3 Easy Ways to Download GSTR 1 for Business Owners- about gstr 1

Download your GSTR-1 filings easily. With these three simple ways, you can save valuable time and ensure accurate GST reporting, allowing you to focus on what truly matters – your business growth with gst invoice manager.

Looking about gstr 1 and how to download gstr 1 filing? We get it – staying on track with your GST compliance is a time-consuming process, especially when dealing with the nitty-gritty of GSTR-1 returns. Here is your hassle-free guide to filing and downloading GSTR-1 filings on the go!

It's time to leave the complexities behind and focus on what you do best – running your business efficiently by filing gst return timely, and the first step would be to begin with getting to know about gstr 1 quickly!

Before we proceed forward you should know about gstr 1 👇

GSTR 1 Non- QMRP Due Date for FY 2025:

▶ GSTR 1- (turnover more than INR 5 Crore)

▶Month- GSTR 1 Filing Due Date:

December 2024- 11th January, 2025

January 2025 - 11th February, 2025

February 2025- 11th March, 2025

March 2025 - 11th April, 2025

For more, refer to GSTR 1 quarterly Filings.

GSTR 1 QMRP Due Date for FY 2025:

▶ GSTR 1- (turnover upto INR 5 Crore)

▶Quarterly- GSTR 1 QMRP Filing Due Date:

Oct-Dec 2024-13th Jan 2025

Jan-Mar 2025- 13th Apr 2025

And if you have forgotten to file gst r 1, we can help you out with gst r 1 late filing penalty calculation with gst invoice manager-

For penalty- late gst r 1 filing penalty calculation is done based on per day delay from the payment due date. Here are reasons why you should download your gst r 1 filing-

It stores all recordkeeping and can file compliance in the gst manager. Gst r 1 filing downloaded files are downloaded as records for your businesses and will become very significant in future audit or taxing assessing terms:.

▶Data Analysis and Insights: Download your GSTR-1 data with gst invoice manager so you can analyze sales trends and identify improvement areas that guide your business decisions.

▶Offline Access and Backup: It is a boon that your gst r 1 filing data is available with you online through gst invoice manager, but it handy in offline mode provides a peace of mind and ensures you can access your information with gst invoice manager even if internet connectivity is limited.

Since we now know why one ought to download gst r 1 returns and keep them handy for long, let us find more information in our next step-wise guide!

Downloading Your GSTR-1: Step-by-Step Guide

With a clear and concise roadmap for downloading your GSTR-1 filings efficiently and hassle-free, we have a guide ready for you to explore:

#First Way- Step-by-Step Guide to download gstr 1 filing.

How to download GST R 1 filing from the GST Portal:

Login: Access the GST Portal and log in with your valid GSTIN credentials.

2. Navigate: Go to Services > Returns > GSTR-1 > Download.

3. Select Tax Period: Choose the specific tax period for which you want to download the GSTR-1 file. (for gst r 1 filing)

4. Choose Download Format: Select the preferred format for your downloaded file, either JSON or PDF.

5. Download and Save: Click Download and choose a secure location on your computer to save the file.

Now, let's explore an app that can easily help you in filing gst r 1 and more quickly.

#Second Way- Step-by-Step Guide to download gstr 1 filing.

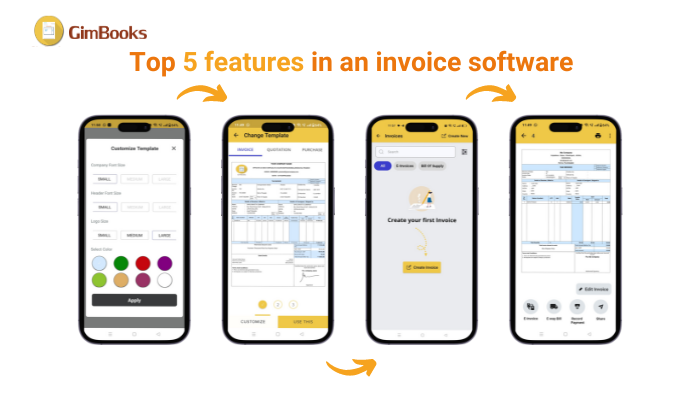

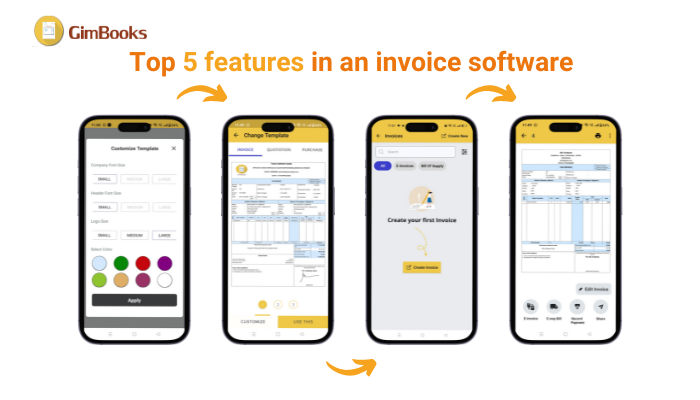

How to download gstr 1 filing from GimBooks App also known as gst invoice manager:

- Download and Launch: Install the GimBooks App or gst invoice manager on your phone and open it.

2. Enter Login Credentials: Provide your GSTIN and login credentials to access the tool.

3. Select Tax Period: Choose the desired tax period for downloading the GSTR-1 file.

4. Choose Download Format: Select the preferred format for your downloaded file, either CSV or PDF.

5. Generate and Save: Click Generate Return File and save the generated GSTR-1 file on your computer.

#Third Way- How to download gstr 1 filing from offline tools:

- Login: Access the tool and log in with your valid GSTIN credentials.

