Cloth HSN Code 5208: Cotton,Fabric Types, Classification & GST Rate

Understanding the 5208 HSN code is essential for anyone dealing with cotton fabrics in the textile industry. Whether you are a manufacturer, trader, or retailer, knowing the correct cloth HSN code helps ensure accurate classification, smooth invoicing, and GST compliance.

In this blog, we break down what the 5208 HSN code covers, explain the applicable 5208 HSN code GST rates, and clarify how this code applies to different types of cotton fabrics used in everyday textile trade.

What is HSN Code 5208?

HSN Code 5208 refers to woven cotton fabrics containing 85% or more cotton by weight and weighing not more than 200 grams per square meter. This category includes popular textiles like unbleached, bleached, dyed, and printed cotton fabrics used for apparel, sarees, shirt materials, dhotis, bedsheets, and more.

GST Rates Applicable Under 5208

GST Rates & Exemptions for HSN Code 5208

As of 2025, the GST rate for all woven cotton fabrics under HSN 5208 is consistently 5%, whether the fabric is unbleached, bleached, dyed, or printed. There are no separate exemptions for specific variants or uses—nearly all retail and wholesale trade in these fabrics attracts the same GST rate according to official government notifications.

Table Notes

- The following rates apply to both handloom and powerloom goods within the 5208 code, provided the fabric composition and weight match the HSN standard.

- GST is charged at 5% plus 0% cess on the invoice value—valid for all-India transactions since 01/07/2017.

- Classification includes special applications: sarees, dhotis, shirting, bedsheets, cambrics, muslin, casement, dobby, and more.

What’s Included in 5208 Fabrics?

5208 HSN code covers unbleached, bleached, dyed, or printed cotton fabrics above 85% cotton, max 200 g/m², with detailed sub-categories for variety. The range includes sarees, dhotis, shirting, bedsheets, lungis, cambrics, muslin, casement, casement, dobby, sheeting, and more—everyday and specialty fabrics for domestic and commercial use.

