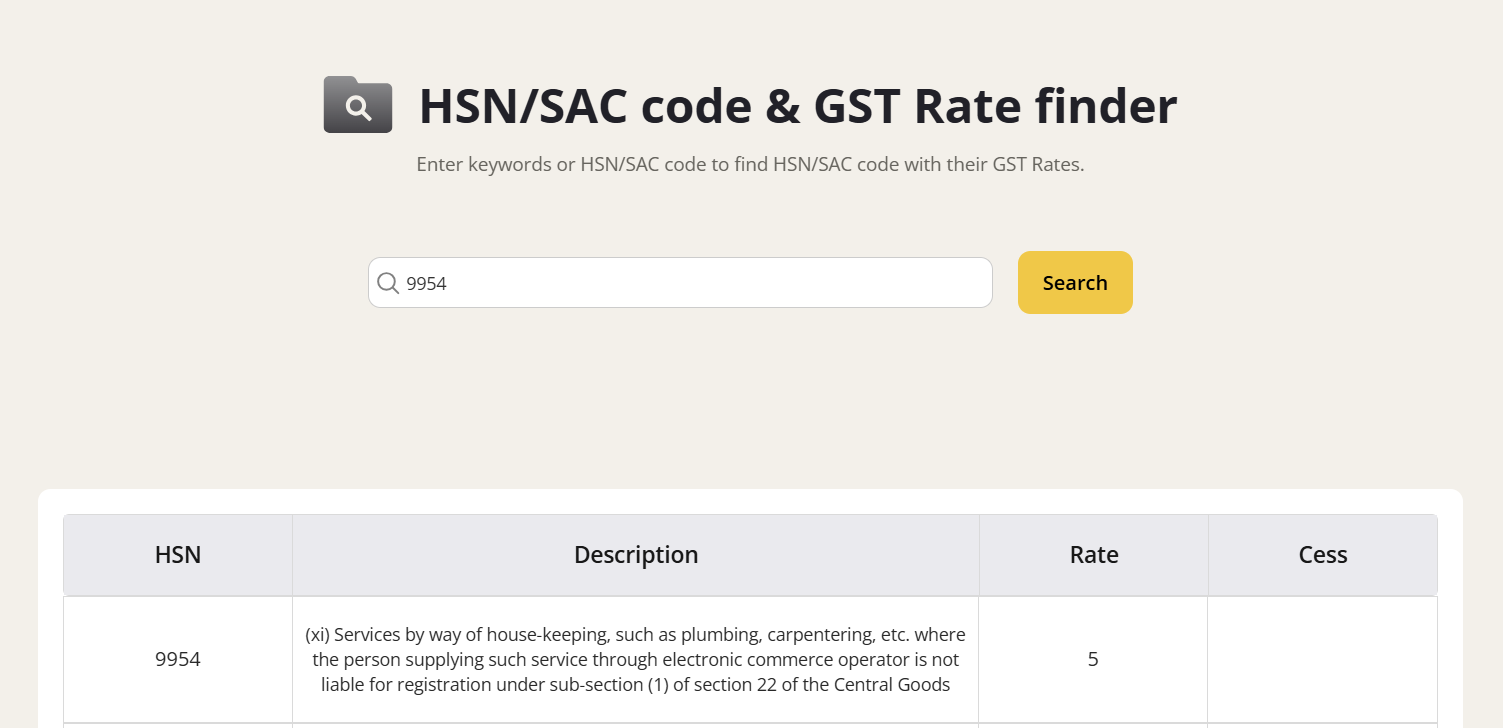

Explore Gimbooks HSN/SAC code & GST Rate finder

Key Exemptions Under GST for 9954

Exemptions and concessions are available for affordable housing, certain government projects, or government entities. Affordable residential projects (carpet area not less than 50% of total project, price below specified threshold) can avail lower GST rates. Services linked to certified events and government schemes may receive concessional or nil GST.

Input Tax Credit (ITC) Rules for Construction Services

ITC is governed by strict norms under HSN 9954. For affordable housing at 1.5% or 5%, ITC on goods and services is typically restricted, except as prescribed for specific projects. For 12–18% projects (most commercial/industrial sites), full ITC on inputs and services is allowed, improving cash flow and tax neutrality for builders and developers. Cement from unregistered suppliers always requires reverse charge GST at the full rate.

GST on Work Contract Billing: Practical Scenarios

- A developer bills a residential apartment project at 1.5% GST with restricted ITC if qualifying for affordable housing.

- A builder constructing a new shopping mall applies 12% GST with full ITC on all construction inputs.

- A school building project for a government client is billed at a reduced 5% rate if covered by exemption, and follows prescribed ITC eligibility.

Common Mistakes in Construction GST

- Misclassifying building type and applying incorrect GST rate or ITC.

- Not monitoring the percentage of registered suppliers for project input (80% mandate).

- Incorrect reverse-charge calculation for cement, or failure to update ineligible ITC in GSTR-3B.

- Ignoring project-wise accounting for input credits, risking audit and penalties.

Conclusion

Work Contract and Construction Services under HSN Code 9954 span all major project types, with GST rates and ITC entitlements shaped by project nature, buyer, and government guidelines. Correct billing and ITC management deliver compliance and savings for promoters, builders, and contractors in 2025.

Also check

- T Shirt HSN Code 6109

- Service Charge HSN Code 9983

- Cloth HSN Code 5208

- Furniture HSN Code 9403

- Maintenance, Repair & Installation Services – 9987 HSN Code and GST rate

FAQs: HSN Code 9954 & Construction GST

What is HSN 9954?

HSN 9954 covers construction, renovation, repair, and maintenance of all types of buildings, both residential and non-residential.

What’s the standard GST rate for 9954 work contracts?

GST rates range from 1.5% (affordable housing) up to 18% (commercial/industrial), subject to project type, client, and credit scheme.

Can ITC be claimed on work contracts under 9954?

Full ITC is available for standard-rate commercial and industrial contracts. Restricted or no ITC applies for affordable housing, per government rules.

Which work contracts or services are GST-exempt?

Exemptions or lower rates apply for approved affordable housing, government schemes, certified events, and specific government entity projects.