- Navigate: Click > Returns > GSTR-1 > Download.

- Select Tax Period: Choose the specific tax period for which you want to download the GSTR-1 file.

- Choose Download Format: Select the preferred format for your downloaded file.

- Download and Save: Click Download and choose a secure location on your computer to save the file.

Each GST R filing- GST R 2, GSTR 3B, GSTR 4, GST 5, GST R 6, GST R 7, GST R 8, GT R 9, GST R 9A and more have a different purpose, which will be covered in

▶ GST R Filing blogs with gst invoice manager.

3 Best Downloadable Formats for GSTR 1 filing

When it comes to downloading your GSTR-1 filings, the options can seem overwhelming. But fear not!

We’ll help you choose the perfect one in seconds ( You can do it with gst invoice manager too!)

Format: JSON

▶Strength- Very structured and machine-readable, allowing further data analysis and integration into software. Its file size is smaller than that of PDF.

▶Weaknesses- Not human-readable without special software. It needs other specialized tools to view and edit.

▶Suitability- All organizations that require analysis of the GSTR-1 data or integration with accounting software.

Format PDF: Portable Document Format

▶Strengths- PDF format is universally readable and is compatible with most devices. It provides an easy-to-view, print-out format.

▶Weaknesses- Not easy to edit. It has larger file size than JSON.

▶ Suitability- Suitable for firms that need to print the GSTR 1 on paper or which intend sending the copy to non-techno-savvy recipients.

Format: Offline Tool Software Approved by GSTN

▶Strengths: Allows for GST R 1 filing to be generated and downloaded without the internet. Useful to companies with low internet access.

▶Weaknesses: It requires installation and may not be compatible with all operating systems. Takes a lot of time to learn when compared to other formats.

▶Suitable for: Businesses who'd need to operate offline or have a low-speed internet connection, or who prefer a dedicated software tool.

While choosing right format or various gst invoice manager software for downloading the gst r 1 filing, forget not to consider your purpose as well as your preferences are regarding quick calculations and insight, easy viewing and printing, and last but not the least, the type of access you need while doing so whether it is to be online, offline or if you need a synchronization platform for gst related activity.

Explore - Difference Between GSTR 2A and 2B with Examples

Benefits of GST R 1 filing You Can't Ignore

GST R 1 filing seems like a new added work for your business but actually is a treasure to you.This is why:

1. Tax- Smooth compliancewith GST R 1 filing connects sales with thesupplier's recordsandeasycalculationandgetsridofallconfusioninthesame. It could be like the jigsaw puzzle fix up for you.

2. Invoicing in seconds- GST R 1 filing hand in hand works with e-invoicing thus making things automatic and smooth. No more hard data entry! It's like having a self-driving car for your invoices!

3. Cash Flows Management- GST R 1 Filing willclearlystatetowhom you oweandfaster you getit sothemoney keeps flowing in the business like a healthy heartbeat.

4. On-the-go filing- Filing GST R 1 filing in time saves you from penalties and headaches. That keeps you free to focus on what really matters-build your business!

So, don't just see GST R 1 filing or gst r 1 as a rule; see it as a chance to improve your business in many ways. Go out there and file with confidence, knowing you're unlocking a treasure chest of rewards!

Tips for successful GST R 1 filing-

▶Downloading Specific Invoices: You can download individual invoices by accessing the E-Invoice Download History section on the GSTR-1 page for GST R 1 filing.

▶Downloading Reconciliation Statement: Access the Reconciliation Statement section on the GSTR-1 page and download it for your chosen tax period.

▶Troubleshooting: Encountering issues during download? This guide provides troubleshooting tips for common download errors.

An in order to staying updated, don’t forget to Bookmark this guide for future reference and check back regularly for updates reflecting any changes in the GST R 1 filing format or download process.

Compilation- Downloading Gstr 1 Filing

By following this comprehensive guide, you can now download your GSTR-1 filings confidently and efficiently. Remember, filing gst r 1, and downloading gstr 1 filing on time will increase management of your GST compliance, which is key to avoiding penalties and maintaining a thriving business. And when you have gst invoice manager, you have got nothing to worry about!

Tap to know how ▶ GimBooks GST 1 filing can help you easily and more quickly in filing your gst-

Frequently Asked Question-

How can I download Gstr 1?

There are two primary ways to download GSTR-1:

Directly from the GST Portal:

- Log in to the GST Portal with your credentials. 1. Manual > Logging in and Managing Username and Password - Goods and Services Tax

- Navigate to the 'Returns' section.

- Select 'GSTR-1' and the desired return period.

- You can usually download it in PDF or CSV format.

How to view GSTR 1 in offline tool?

You can view GSTR-1 offline using the GST Offline Tool:

- Download and install the latest version of the GST Offline Tool.

- Import the downloaded GSTR-1 file into the tool.

- Once imported, you can view and analyze the data offline.

How do I download GSTR1 in Excel full year?

To download GSTR-1 data for a full year in Excel format:

- Directly from the GST Portal:

- Download GSTR-1 for each month of the year.

- Combine the downloaded Excel files into a single file using spreadsheet software.

- Using Third-Party GST Software:

- Many GST software providers offer tools to generate annual GSTR-1 summaries in Excel format.

- Also check - The Ultimate Guide to GST Return Filing Online

GSTR 1 FILING

.jpeg)