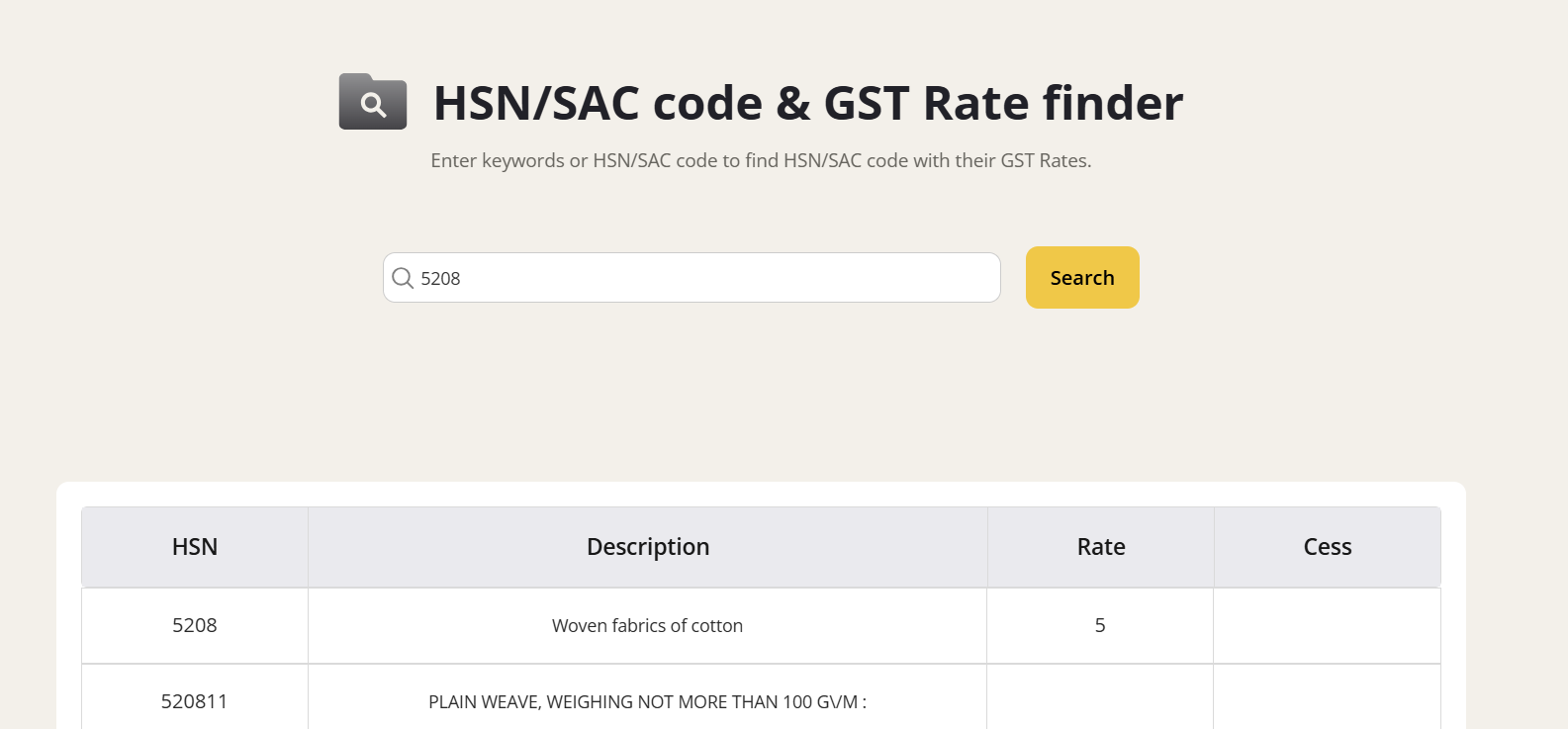

Explore Gimbooks HSN/SAC code & GST Rate finder

Key Exemptions Under GST for 5208

No common GST exemptions apply to finished woven cotton fabrics in HSN 5208. Unprocessed raw cotton or certain handloom products (specified by government notifications) may enjoy exemptions, but woven fabrics, whether powerloom or handloom, are standardly taxed at 5%.

Input Tax Credit (ITC) Rules for Cotton Fabrics

ITC (Input Tax Credit) can be claimed by businesses (fabricators, traders, exporters, garment manufacturers) purchasing HSN 5208 fabric for commercial use, further production, or resale. Invoices must be GST-compliant. End-users/retail buyers are not ITC eligible; ITC benefits are meant for registered business entities only.

Related - Boy's Suits & Garments – GST Rate and HSN Code 6203

GST on Cloth Billing: Practical Scenarios

- A wholesaler invoices 500 meters of cambric shirting (HSN 5208) at 5% GST; the buyer, if GST-registered, can claim ITC.

- Retail sellers of sarees or bedsheets below ₹2500 each use HSN 5208 and apply 5% GST on all invoices.

- An exporter buying bulk casement fabric (≥85% cotton, ≤200 g/m²) can use ITC from GST paid on fabric purchases.

Common Mistakes in Cloth GST

- Using HSN 5208 for synthetic- or polyester-heavy blends (should use 5209–5212).

- Billing at higher or lower rates due to outdated groupings (current woven cotton is all 5%).

- Not correctly tracking or documenting input tax credit.

- Failing to use exact description/subtype, risking audit queries.

Conclusion

HSN Code 5208 is the definitive GST classification for India’s woven cotton fabric sector, creating clarity, uniformity, and affordability with a flat 5% GST rate nationwide in 2025. Proper code usage protects from compliance risks and ensures maximum claim of credits in supply chains.

Explore Gimbooks GST Billing Software for Cloth Shop

Also check

T Shirt HSN Code 6109

Service Charge HSN Code 9983

FAQs: HSN Code 5208 & GST on Cotton Fabric

What is HSN 5208?

It’s the GST code for cotton woven fabrics (≥85% cotton, ≤200 g/m²) covering most mainstream Indian cotton textiles.

What’s the GST rate for cotton cloth HSN 5208?

The GST rate is 5% for all woven cotton fabrics under HSN 5208, effective India-wide for 2025.

Can business buyers claim ITC on cotton fabric under 5208?

Yes, GST-registered businesses can claim ITC for purchases used in manufacturing or resale, with proper GST invoicing.

Which cotton fabrics are GST-exempt?

Only unprocessed raw cotton, cotton waste, or specific notified handloom goods outside HSN 5208 may be exempt.

Which code covers bleached, dyed, or printed cotton?

All such varieties (meeting weight/content norms) fall under subcategories of HSN 5208 and are taxed at 5%.

What is the HSN code for cotton fabric?

The HSN code for cotton fabric generally falls under Chapter 52 of the HSN classification, which covers “Cotton” and cotton-based textiles. The specific code depends on the type, weave, and weight of the fabric. Commonly, HSN 5208, 5209, and 5210 are used for different woven cotton fabrics.

What is the HSN code 5208 for cotton cloth?

HSN 5208 refers to:

“Woven fabrics of cotton, containing 85% or more by weight of cotton, weighing not more than 200 g/m².”

This category typically includes lightweight cotton fabrics like poplin, voile, cambric, etc.

What is the HSN code for cotton lining fabric?

The HSN code for cotton lining fabric usually falls under 5208 or 5209, depending on the weight:

- 5208 – Woven cotton fabric, 85% or more cotton, weight ≤ 200 g/m² (lightweight lining).

- 5209 – Woven cotton fabric, 85% or more cotton, weight > 200 g/m² (heavier lining).

What is a textile HSN code

A textile HSN code is a standardized classification used under GST to identify different types of fabrics and textile products. It helps determine applicable tax rates and ensures uniformity in trade and invoicing.

What is the HSN code and GST rate for cotton roll?

Cotton rolls are generally classified under textile-related HSN codes depending on their use and fabric type, commonly falling under cotton fabric categories such as HSN 5208. The applicable GST rate is typically 5%, but businesses should verify based on product specification and intended use.

What is the HSN code for cotton sarees in India?

Cotton sarees are classified under HSN Code 5208 if they are made of pure cotton fabrics.

What is the 8-digit HSN code for cotton sarees?

The 8-digit HSN code for cotton sarees is 52084100, which classifies sarees made of pure cotton fabrics under chapter 52 of textiles.

What is the HSN code and GST rate for cotton fabric in India?

Cotton fabrics are classified under HSN Codes 5201 to 5212 depending on thread count, weave, and finishing. The standard GST rate is 5% for most plain or unprocessed cotton fabrics.